DALLAS — The Utah Transit Authority will complete financing for its 2015 rail projects and convert about half of its variable-rate bonds to fixed rate in a $296.8 million issue planned for Oct. 30.

The deal comes with the UTA running two years ahead of schedule on construction on its rail network throughout the Salt Lake City region, which was originally targeted for completion in 2015.

The bonds will be priced through negotiation with Morgan Stanley and Bank of America Merrill Lynch. Ballard Spahr serves as bond counsel, with Zions Bank Public Finance as financial advisor.

Proceeds will provide about $180 million of new money for rail projects, and allow the authority to grab historically low fixed rates by refinancing variable-rate bonds, said Brian Baker, vice president at Zions Bank Public Finance.

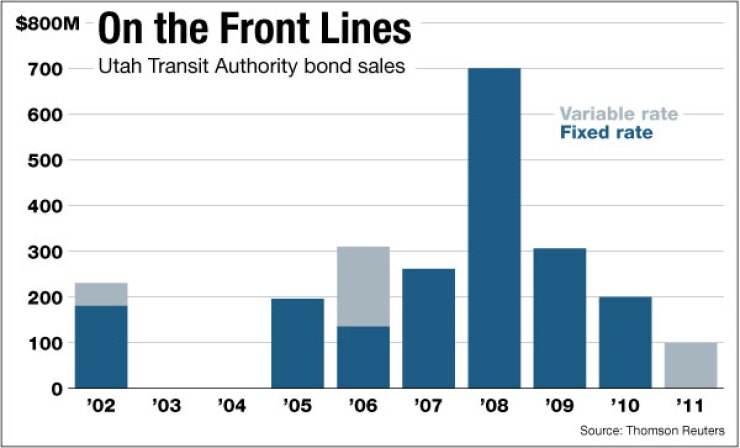

The refunding portion will be used to fix rates on the remainder of $100 million of Series 2011 and $32 million of the Series 2006 variable-rate bonds, reducing the UTA’s total amount of variable-rate debt from $275 million, or 14.4% of total debt, to $143 million or 6.9%.

The subordinate-lien sales-tax revenue bonds are rated A-minus by Standard & Poor’s, A-plus by Fitch Ratings and and equivalent A1 by Moody’s Investors Service. The credit outlooks are stable.

Revenues backing the bonds are pledged through interlocal agreements with the counties of Salt Lake and Utah through at least 2045, beyond the final maturity date of the bonds.

Fares and interest subsidy payments for Build America Bonds are included in the pledged revenue. The bonds are additionally secured by debt-service reserve funds.

The UTA system covers about 1,400 square miles in six counties representing nearly 80% of the state’s population. The service area spans Utah’s Wasatch Front, linking the city and county of Salt Lake with fast-growing suburban areas, including the counties of Box Elder, Davis, Tooele, Utah and Weber.

“The system’s economic and tax bases are broad, diversified, and contain positive drivers for long-term growth, including historically very high birth and family-formation rates that will continue to drive population growth,” Fitch analyst Scott Monroe wrote.

Sales tax collections rose 6.5% in fiscal 2011, significantly outperforming the authority’s original projection of a 4.2% gain.

Sales tax revenues for the first seven months of 2012 have similarly outperformed, rising 7.5%, versus the agency’s original projection of a 4% increase.

The UTA expects 4% sales-tax revenue growth in fiscal 2013, gradually rising to 5% annually from fiscal 2017 onward. Utah’s state economist recently revised the fiscal 2013 sales-tax growth rate to 5.7% from 4%.

“Fitch believes the authority’s long-term sales tax growth-rate assumptions are somewhat aggressive, notwithstanding recently strong performance, as future sales tax growth may not match historically high levels that averaged about 5% since 1982,” Monroe noted.

The refunding pushes peak annual debt service to fiscal 2021 from fiscal 2018, and reduces the rate of debt service growth. The tradeoff is somewhat higher maximum-annual debt service for avoiding a bump in 2018.

Following this issue, the UTA will have $2.1 billion in senior and subordinated bonds outstanding, according to Moody’s.

“The remaining variable-rate risk is partially mitigated by the absence of swaps, which provides the authority with greater flexibility to fix out the variable-rate debt if needed,” wrote Moody’s analyst Kenneth Kurtz. “In addition, the authority conservatively budgets 3.6% for interest on its variable-rate debt. Actual interest rates on its VR debt have been significantly lower, even including the periods of market disruption in 2008 and 2009.”

The new-money portion of the Series 2012 bonds will fund the authority’s remaining share of the costs of the Frontlines 2015 Project. The agency has no major capital plans beyond those in the 2015 project and no additional new-money borrowing plans. The UTA has a positive track record of delivering large capital projects on schedule and within budget, according to Kurtz.

The FrontLines 2015 program is a group of five UTA rail projects scheduled to be in operation by the year 2015, adding 70 miles to the authority’s existing 64-mile rail network.

FrontLines 2015 was approved by voters in 2006, providing increased sales-tax revenue to fund the project, which includes five extensions to the rail transit system.

Some of the 2012 bonds will finance expansion of the FrontRunner South commuter train project and construction of the Draper and Airport Trax light-rail lines.

The FrontRunner South is a 44-mile-long rail line that will extend the UTA’s commuter rail system south from Salt Lake City to Provo City in Utah County.

The line has six stations, including two intermodal centers. Two additional stations are planned for the future.

With a total capital costs estimated at $907 million, Front Runner South is 97% complete, officials said, with operations expected to begin in December.

The Draper Trax line will include 3.8 miles of light rail and three stations. Construction of the project is 84% complete and is expected to be operational in August 2013, with a total capital budget of $191 million. The UTA has received a full-funding grant agreement for 60% of the costs of the Draper project. It expects to fund the rest of the project from sales and use taxes.

The airport light-rail line will extend 5.5 miles from the northern end of the North-South line to Salt Lake City International Airport. The line will have five stations. Construction of the project is about 92% complete and is expected to be operating in April 2013, at an expected capital cost of $344 million. Salt Lake City is funding $35 million of the airport line.

The projects began before the collapse of the housing and finance markets and are coming to fruition amid a fairly robust economic recovery.

“Recent economic indicators have been solidly positive, suggesting the state is recovering from the recession at a sound pace,” Kurtz said.

August employment was up 3.4% year over year, far outpacing the 1.6% national expansion. The employment growth resulted in a relatively low 5.4% unemployment rate, an improvement from the previous year’s 6.8% rate.

Although government employment contracted significantly over the past year, most private employment sectors recorded gains, analysts said. The biggest job gains came from leisure and hospitality, professional and business services, and construction sectors.