Bond yields at a glance | ||||

MBIS benchmark (~AA) | MBIS AAA | MMD AAA | U.S. Treasuries | |

10 year | 2.586 | 2.496 | 2.35 | 2.73 |

30 year | 3.027 | 2.927 | 2.91 | 2.95 |

|

MBIS indices are updated hourly on the Bond Buyer Data Workstation. | ||||

Municipal bond market participants are weighing in on what they think about what President Trump said about infrastructure in his State of the Union address.

The president on Tuesday night called for Congress to pass legislation that will generate at least $1.5 trillion for new infrastructure investment, but he provided no details on how it should be funded.

Some members of the buyside community feel the infrastructure plan may be too much for lawmakers, municipalities, and investors to swallow after barely having time to digest the latest tax amendments that kicked off the New Year.

"Given the recent passage of tax reform we sense that members of both political parties may be concerned with potentially adding to the federal deficit," Michael Pietronico, chief executive officer at Miller Tabak Asset Management, said in an interview on Wednesday.

"While the case can be made for states to work alongside the federal government on this initiative, we remain of the mindset that out-sized pension obligations are handcuffing lawmakers at the local level," he said. "It is for this reason we sense infrastructure spending may become more of a 2019 possibility after the results of the midterm elections."

Other buyside participants said the $1.5 billion infrastructure proposal is still in its infancy -- and therefore wasn't disappointing as much as it just wasn't ironed out yet.

"It's going to be something that is a political process," said Ron Schwartz, managing director and senior portfolio manager at Seix Investment Advisors, who manages $1.4 billion in tax-exempt mutual funds and separately managed accounts.

"We will see what is proposed and if it can pass through Congress. Right now, there's nothing to say about it because there are no details about it," he said, adding that he hadn't expected President Trump to provide details Tuesday.

"I'm not sure they know what it will be at this point in time," Schwartz added. "They have to figure out the plan they want to set up, and once they have their plan set up, they will release it."

Others were not convinced.

"I am skeptical of the announcement," John Donaldson, director of fixed income at Haverford Trust, said in an interview on Wednesday afternoon. The few details seem to indicate that very little federal money will be involved in the stimulus plan and there are many rumors about actual figures involved, he said.

He also questioned the fundamentals of how municipalities would be involved and how the plan would translate into day-to-day operations on some of the aging infrastructure.

"For the vast majority of necessary projects; how do those who fund the difference earn an acceptable return? Bridges not [located] on toll roads that need replacing do not generate revenue. All of the older dams that need replacing do not generate revenue," he said.

"I am sure that we are not the only city that has suffered multiple water main breaks on very cold days," Donaldson said. "If cities could charge rates sufficient to replace aging systems, new pipes would already be there."

Donaldson said he was in a position to see the earliest Infrastructure funds in 2006-2007.

"The ones that were most successful were private equity funds in disguise," he explained. "That is, they bought assets and then sold them at a profit. The promise of long-lived assets generating cash flows for long-term investors has always appeared to be more myth than reality."

Donaldson said there are various turnpike and parking assets as evidence of projects not meeting projections.

"I doubt there will be any impact on the muni market until a plan has more defined revenue generation to repay potential lenders," he added.

The market will now be waiting for any further word from the White House on what form the financing and funding for this huge program could take.

Primary market

Morgan Stanley priced Kansas City, Mo.’s $165 million of Series 2018A sanitary sewer system improvement revenue bonds.

The issue was priced to yield from 1.83% with a 4% coupon in 2021 to 3.51% with a 4% coupon in 2035; a 2042 maturity was priced as 4s to yield 3,55%. A 2019 maturity was offered as a sealed bid.

The deal is rated Aa2 by Moody’s Investors Service and AA by S&P Global Ratings.

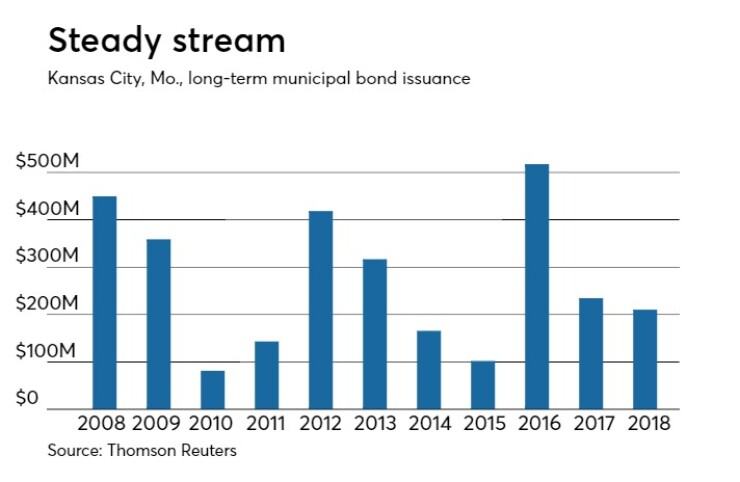

Since 2008, Kansas City, Mo., has sold about $2.99 billion of bonds, with the most issuance occurring in 2016 when it sold $517 million and the least amount in 2010 when it sold $81 million.

Bank of America Merrill Lynch priced the School Board of Palm Beach County, Fla.’s $114.73 million of Series 2018A certificates of participation.

The COPs were priced as 5s to yield from 1.38% in 2018 to 2.65% in 2027.

The deal is rated Aa3 by Moody’s and AA-minus by Fitch Ratings.

There are no competitive sales of $100 million or above slated for the week.

Bank of America Merrill Lynch received the official award on the Upper Arlington City School District, Ohio’s $230 million of Series 2018A school facilities construction and improvement GOs and Series 2018B taxable school facilities construction and improvement GOs.

The deal is rated Aa1 by Moody’s and AAA by S&P.

JPMorgan Securities received the written award on the Arizona Board of Regents $110.84 million of University of Arizona system revenue bonds.

The deal is rated Aa2 by Moody’s and AA-minus by S&P.

Secondary market

The Federal Open Market Committee left interest rates unchanged at the conclusion of its two-day monetary policy meeting. It was Janet Yellen’s last FOMC meeting and set the stage for a rate hike in March under her successor Jerome Powell.

The MBIS municipal non-callable 5% GO benchmark scale was weaker in late trading while the MBIS AAA scale was also weaker.

The 10-year MBIS muni benchmark yield rose to 2.586% on Wednesday from the final read of 2.565% on Tuesday, according to

The 10-year MBIS muni AAA yield increased to 2.496% on Wednesday from the final read of 2.464% on Tuesday, according to

The MBIS benchmark index is updated hourly on the

Top-rated municipal bonds finished mixed on Wednesday. The yield on the 10-year benchmark muni general obligation rose one basis point to 2.35% from 2.34% on Tuesday, while the 30-year GO yield was unchanged from 2.91%, according to the final read of MMD’s triple-A scale.

On Wednesday, the 10-year muni-to-Treasury ratio was calculated at 86.5% compared with 84.1% on Tuesday, while the 30-year muni-to-Treasury ratio stood at 96.6% versus 99.0%, according to MMD.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 45,113 trades on Tuesday on volume of $10.87 billion.

California, New York and Texas were the three states with the most trades on Tuesday, with the Golden State taking 15.119% of the market, the Empire State taking 11.668% and the Lone Star State taking 11.056%.

--Aaron Weitzman contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.