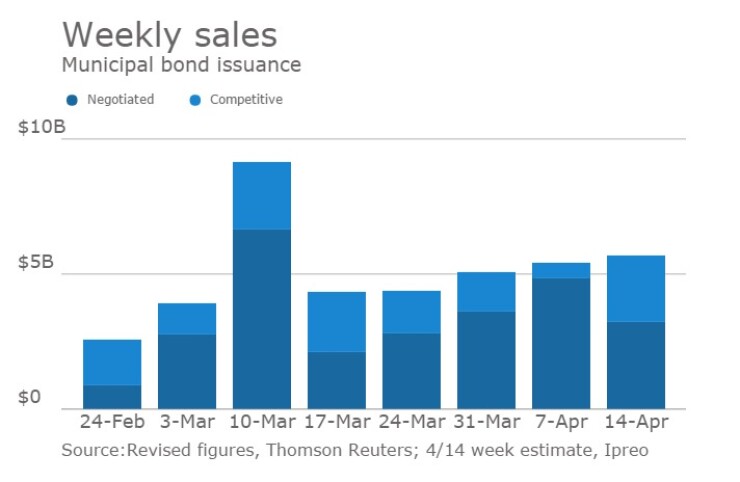

Municipal market participants will see a little more volume to go along with one less work day in the coming week, on the heels of Friday's weaker-than-expected March employment report.

Ipreo estimates volume will nudge up to $5.69 billion, from a revised total of $5.48 billion in the past week, according to updated figures from Thomson Reuters. The calendar for the week ahead is composed of $3.23 billion of negotiated deals and $2.46 billion of competitive sales.

The week will be cut to four days, with the market closed in observance of Good Friday. There are 12 deals on the schedule of $100 million or more in par amount, six negotiated and six competitive transactions.

“We might see supply levels start to pick up a bit in the next few weeks throughout the remainder of the new quarter,” said Dan Heckman, senior fixed income strategist at U.S. Bank Wealth Management. “There were several local elections that were being held and the vast majority of ballot initiatives have been passed.”

He also said he believes there is now a higher level of confidence of municipalities when it comes to spending money and starting more projects.

Despite the see-sawing of weekly municipal bond fund flows, as reported by Lipper, demand in the primary market is still pretty good, according to Heckman.

“I think we could start seeing inflows come in at a greater pace,” he said. “Once we get past tax season, I wouldn’t be surprised if inflows pick up.”

The New York City Transitional Finance Authority is set to hit the market with roughly $1.14 billion, separated into one negotiated deal and two competitive sales.

RBC Capital Markets is scheduled to price the $840 million of future tax secured subordinate bonds fiscal 2017 bonds on Tuesday following a two-day retail order period.

On Friday, the $800 million of Series E, Subseries E-1 bonds were priced for retail to yield from 1.19% with a 4% coupon in 2020 to 3.712% with a 3.625% coupon in 2045. The 2019 maturity was offered as a sealed bid. No retail orders were taken in the 2032, 2035-2036, 2039 and 2041-2043 maturities.

The $40 million of Series A, Subseries A-2 bonds were priced for retail to yield 1.15% with a 4% coupon and 1.15% with a 5% coupon in a 2019 split bullet maturity. The deal is rated Aa1 by Moody’s Investors Service and triple-A by S&P Global Ratings and Fitch Ratings.

The NYC TFA will sell the two competitive deals on Tuesday. The future tax secured subordinate taxable bonds will come in two tranches: one for $234.21 million and the other for $65.79 million. The deals are rated Aa1 by Moody’s and triple-A by S&P and Fitch.

JP Morgan is slated to price Energy Northwest’s $592 million of electric revenue refunding bonds on Tuesday. The deal is rated Aa1 by Moody’s, AA-minus by S&P and AA by Fitch.

In the competitive arena, California is set to sell $635.59 million of various purpose general obligation refunding bonds on Wednesday. The deal is rated Aa3 by Moody’s and AA-minus by S&P and Fitch. The Golden State is the top municipal issuer through the first quarter of the year, having issued $16.48 billion in the first quarter of 2017.

“Demand will be solid for the top few largest deals of the week, Heckman said. "Some people out there are searching for yield and then any other credit that people generally view as ‘solid’ will attract a lot of demand.”

Secondary market

Municipal bonds finished stronger on Friday, after the March employment report came in weaker than expected.

The Labor Department reported that the March non-farm payrolls rose 98,000, less than the 180,000 gain forecast by economists surveyed by IFR Markets. Additionally, the unemployment rate fell 4.5%, lower than the 4.7% rate expected by economists polled by IFR.

The yield on the 10-year benchmark muni general obligation fell two basis points to 2.17% from 2.19% on Thursday, while the 30-year GO yield dropped two basis points to 2.97% from 2.99%, according to the final read of Municipal Market Data's triple-A scale.

U.S. Treasuries were also stronger on Friday. The yield on the two-year Treasury rose to 1.28% from 1.24% on Thursday, while the 10-year Treasury yield gained to 2.37% from 2.34%, and the yield on the 30-year Treasury bond increased to 3.00% from 2.99%.

The 10-year muni to Treasury ratio was calculated at 91.4% on Friday compared to 93.5% on Thursday, while the 30-year muni to Treasury ratio stood at 99.1%, versus 100.0%, according to MMD.

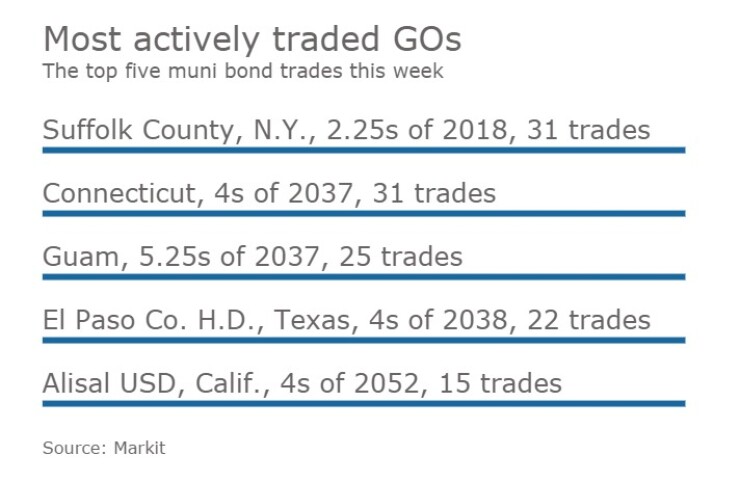

Week's most actively traded issues

Some of the most actively traded issues by type in the week ended April 7 were from New York, California and Michigan, according to Markit.

In the GO bond sector, the Suffolk County, N.Y., 2.25s of 2018 were traded 31 times. In the revenue bond sector, the California Golden State Tobacco Securitization Corp. 5s of 2028 were traded 37 times. And in the taxable bond sector, the L'Anse Creuse Public Schools, Mich., 2.678s of 2022 were traded 21 times.

Week's most actively quoted issues

South Carolina, Connecticut and California names were among the most actively quoted bonds in the week ended April 7, according to Markit.

On the bid side, the South Carolina State Public Service Authority revenue 5s of 2048 were quoted by 86 unique dealers. On the ask side, the Connecticut GO 4s of 2037 were quoted by 261 unique dealers. And among two-sided quotes, the California taxable 7.95s of 2036 were quoted by 24 unique dealers.

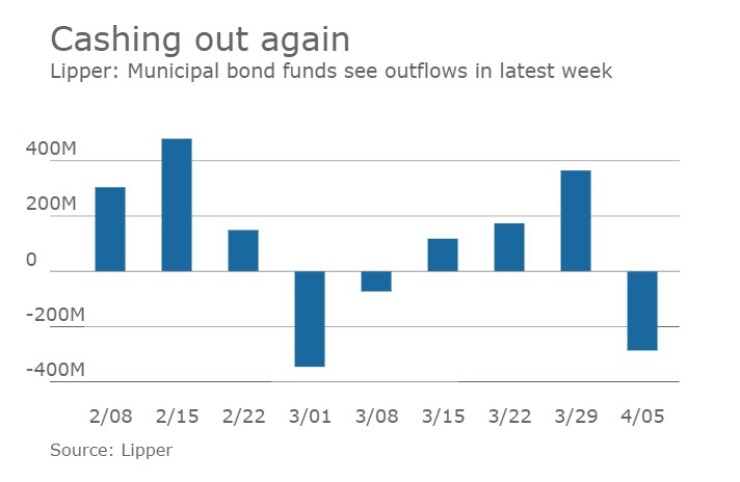

Lipper: Muni bond funds report outflows

Investors in municipal bond funds reversed course and pulled cash out of the funds in the latest week, according to Lipper data released late Thursday.

The weekly reporters saw $287.201 million of outflows in the week ended April 5, after inflows of $265.041 million in the previous week.

The four-week moving average was still in the green at positive $8.313 million, after being positive at $61.827 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds also had outflows, losing $166.361 million in the latest week after rising $271.561 million in the previous week. Intermediate-term funds had outflows of $79.763 million after outflows of $15.992 million in the prior week.

National funds had outflows of $135.789 million after inflows of $358.965 million in the previous week. High-yield muni funds reported inflows of $68.334 million in the latest reporting week, after inflows of $277.761 million the previous week.

Exchange traded funds saw inflows of $81.089 million, after inflows of $141.468 million in the previous week.