U.S. Virgin Islands senators grilled the leaders of the islands’ Water and Power Authority over its bid for a rate increase, blaming mismanagement for putting the island's economy at risk.

In a nearly 12 hour session Tuesday, senators complained about the authority’s intermittent provision of electricity, failure to use past rate increases for promised purposes, lagging and inaccurate bills, and history of cost overruns on contracts. WAPA Executive Director Lawrence Kupfer said the authority needed to sell a bond, and could not do so without a rate increase.

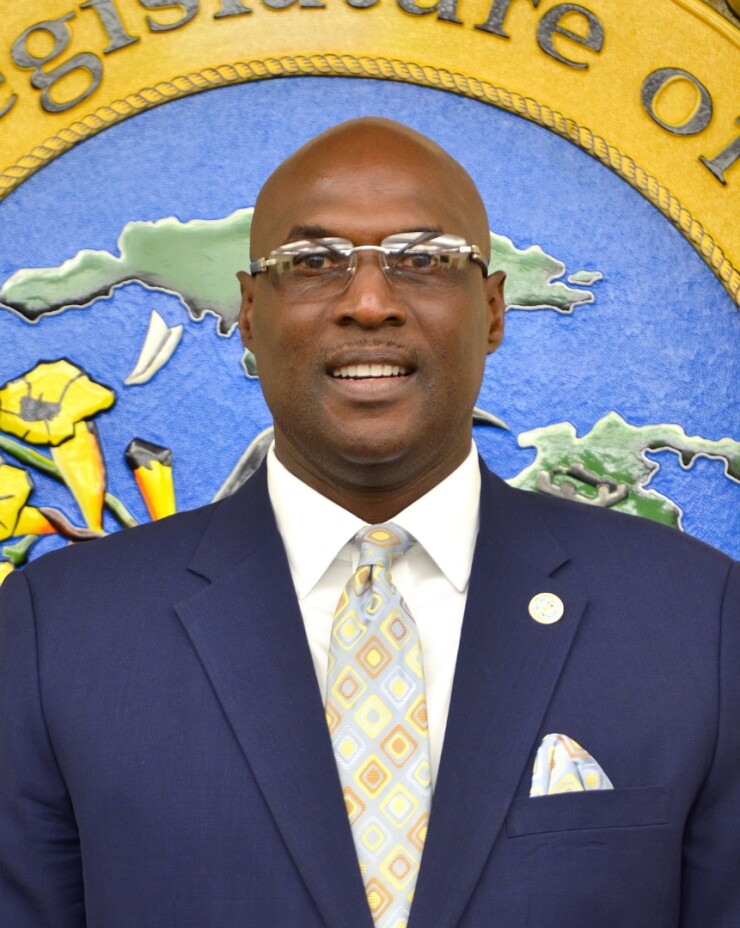

“To say the only solution is to raise the rates is a damn slap in the face," Sen. Kenneth Gittens said, "Maybe every one of you should go home.”

The power outages last month prompted the Virgin Islands' non-voting representative to Congress to call for the local government to declare an emergency and suggest that the authority’s debt needed to be adjusted. Moody’s dropped WAPA’s senior electrical system bonds to Caa2 from Caa1and its subordinated bonds to Caa3 from Caa2, and Fitch Ratings put the authority’s CCC rating on rating watch negative.

Kupfer told the island senate the authority had $550 million of debt, including $252 million of bond debt. Senator Donna Frett-Gregory asked about a figure of $1.2 billion that WAPA had given for liabilities in March. Kupfer said this included pension obligations and money owed to fuel suppliers and banks.

Kupfer also revealed that electrical demand from WAPA had gone down more than 15% in the last fiscal year from the level in fiscal year 2017, the last fiscal year unaffected by Hurricanes Irma and Maria.

But most of the hearing was devoted to the senators' questioning the authority’s past and current actions.

Gittens complained that in response to the senate’s request for documents the authority had submitted thousands of pages the day before the hearing without labeling the documents. “Are you thinking you’re playing with fools?”

Gittens noted that 17 of WAPA’s 19 top-tier professionals were paid $100,000 or more a year. He said that not all of its contractors were licensed to do business in the Virgin Islands.

Several senators brought up the history of WAPA’s contract with Vitol to make changes at its generator plants to allow them to burn propane gas. While the original contract was for $87 million, the authority ultimately had to pay $160 million.

“Every single contract WAPA enters into, there’s cost overruns,” said Senator Kurt Vialet.

Senator Marvin Blyden said electrical outages that have hit the islands over the last two months are “devastating our economy.”

Senate President Novelle Francis Jr. asked Kupfer if the authority had a plan B if there is no rate increase. Kupfer said that the authority needed to sell a bond and that it wouldn’t be able to do so without a rate increase.

Frett-Gregory said that Kupfer’s failure to present its $1.2 billion in liabilities in his morning presentation to the senators was an example of how the authority wasn’t giving them full information.

Public Service Commission Chairman Raymond Williams asked the senators to amend local law to require WAPA to use authorized rate increases for the uses that that the commission specified.

Kupfer told the board that the authority is taking several steps to address the outages. Some of the solutions will be introduced in the next few weeks. However, he said it would take time to implement long-term solutions.

He said the authority was at a fork in the road. In either path, there will be more renewable energy use. In one path this could lead to reduced use of WAPA’s services as people turned to providing their own power and this could be a further financial strain to the authority. In another path, the authority itself could add renewable sources and this could lower its costs and improve its reliability.