-

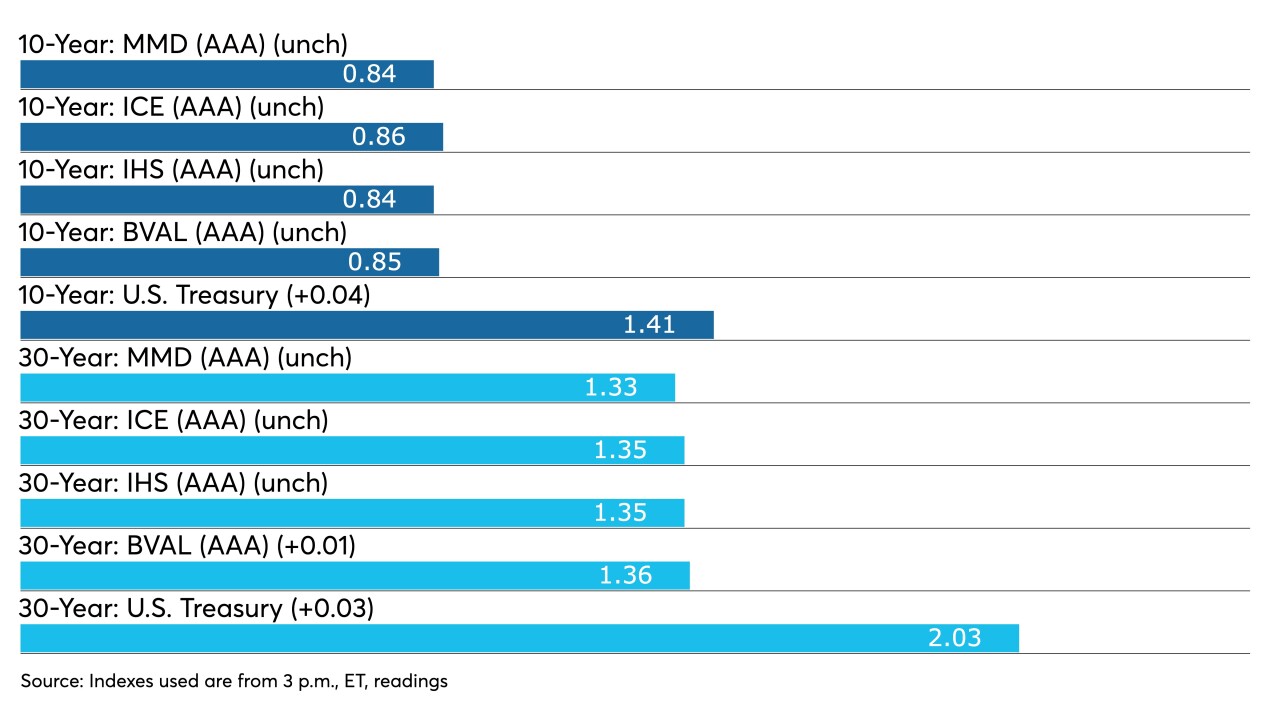

Municipals outperformed U.S. Treasuries for a third sessions moving the 10-year municipal to UST ratio below 60%.

July 13 -

The high level of incarceration in the U.S., especially among Americans of color and indigenous people, constrains the labor market and the economy’s ability to reach its full potential, Federal Reserve Bank of Atlanta President Raphael Bostic said.

July 13 -

Senate Banking Committee Chair Sherrod Brown said he expects Federal Reserve Vice Chair Randal Quarles’s oversight of the central bank’s financial supervision to end with the conclusion of his term in October.

July 8 -

As the White House weighs the potential renomination of Jerome Powell as chair of the Federal Reserve, officials are discussing the use of openings on the board to reshape the central bank.

July 7 -

More of the same from the FOMC did little to move UST or munis. ICI reported the 17th consecutive week of inflows at $1.98 billion. July is looking good for municipal issuers.

July 7 -

President Joe Biden would be well advised to offer Jerome Powell a second term as chair of the Federal Reserve to preserve policy stability as the U.S. economy recovers from the pandemic, said former Fed Vice Chair Alan Blinder.

July 7 -

The Federal Reserve’s tapering of its asset purchases, which he hopes will start “soon,” will run smoother this time around because investors already know that a move is being discussed, said Federal Reserve Bank of Dallas President Robert Kaplan.

June 30 -

Federal Reserve Gov. Christopher Waller said the better-than-expected performance of the U.S. economy warrants scaling back asset purchases sooner than expected and he favors starting with mortgage-backed securities.

June 30 -

The Federal Reserve might consider an interest-rate hike from near zero as soon as late 2022 as the labor market reaches full employment and inflation is at the central bank’s goal, Federal Reserve Bank of Boston President Eric Rosengren said.

June 25 -

The U.S. economy will likely meet the Federal Reserve’s threshold for tapering its asset purchases sooner than people think, said Dallas Fed President Robert Kaplan, who has penciled in an interest-rate increase next year.

June 23