SAN FRANCISCO — With the national recession reaching the Puget Sound, Washington state lawmakers had to lay their budget cards on the table this week in the release of their operating and budget proposals.

With the state’s tax revenue predicted to remain flat over the next two-year budget, the Democrats who control each house released no-new-tax budgets that include cuts to programs that would otherwise have grown by billions of dollars if no changes were made.

Their budget proposals also depend on one-time tools — federal stimulus funds, plus the use of bonds to fund capital spending that ordinarily is funded on a pay-as-you go basis.

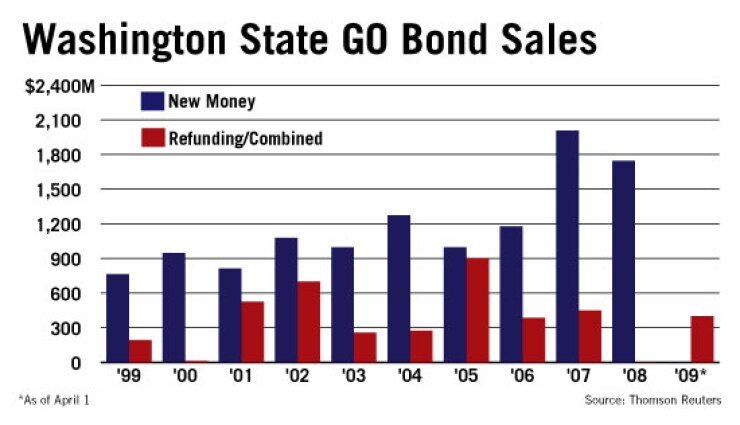

Senate Democrats’ capital budget proposal would have the state issue bonds to cover $743 million ordinarily paid for out of general fund cash; the House Democrats would shift $780 million.

Proposed shifts include using debt instead of cash for the state’s Public Works Assistance Account, used to fund loans for local infrastructure projects, and for a fund used to finance toxic cleanup projects. Loan programs would be converted to grant programs if bonds were used, Senate Ways and Means chair Karen Fraser, D-Olympia, said when introducing the new budget to reporters Wednesday.

Despite the shift, she said her budget would actually require 17% less bonding over the next two years — about $1.8 billion in total — and that the total $3.3 billion capital budget would be 29% smaller. The House capital proposal is similar.

That’s because fewer capital projects made the cut.

Even so, given the tight revenue picture, lawmakers will have to approve separate legislation moving several budget sub-accounts into the general fund to keep issuance within the state’s debt limit.

Washington Treasurer Jim McIntire issued a statement Wednesday commending both Democratic capital budget proposals.

“These budgets rely on levels of bond sales that are affordable and achievable, even in this tough credit market,” said McIntire, a Democrat elected in November, and a former chair of the House Finance Committee.

He said the municipal bond market appears to be recovering from a sharp volume drop-off last September, after Lehman Brothers Holdings filed for bankruptcy.

“That said, the market remains tight and there’s a limit of how much debt the state can issue at an affordable rate,” McIntire said. “We see the market for tax-exempt bonds returning slowly — which will help us issue just over $2 billion of new bonds this year for transportation and regular capital projects.”

Washington last sold GO bonds in January, a deal scaled back by more than half to $400 million.

The state taps the market again next week, in its first GO issuance since McIntire took office, pricing $479.5 million competitively Monday. Two series price separately: a $441.4 million Series 2009E, for various purposes, and a $38.2 million for transportation, backed by motor vehicle fuel taxes and the state’s GO pledge.

Seattle-Northwest Securities Corp. and Montague DeRose and Associates LLC are financial advisers.

Washington’s GO bonds most recently garnered ratings of AA from Fitch Ratings and Aa1 from Moody’s Investors Service. Standard & Poor’s yesterday affirmed its AA-plus rating on the credit.

The state released its Comprehensive Annual Financial Report for 2008 in December.

The capital budget proposals should allow Washington to retain its ratings, despite its budget issues, McIntire said.

“If our credit rating drops to California’s level, we will have difficulty selling bonds at an affordable rate,” he said in his statement. “Debt is a limited resource that must be managed with caution if it is to be useful. Issuing too much debt can risk our credit rating and drive up costs on all of our bonds.”

All three ratings agencies dropped California to the single-A level this year.

Washington’s economy is likely to remain weak into next year, according to the most recent forecast issued this month by the state’s independent Economic and Revenue Forecast Council.

“Our new baseline forecast assumes that the U.S. and Washington economies will be in recession for most of this year, flattening out sometime late in the third quarter,” the council reported in its March 19 forecast. “Growth will remain flat in the first half of 2010, and improve only in the second half of the year.”

Both caucuses unveiled their operating budgets this week as well, in each case proposing about $31.3 billion in spending over two years, roughly flat over the previous two years.

With Democrats holding more than 60% majorities in each house, and the governorship, the main action between now and the Legislature’s April 26 adjournment will be in conference as the two chambers reconcile the detail differences over budget proposals that are similar in broad outline.

There may also be proposals to place either tax increases or a separate bond measure on the state ballot sometime this year; those trial balloons have been floated in published reports but not formally introduced.

The GOP minority, for its part, is largely in a position of offering criticism, such as in a news release Wednesday from Judy Warnick of Moses Lake, the ranking Republican on the House Capital Budget Committee.

“The operating budget proposal would transfer $780 million of designated fund accounts normally used by the capital budget to fill part of the massive hole in the operating budget,” she said. “Raiding these funds is not a wise use of our resources in my opinion.”

Senate Majority Leader Lisa Brown of Spokane defended the cash-to-bonds capital spending shifts as necessary given the times.

“Using bonds for these kinds of projects is completely appropriate because they are long-term projects,” she told reporters Wednesday.