-

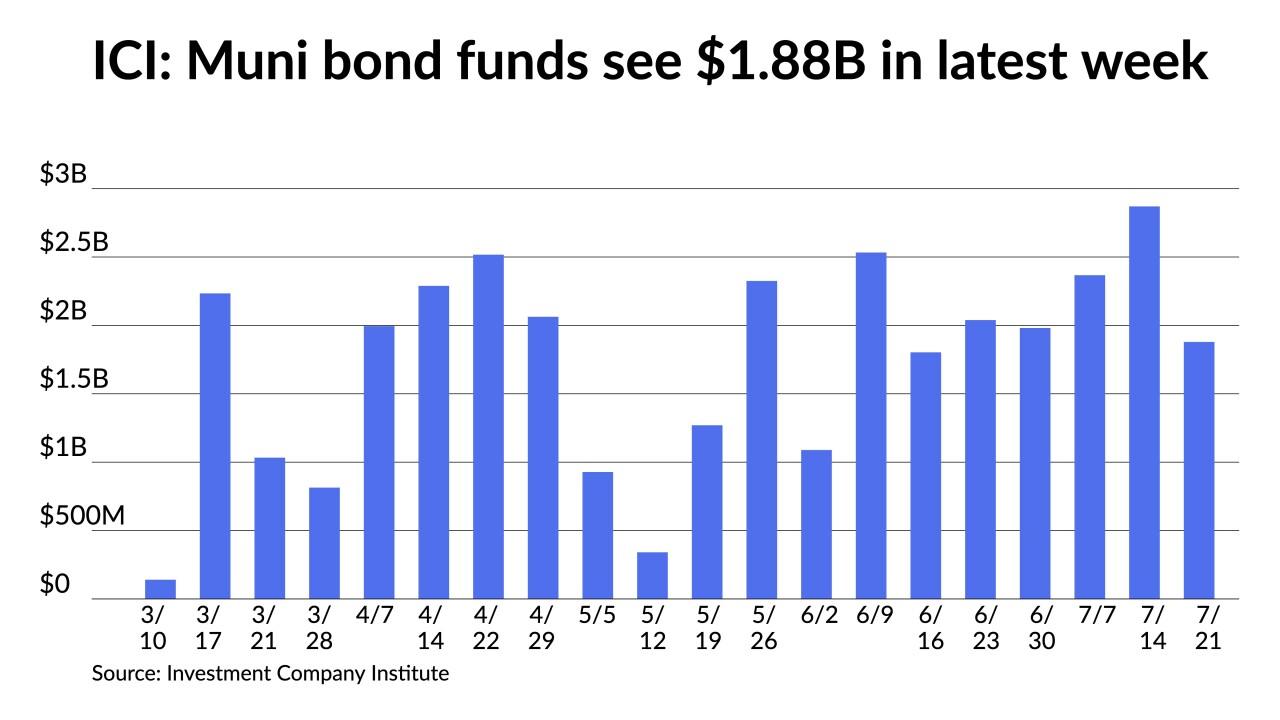

The massive summer reinvestment into municipal bond mutual funds continue and are both sustaining the strength of investor demand and solidifying the technical footing of the market.

July 28 -

The economy continues to recover, with durable goods orders and consumer confidence suggesting strength, but concerns about the Delta variant of COVID-19 and continued supply-chain problems cloud the future outlook.

July 27 -

The last week of July marks a lighter calendar while August redemptions are huge compared to the expected supply. Investors need to get in line and likely accept lower yields and continued historically low ratios.

July 23 -

Federal Reserve Chair Jerome Powell enjoys broad support for his renomination among top White House advisers, though the decision is expected later this year.

July 21 -

Increasing attention to whether inflation is a problem for the U.S. economy and financial markets isn’t resolved easily by looking at the most recent economic and financial market data.

July 21 Keel Point

Keel Point -

Ed Moya, senior market analyst for the Americas at OANDA, talks with Bond Buyer Managing Editor Gary Siegel about the upcoming FOMC meeting, inflation, the possibility of tapering and the future make-up of the Fed in a wide-ranging discussion on the economy and monetary policy. (31 minutes)

July 20 -

Some Democrats are weighing the possible reappointment of Federal Reserve Chairman Jerome Powell, the Financial Times reports, citing California Democratic Congressman Brad Sherman.

July 19 -

U.S. Treasury Secretary Janet Yellen said the question of whether to nominate Federal Reserve Chair Jerome Powell for a second term is a conversation for her and President Joe Biden.

July 15 -

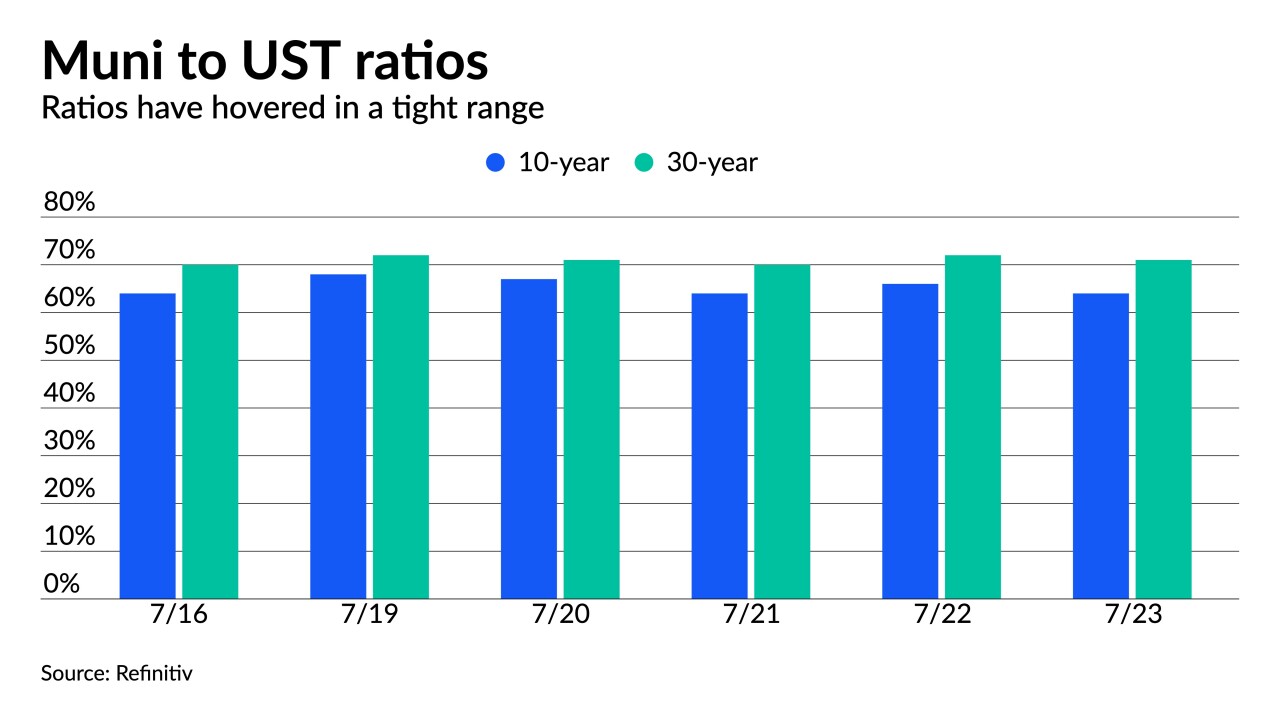

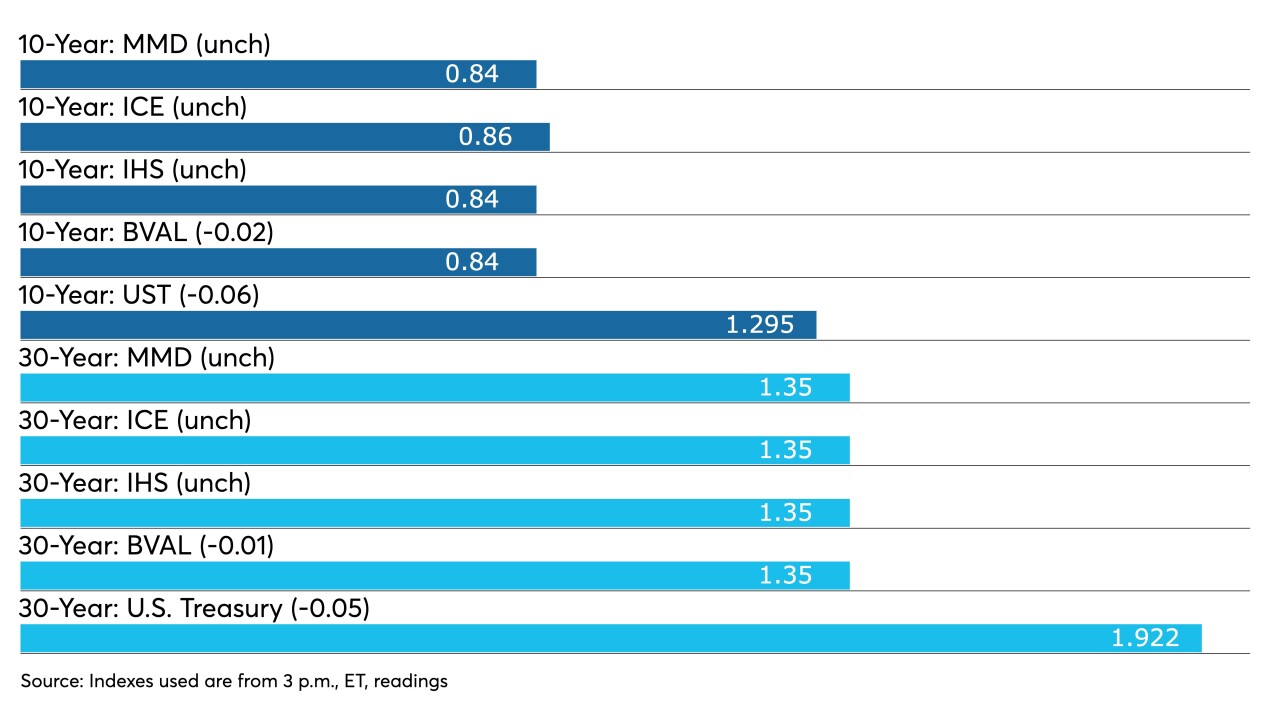

U.S. Treasuries have been volatile the past five sessions, with municipals largely ignoring the ride. Participants mostly have accepted current rates and ratios as large amounts of cash slosh around a market with strong technicals.

July 15 -

Federal Reserve Bank of St. Louis President James Bullard said the central bank has met its goal of achieving “substantial further progress” on both inflation and employment, urging policy makers to move forward in reducing stimulus.

July 15