DALLAS — The University of Texas System Board of Regents plans to price $520 million of Build America Bonds today, its largest single issue of the taxable debt and second-largest deal overall in at least a decade.

With natural triple-A ratings across the board, UT’s debt fits the portfolios of large institutional funds that require gilt-edged credits, officials said.

The debt comes from UT’s revenue financing system with $6.2 billion of pledged revenue.

After traversing the deepest trough of the recession, the UT System appears well-protected against further upheavals, according to analysts.

“While volatility in global financial markets may continue to pressure the near- to intermediate-term performance of the system’s financial assets, superior investment management provided by University of Texas Investment Management Co. will help limit significant declines in resource levels and overall liquidity,” wrote Fitch Ratings analyst Douglas Kilcommons.

Morgan Stanley and Barclays Capital are senior managers on the negotiated deal, with eight co-managers. UT acts as its own financial adviser. McCall, Parkhurst & Horton is bond counsel.

Proceeds from this sale will refinance $320 million of commercial paper and provide $163 million of new money for expansion and improvement projects on the system’s 15 institutions, which include the flagship Austin campus, eight satellite universities, and six medical centers.

The system will still have $298 million of commercial paper outstanding.

The UT System has about $4.4 billion of debt on parity with this deal. The debt is made up of bonds backed by all system revenues.

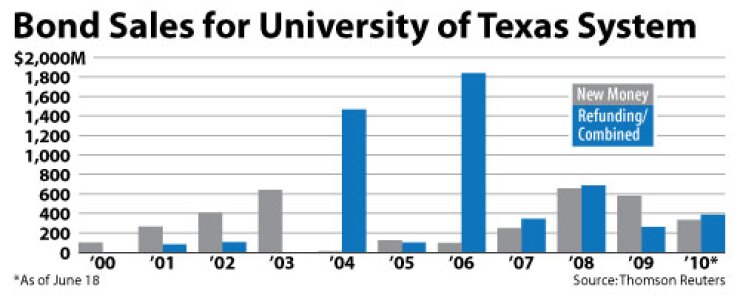

With this issue, the system’s debt service will grow to $419 million, which is about 4% of fiscal 2009 revenues, according to Fitch. Its largest debt issue, totaling $674 million, came in 2008.

Jeffrey Timlin, portfolio manager and principal at Sage Advisory Services in Austin, said that upheaval in the sovereign debt market could benefit bonds that offer an alternative to Treasuries.

“The tax-exempt side has been very slow, but because this is a taxable deal, you could potentially see some enhanced demand over what you’ll see in the tax-exempt side,” Timlin said. “Foreign buyers may seek to diversify into this asset class. So that adds another layer of demand.”

The UT Regents issued $331 million of BABs in June 2009 and $250 million of the stimulus debt in September 2009.

And more debt is on the way as the system continues its six-year, $8 billion capital improvement program. Trend lines look favorable for the credit, analysts indicated.

“We understand that the system has plans for a substantial new debt issuance — currently estimated at more than $500 million — in the next several years for its ongoing capital plans,” wrote Standard & Poor’s analyst Bianca Gaytan-Burrell. “We expect that additional debt will remain manageable relative to the budget.”

Nevertheless, UT, like every public university system in Texas and most in the country, faced strict belt-tightening over the past two years. As of Aug. 31, available funds for revenue financing system debt service dropped about 9.8% compared to the previous fiscal year.

Earlier this month, chancellor Francisco Cigarroa announced cutbacks and realignments designed to save $2.2 million annually.

“With the current economic climate, the UT System and UT institutions must implement efficiencies, wean programs which have successfully fulfilled their purpose, and look to the future,” Cigarroa said in the written announcement. “This strategic reorganization plan accomplishes these goals.”

The cuts eliminate 19 full-time positions and consolidate others.

The announcement followed Gov. Rick Perry’s order to cut spending across all state agencies by 5% in the face of a budget shortfall that could rise as high as $18 billion by the time the Legislature meets in January.

State appropriations represent a declining share of UT System revenue, falling 18% in fiscal year 2009 from nearly 50% in 1985. In late May, the state asked agencies for plans to cut an additional 10% in 2012 and 2013.

“Moody’s is concerned that political pressure to retain low student charges despite tuition deregulation in 2003 may limit the system’s flexibility in addressing reduced state appropriations,” wrote Moody’s Investors Service analyst Laura Sander.

With more than 84,000 employees and 202,000 students, the UT System operates on an annual budget of $11.9 billion for the current fiscal year, which ends Aug. 31. The budget includes $2.5 billion in programs funded by federal, state, local, and private sources.

With more than 50,000 students, the Austin campus remains the center of gravity for the UT System, though the satellite campuses are growing quickly.

The multi-campus UT San Antonio ranks as the system’s second-largest university with 29,000 students and is one of the nation’s fastest growing.

UT Arlington, halfway between Dallas and Fort Worth, enrolls more than 20,000 students. Along with San Antonio, Dallas, and El Paso, UT Arlington has been designated one of the state’s research universities with a goal of reaching tier-one status nationally.

The Texas Research Incentive Program approved by the Legislature and voters in 2009 made $50 million in matching grants available for gifts given to institutions. The matching funds provide the emerging research universities the means to establish more endowed faculty positions and graduate fellowships, enhance research facilities and programs, and bolster research capacity.

The system’s total financial assets as of Sept. 1 included $4.1 billion of operating funds, a $6.4 billion share of the state’s Permanent University Fund, and $5.5 billion of other endowment funds. The system’s financial assets, including the PUF, are invested by UTIMCO.

Private gifts have boosted financial resources, with a three-year average of nearly $600 million annually between fiscal 2007 and 2009. However, gift revenue for fiscal 2009 declined to $455 million, the lowest amount in several years. Gifts are expected to be flat or slightly higher in the current year, according to officials.

Large capital campaigns are underway at UT-Austin, where officials expect to reach a $3 billion campaign goal by 2014. UT’s M.D. Anderson Cancer Center has a fundraising goal of $1 billion by 2011.

Last year’s return on the general endowment fund was negative 13%, and the return on the PUF was negative 13.3%. In the previous year, returns were negative 3.1% and negative 3.3%, respectively.

Of UT’s $8 billion capital program, $4.1 billion is expected to be funded with debt, including $2.8 billion of revenue financing system debt.

About $676 million of tuition revenue bonds will also be issued, while another $622 million of debt will be supported by the PUF.

Moody’s noted that nearly two-thirds of the capital program is devoted to projects at health care institutions, which have produced more volatile operating performance in recent years.

“We expect that additional debt issuance will be paced with growth in financial resources,” analysts wrote.