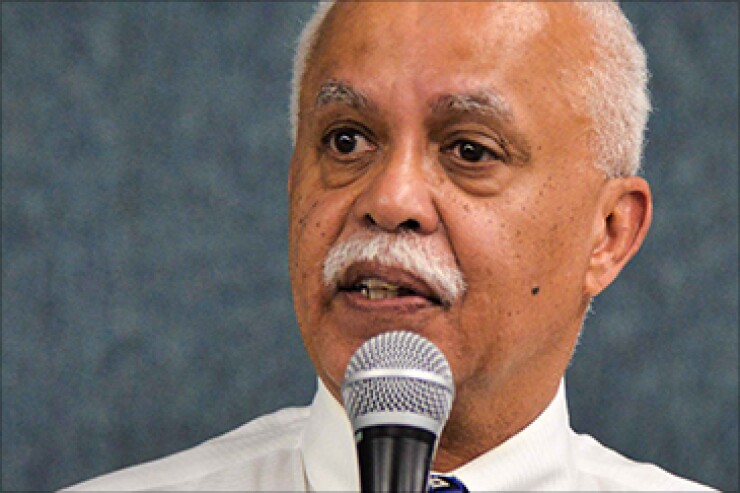

DALLAS -- Wayne County, Mich.'s books are back in the black for the first time in eight years and the county will soon ask to be released from a state consent agreement, county Executive Warren Evans said.

Evans delivered the state of county address on Tuesday night and said that the county's effort to cure its financial emergency under the consent agreement powers had effectively staved off an emergency manager and bankruptcy.

The county, because of its financial distress, is operating under a consent agreement with the state, an agreement that "was essential to implementation of important pieces of its recovery plan," Evans said.

"Many warned that the consent agreement would fail. They were wrong. It worked and I am proud to report that this year we will petition the state treasurer to release Wayne County from the consent agreement," he said.

The release could happen in the coming months, he said.

Wayne, home to Detroit which emerged from Chapter 9 in late 2014, turned around years of fiscal mismanagement and eliminated a nearly $100 million accumulated deficit and a yearly structural deficit of approximately $52 million. The county was also grappling at the time it entered the state consent agreement with $1.3 billion in unfunded health care liabilities and faced a depleted pension fund that required about $900 million to reach full funding.

The county has trimmed nearly $50 million in spending, achieved with elimination or modification of retirement benefits, a contraction of payroll, and other operating efficiencies over the last six months.

Earlier this month the county announced that it is expecting $23 million in fiscal 2016 budget relief from cuts in retiree healthcare benefits after trimming $850 million from its unfunded liabilities. The annual savings are expected to grow.

"Many local governments have been required to make similar painful cuts," said Evans. "These cuts are to the muscle not just the fat of local governments."

Evans said in his address that the county's fiscal progress improves its ability to borrow money to complete essential projects like its partially built jail.

"It will cost hundreds of millions of dollars to finish that jail. The costs of restarting construction and the natural increase in prices will add millions to the cost to complete it," he said.

The county also plans to undertake renovations for its existing jails and the Frank Murphy Hall of Justice.

Evans said that such cuts highlighted a larger fundamental problem that Wayne County shares with Michigan's 43 cities and townships and that is "[management] of their financial affairs under a broken system of local government financing."

Evans said that the decline in property values during the recession that began in 2008 drove down the county's property tax revenues by $418 million from 2008 to 2014.

"Local governments can't sustain that kind of loss without significantly affecting the quality of the essential services they are required to deliver," said Evans. "So the heavy reliance on property taxes to fund local governments, by itself, is of major concern."

In February, Moody's Investors Service revised its outlook on the junk-level rating upward to stable from negative in recognition of the county's success in making substantial cuts to its retirement liabilities and other operating expenses.

The rating agency affirmed the county's Ba3 general obligation limited tax debt rating. The county has a total of $518 million of long-term GOLT debt outstanding, of which $336 million is rated by Moody's.

An additional $300 million of short-term GOLT delinquent tax anticipation notes are outstanding, but are not rated by Moody's.