-

Jerome Powell is widely expected to be renominated to a second term as Federal Reserve chair, but his chances have been modestly dented by the revelations of stock trading by some senior Fed officials in 2020, according to economists surveyed by Bloomberg News.

November 2 -

Though monetary policy has been in the forefront, at mid-month the tone changed with global inflation outlooks and federal infrastructure and social package in flux.

November 1 -

A lighter, $5 billion calendar, heavy on healthcare, kicks off November. Most participants agree volatility in U.S. Treasuries will be a leading factor for municipal market performance. Uncertainty in Washington also isn't helping the asset class.

October 29 -

ICI reported the lowest inflows since outflows in March, while exchanged-traded funds saw an uptick.

October 27 -

Jeffrey Cleveland, chief economist at Payden & Rygel, discusses the Federal Reserve’s upcoming meeting, inflation, what taper will mean, when the Fed might decide to lift off, and possible leadership changes. Gary Siegel hosts. (30 minutes)

October 26 -

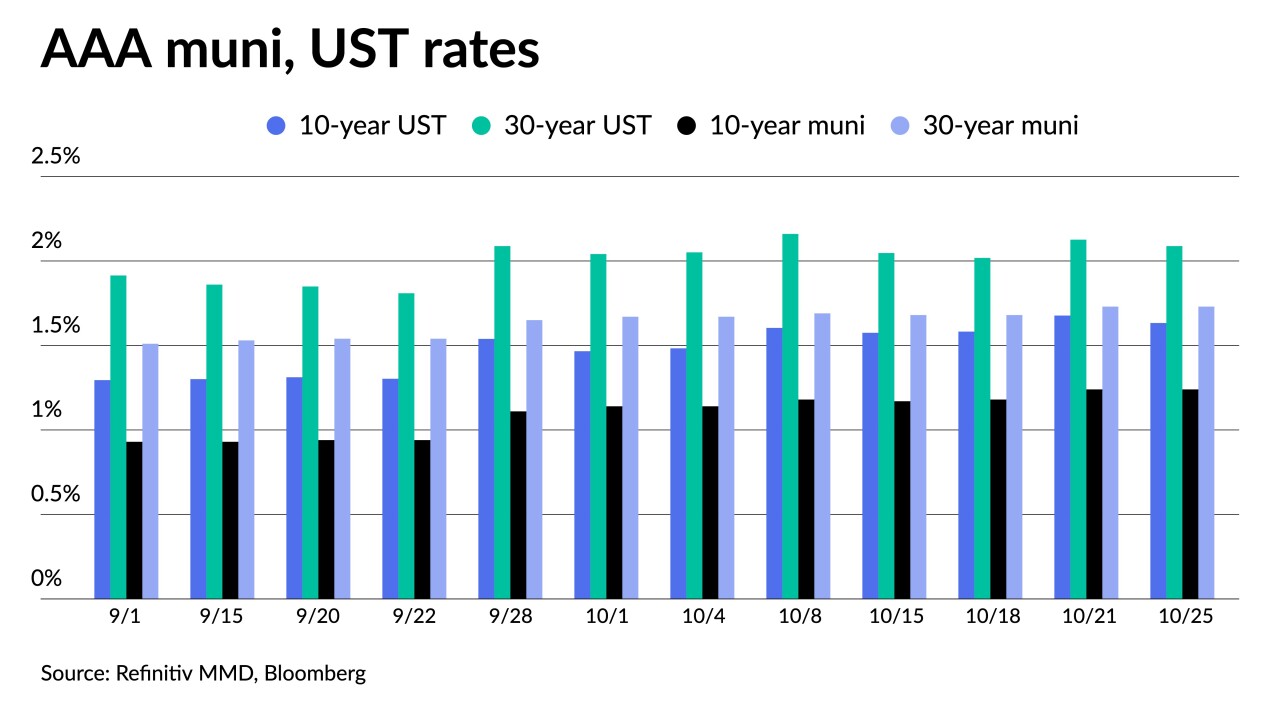

Despite a short-end U.S. Treasury rally, municipals face pressure on the one- and two-year as participants look to month-end positioning.

October 25 -

Friday’s data suggested inflation remains a problem, as the voices calling for Federal Reserve action increase.

October 15 -

Another round of inflows was reported from the Investment Company Institute — the 31st consecutive week — but they came in at $308 million for the week ending Oct. 6, the lowest since outflows in March.

October 13 -

Federal Reserve Vice Chair Richard Clarida traded between $1 million and $5 million out of a bond fund into stock funds one day before Chair Jerome Powell issued a statement flagging possible policy action as the pandemic worsened, his 2020 financial disclosures show.

October 4 -

Fed ethics questions spread to Barkin on McKinsey’s opioid role

September 30