The Bond Buyer's weekly yield indexes were narrowly mixed this week, as fears of a supply-driven sell-off were washed away by two days of gains, spurred by refunding postponements and rallying Treasuries.

"It's been a real interesting week," according to Evan Rourke, a portfolio manager at Eaton Vance. "In the beginning, everyone was concerned about supply. Then suddenly, there was a nice rally in Treasuries. Our relative value has proven attractive to crossover buyers, as we're over 100% of Treasury yields all along the curve at this point."

"We also had the refunding portions of some deals get pulled, and the combination has allowed munis to perform pretty nicely," he added.

Leading the stacked primary market this week, the California Department of Water Resources priced $1.8 billion of power supply revenue bonds, Illinois' Metropolitan Pier and Exposition Authority came to market with $1.1 billion of debt, and New York City brought $925 million of taxable debt over two series, including $775 million of taxable Build America Bonds.

Additionally, due to what was at that point a weakening municipal market, Georgia and Pennsylvania Tuesday postponed tax-exempt refundings worth $321 million and $386.5 million, respectively.

"Once those refundings were pulled, people started to bid things up," Rourke said.

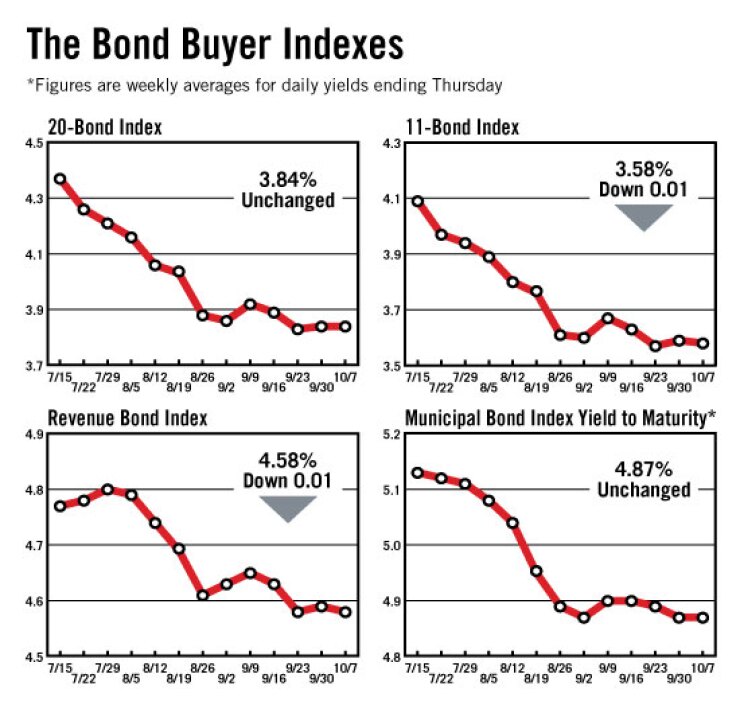

The Bond Buyer 20-bond index of 20-year general obligation bond yields was unchanged this week at 3.84%.

The 11-Bond GO Index of higher-grade 20-year GO yields declined one basis point this week to 3.58%, but still remained above its 3.57% level from two weeks ago.

The revenue bond index, which measures 30-year revenue bond yields, dropped one basis point this week to 4.58%, the same level as two weeks ago.

The Bond Buyer one-year note index, which is based on one-year tax-exempt note yields, rose four basis points this week to 0.48%, which is its highest level since Sept. 1, when it was 0.51%.

The yield on the 10-year Treasury note declined 12 basis points this week to 2.40%.

This is the lowest the yield has been since Jan. 15, 2009, when it was 2.20%.

The yield on the 30-year Treasury bond rose three basis points this week to 3.72%, but remained below its 3.74% level from two weeks ago.

The weekly average yield to maturity on The Bond Buyer's 40-bond municipal bond index, which is based on 40 long-term municipal bond prices, remained unchanged this week at 4.87%.