Pennsylvania tomorrow will issue $616.8 million of tax-exempt, long-term general obligation debt via competitive bid in what is expected to be the state's final bond issuance for fiscal 2009.

Absent from the transaction are taxable Build America Bonds, which have generated savings for issuers through a 35% federal subsidy on principal and interest payments. Pennsylvania officials evaluated using BABs, but state law dictates that the commonwealth must issue bonds competitively and offer serial maturities. Recent large BAB deals have included bullet and term maturities and were sold via negotiation.

Officials calculate that Pennsylvania potentially could save 10 to 20 basis points if it were able to utilize BABs, according to Rick Dreher, director of the bureau of revenue, cash flow, and debt in the Budget and Administration Office.

"We were seeing preliminary estimates of - if everything worked out perfectly - anywhere from a 10 to 20 basis point savings using the BAB structure," Dreher said. "But unfortunately, we're not able to avail ourselves to that."

Issuing debt in the taxable market is out of character for Pennsylvania, which by law issues only fixed-rate GO debt with a maximum maturity schedule of 30 years via competitive bid.

"On face value, [BABs] look very attractive, not only for the commonwealth but a lot of our municipalities," Dreher said. "However ... once we started looking at some of the details, the traditional structures you see in a taxable bond market in terms of bullet maturities and negotiated deals, a lot of that runs counter to Pennsylvania state law ... So, the constraints that we have to operate under state law do not lend themselves well to issuing taxable debt."

To date, two states have sold BABs. California issued $5 billion and $57.5 million of BABs on April 22 and April 27, respectively. Louisiana sold $103 million of BABs on May 6.

Fox, Rothschild LLP is bond counsel on Pennsylvania's $616.8 million fixed-rate deal. Public Financial Management Inc. is the financial adviser.

Standard & Poor's and Fitch Ratings assign AA ratings to the deal. Moody's Investors Service rates the transaction Aa2.

The borrowing is slightly larger than the state's two previous issuances for fiscal 2009, which totaled $300 million each. The government tends to sell debt in batches larger than that, but it has reduced the size of its offerings and sold more frequently due to market volatility since September. Dreher said five bidders competed in the commonwealth's last GO deal on March 10.

"We were just in the market in March and received very favorable rates and very significant response in terms of the number of bidders," Dreher said. "So from our perspective, the market seems to have returned."

JPMorgan was the winning bidder for the $300 million deal on March 10, with yields ranging from 1.23% with a 5% coupon in 2011 to 4.80% with a 5% coupon in 2029. Debt maturing in 2010 was sold with a sealed bid.

Among those bonds that carry a 5% coupon, debt maturing in 2011 was priced to offer yields closest to that day's Municipal Market Data triple-A yield curve - 10 basis points higher. Bonds maturing in 2014 through 2018 were widest to the spread - 23 basis points higher.

As of May 14, yields on double-A rated, tax-exempt GO bonds in Pennsylvania range from 0.44% in 2010 to 4.53% in 2039, with yields one basis point over that day's MMD triple-A yield curve in 2010, according to Thomson Municipal Market Monitor. The widest yields are on debt maturing in 2012 through 2020, with yields 14 basis points over the MMD curve.

The $616.8 million transaction includes $464 million of new-money bonds and $152.8 million of refunding. The new-money portion offers serial maturities from 2010 through 2029 while the refunding bonds contain serial maturities from 2009 through 2014, according to the preliminary official statement.

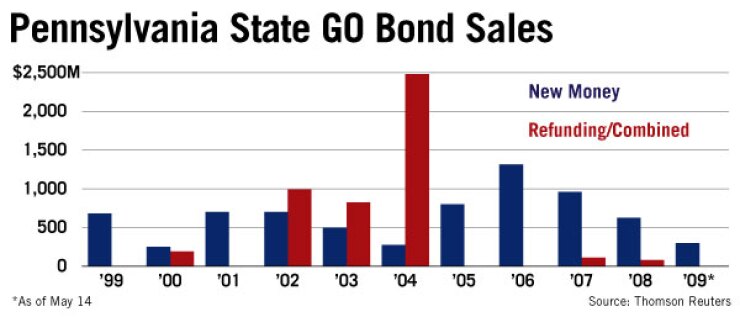

Dreher said the state expects the refinancing to generate present-value savings of 3.1%. Refunding candidates include bonds sold in 1999, 2000, 2001, and 2002.

The bulk of the new-money proceeds will help finance the construction and rehabilitation of public buildings, redevelopment assistance projects, transportation infrastructure, and furniture and equipment purchases. About $40 million will go towards open space and farmland preservation, abandoned mine reclamation, and other environmental initiatives.

Pennsylvania during the next few years plans to address its aging infrastructure by issuing more debt. The state typically issues roughly $1 billion of debt annually but expects to sell $1.93 billion, $2.38 billion, and $1.48 billion of bonds in the next three fiscal years, respectively.

The increased borrowing will help finance four new state correctional facilities, expand the Pennsylvania Convention Center in Philadelphia, and support bridge and road repairs.

Lawmakers last year approved $1.3 billion of state-supported debt to be issued during the next three to five years through the Commonwealth Financing Authority. The CFA bonds will support water and sewer infrastructure, dams and flood control projects, and alternative energy upgrades.

Even with the additional borrowing, Dreher said total debt service costs will not exceed 4% of operating budgets. Pennsylvania has about $8.2 billion of outstanding debt.

All three rating agencies noted the increased borrowing scheduled for the next few years and believe the state can absorb the additional debt.

"While planned issuance is significant and the appropriation debt is a departure from practice, Pennsylvania's policy of limiting debt service to around 4% of revenues should keep debt obligations moderate," according to a Fitch report.

The state does need to deal with pension contribution costs that are estimated to rise by roughly $1 billion to $1.2 billion per year beginning in fiscal 2013. In addition, losses in the pension fund during the past six to nine months will require additional payments. Pennsylvania's total pension liability is $12.1 billion, according to the POS.

"We're actively looking at ways to mitigate those spikes, but I don't believe that pension obligation bonds are anything that we're going to be pursuing in the immediate future," Dreher said. "It's a tool that is available and worth consideration, but there has been no decision to issue them and we're just not in that market right now."

Dreher said investment firms have been pitching pension bonds to the administration as one solution to the problem. Originally, the state was considering gradually increasing its contribution rate to smooth out the hike in the payment, but then the economy fell into a recession and revenues began to drop, creating shortfalls in the fiscal 2009 budget.

Standard & Poor's analyst Rich Marino said the current decreases in revenue are a more urgent problem than the large pension payment increases. "That will put more pressure on them, but I think the immediate pressure is greater," he said.

April's general fund revenue collections of $3 billion came in $941.5 million, or 24.2%, below prior estimates, according to the Department of Revenue. Year-to-date, the state has received $21.7 billion of total revenue, with is $2.6 billion less than projections, a 10.5% drop.

The administration plans to use Pennsylvania's entire $750 million rainy-day fund to help balance the fiscal 2009 budget, leaving no cushion for fiscal 2010.

"We know that it produces less flexibility because they have closed out their rainy-day fund to close out the fiscal 2009 budget gap," Marino said. "And we'll wait and see how the [fiscal] 2010 budget turns out and what corrective actions they would take to put that into balance."