Municipals turned stronger on Monday as some new issue supply hit a quiet primary market.

Primary market

The Virginia College Building Authority competitively sold almost $215 million of educational facility revenue bonds and taxable bonds in two sales on Tuesday.

Public Resources Advisory Group was the financial advisor while Kutak Rock was the bond counsel.

Citigroup won the $137.795 million of Series 2018A tax-exempts for the public higher education financing program with a true interest cost of 3.4974%. JPMorgan Securities won the $77.15 million of Series 2018B taxables with a TIC of 4.4209%.

Proceeds from both sales will be used to acquire institutional notes to provide funding for capital projects at public higher educational institutions.

The deals are rated Aa1 by Moody’s Investors Service and AA-plus by S&P Global Ratings and Fitch Ratings.

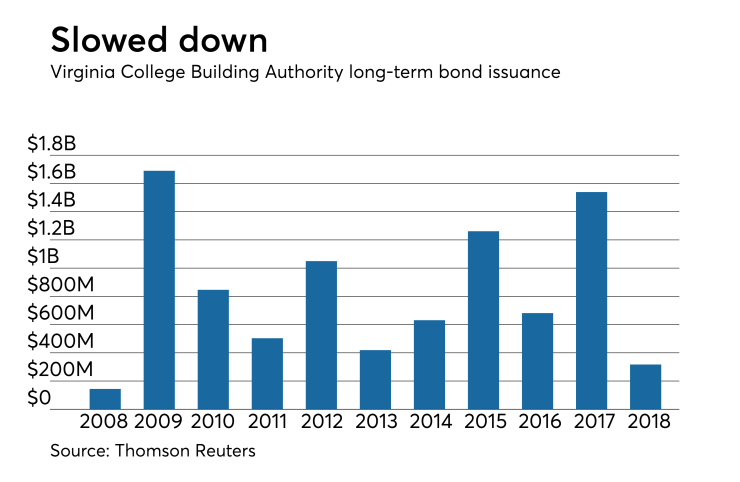

Since 2008, the authority has sold roughly $9.08 billion of securities, with the most issuance occurring in 2009 when it issued $1.69 billion. The VCBA saw a low year of issuance in 2008, when it sold $144 million.

RBC Capital Markets priced Tacoma, Wash.’s $101.71 million of sewer revenue bonds. The deal is rated Aa2 by Moody’s and AA-plus by S&P and Fitch.

Goldman Sachs is slated to price the Central Plains Energy Project’s $527 million of gas project revenue bonds, including fixed rate, LIBOR index rate and SIFMA index rate bonds. The deal, coming out of Nebraska, is rated A3 by Moody’s and A by S&P.

Piper Jaffray is expected to price Portland Community College, Ore.’s $172 million of full faith credit pension taxable bonds on Tuesday. The deal is rated Aa1 by Moody’s and AA-plus by S&P.

Bond sale results

Virginia

Washington

Bond Buyer 30-day visible supply at $6.4B

The Bond Buyer's 30-day visible supply calendar increased $756.2 million to $6.40 billion for Tuesday. The total is comprised of $2.07 billion of competitive sales and $4.33 billion of negotiated deals.

Secondary market

Municipal bonds were mostly stronger on Tuesday, according to a midday read of the MBIS benchmark scale. Benchmark muni yields fell as much as one basis point in the three- to 30-year maturities, rose less than a basis point in the one-year maturity and were unchanged in the two-year maturity.

High-grade munis were mostly stronger, with yields calculated on MBIS' AAA scale falling as much as one basis point in the five- to 30-year maturities, rising less than a basis point in the one- to three-year maturities and remaining unchanged in the four-year maturity.

Municipals were mixed on Municipal Market Data’s AAA benchmark scale, which showed the yield on the 10-year muni general obligation remaining unchanged while the yield on 30-year muni maturity rose as much as one basis point.

Treasury bonds were mixed as stocks traded higher.

On Monday, the 10-year muni-to-Treasury ratio was calculated at 86.5% while the 30-year muni-to-Treasury ratio stood at 100.2%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Puerto Rico bonds mixed

The Puerto Rico Oversight Board rejected the tax reform bill the local legislature had passed, saying it would push Puerto Rico off the road of a balanced budget. In response, Puerto Rico House of Representatives President Carlos Méndez Núñez said he would like to meet board Executive Director Natalie Jaresko to talk about the board’s objections.

In trading on Tuesday, the Puerto Rico Sales Tax Financing Corp. Series 2007A 5.25% revenue bonds of 2057 were at a high price of 83.25 cents on the dollar, compared with 82.5 cents on Friday, according to the Municipal Securities Rulemaking Board’s EMMA website. Trading volume totaled $19.03 million in six trades compared with $15.08 million in six trades last Friday.

The COFINA Series 2018 first subordinate 5.375% sales tax revenue bonds of 2039 were trading at a high price of 48.386 cents on the dollar compared with 49 cents on Friday. Trading volume totaled $160,000 in five trades compared with $4.02 million in one trade on Friday.

In comparison, the commonwealth’s benchmark Series 2014A general obligation 8% bonds of 2035 were trading at a high price of 61 cents on the dollar compared with 61.5 cents on Monday. Trading volume totaled $23.49 million in eight trades compared with $49.56 million in 23 trades on Monday.

Previous session's activity

The Municipal Securities Rulemaking Board reported 43,848 trades on Monday on volume of $10.05 billion.

California, Texas and New York were the municipalities with the most trades, with the Golden State taking 15.081% of the market, the Lone Star State taking 11.651% and the Empire State taking 11.116%.

T-bills auctioned

The Treasury Department Tuesday auctioned $50 billion of four-week bills at a 2.200% high yield, a price of 99.828889. The coupon equivalent was 2.234%. The bid-to-cover ratio was 2.91. Tenders at the high rate were allotted 0.20%. The median rate was 2.165%. The low rate was 2.140%.

Treasury also auctioned $30 billion of eight-week bills at a 2.240% high yield, a price of 99.657778. The coupon equivalent was 2.279%. The bid-to-cover ratio was 3.09. Tenders at the high rate were allotted 98.33%. The median rate was 2.220%. The low rate was 2.185%.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.