Municipalities buy insurance to obtain a higher credit rating for a bond issue and a commensurately lower borrowing cost. The savings arise from a lower coupon or, if the coupon is fixed, a higher price (greater proceeds). But how can municipalities make sure that bond insurance makes economic sense for them? The answer is to pay close attention to the costs and benefits. In the standard case, the analysis is easy. If the coupon of every bond in the series is 5%, and the entire insurance premium is paid upfront, the savings (increase in proceeds) should exceed the cost of insurance.

Net Benefit of Insurance=Increase in Proceeds-Full Premium Paid

In this case, the debt service for the same face amount is identical whether or not the bond is insured. Also, in case the bond is refundable, insurance does not affect future refunding decisions. All that matters for refunding purposes is the bond's coupon relative to prevailing rates.

But if the insurance benefit for a refundable structure is in the form of a lower coupon rather than greater proceeds, the answer is more elusive. Consider the case of an advance refundable 30-year bond sold to the public at par. The coupon is 4.25% without insurance and 4.00% with it. It is easy to determine the better alternative assuming that neither bond is refunded – let's suppose that the choice is the 4.00% insured bond. What if shortly after issuance, rates decline significantly to a level where either structure could be economically advance refunded? In this case insurance would provide little benefit (except that the size of the escrow portfolio relating to the advance refunding would be somewhat smaller because of the lower coupon payments to be defeased). This consideration is hardly academic. Millions of dollars of prepaid premiums are washed away when issues are refunded.

In short, if the contemplated insured and uninsured structures are not identical, refundability complicates the determination of whether or not the bond should be insured. For this reason, in order to simplify the discussion below, we assume that the issue structure is fixed — 5% coupon and 10-year par call. The debt service is unaffected by insurance and so we can focus on the cost of insurance. But even in this case the decision can be tricky, because there are alternatives to a one-time upfront insurance premium, and the cost of these alternatives depends on if and when the bond is refunded.

As discussed above, under the one-time upfront payment plan the benefit from insurance immediately vanishes once the bond is refunded. Responding to client demand, some insurers now split the premium into a smaller upfront portion and 'pay-as-you-go' installments starting on the call date and ending when the bond is refunded. In another alternative, the issuer pays an upfront premium, but gets a credit towards future insurance costs if the bond is refunded prior to maturity.

So in today's brave new world, there are three competing payment plans to consider.

A: the traditional single upfront payment

B: smaller upfront payment followed by installments commencing on the call date

C: single upfront payment and a credit towards future insurance cost.

The choice must take into consideration the possibility that the bond will be refunded prior to maturity. A further source of complexity is that the refunding decision may depend on the insurance plan. For example, under Plan B the 'effective' interest payments beyond the call date consist of both the coupon and the premium installment, which creates an incentive to refund earlier than under Plan A.

How then can a municipality determine the best plan? There is no clear-cut choice; the answer depends on when the bond is refunded, which in turn depends on the evolution of interest rates. Like it or not, the calculation of the net benefit requires sophisticated option-based machinery. The effective cost of the premium under Plan B is the sum of the upfront premium and the probability-weighted present value of the pay-as-you-go premium installments. In case of Plan C, it is the upfront premium less the probability-weighted present value of the refunding insurance credit. These can be calculated using a standard interest rate model reflecting the volatility of interest rates, which in turn determines the likelihood of refundings.

The effective premiums of these alternative plans are made comparable to the premiums in the plain-vanilla all-upfront plans, by the following calculation.

Net Benefit of Insurance=Increase in Proceeds-Effective Premium Paid

When the bond is eligible for advance refunding, the effective premium is lower than when it is not. For example, under Plan B there may be scenarios where rates are sufficiently low to warrant refunding prior to the call, in which case there will be no ongoing payments. If the rates in these scenarios are too high beyond the call date, the result would be premium installments continuing through maturity for a non-advance-refundable bond.

The likelihood of refunding increases as the coupon increases, and therefore higher coupon structures favor payment plans which depend on whether or not the bonds are refunded. Early refunding reduces the effective premium paid.

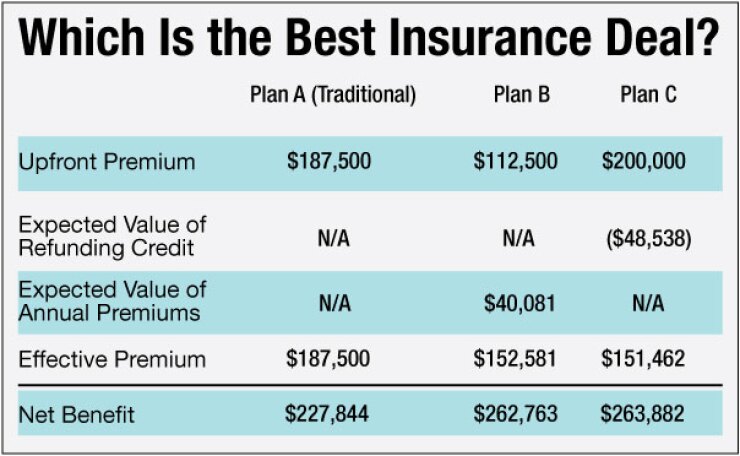

The attached table displays the results of the MINER analysis of the alternative insurance plans for a $10 million 30-year 5% NC-10 bond, eligible for advance refunding. The uninsured yield (to worst) is 3.45%, which converts to a price of 113.015, resulting in proceeds of $11,301,500. With insurance, the yield to worst would decline to 3.00%, or a price of 117.169, and proceeds of $11,716,900, exceeding the uninsured proceeds by $415,344.

The debt service is $25,000,000. Plan A has an all-upfront premium of 0.75% of the debt service, or $187,500. Because this plan would save the issuer $227,844 ($415,344- $187,500), insurance is clearly beneficial. But is there a preferable alternative premium plan?

Plan B charges 0.45% of debt service upfront ($112,500) and 0.10% of par ($10,000) every year starting from the first call date, at the end of the 10th year. Plan C has an upfront premium of 0.80% of debt service ($200,000), but provides a credit of 50% of the premium ($100,000) towards future insurance costs, if the bond is refunded.

As we see, Plan C is the best deal, with a net benefit of $263,882. The high upfront premium is mitigated by the 50% credit upon refunding.

In the above analysis it is assumed that the credit improvement (price after insurance) would be the same for each insurer. This may not be the case in practice, but fortunately

Because optional redemption features are standard in municipal bond issues, even a seemingly simple decision — selecting the best insurance plan — requires modern option-based analytics. Issuers and their financial advisors should take note.

Andrew Kalotay is president of Andrew Kalotay Associates.