Want unlimited access to top ideas and insights?

The U.S. economy will face “a fairly sharp slowdown” later this year into next year, but should not fall into recession, according to economists at BNP Paribas.

“The global economy can still be pulled back from the brink of recession," said Luigi Speranza, BNP chief global economist. “There are no obvious signs of large global imbalances and the policy response is likely to be prompt.” Downside risks remain, he said, “especially if exacerbated by additional downside shocks."

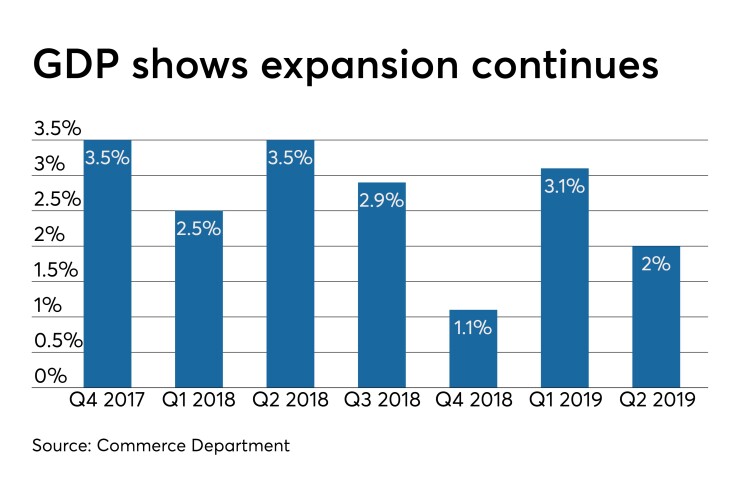

In the U.S., gross domestic product will grow at just 0.9% on a seasonally adjusted annual rate in the fourth quarter and improve to just 1.2% in the first quarter, before rebounding to near-trend growth in the last half of 2020, the bank predicts.

“Business investment is in negative territory, manufacturing is in negative territory. At some point that will cease,” said Daniel Ahn, chief U.S. economist and head of Markets 360 North America at BNP. “We think that will happen next year.”

Spurring the return of business investment will be “the need to invest” in intellectual property “to remain competitive,” he told reporters at a briefing. BNP is “more optimistic about the long-term potential growth” — the bank sees it at around 2% — and sees “reason to hope” as the downturn in worldwide production “may resolve a little as the U.S. comes out of its soft patch.”

While trade issues are still seen as having just a “small direct impact on the U.S.,” the economy will suffer from “related uncertainty and anxiety.”

But it’s not only trade issues that will halt economic growth, Ahn said. Geopolitical events, manufacturing weakness and slow business investment will play a role. “The debate will move beyond monetary policy to fiscal policy” and perhaps structural reform. The world will need to address changes caused by aging demographics and productivity issues.

Trade issues will continue to escalate, with an occasional “cease fire,” he said. “There are more than enough irritants in the strategic relationship that we don’t see an easy path to resolution.

Central banks will respond by easing rates. The Federal Reserve, which has more flexibility because rates are higher in the U.S. than elsewhere, “will probably be the most patient and cautious,” he added.

“The Fed will react more to growth concerns and past inflation target misses while it completes its strategy review during the first half of 2020.”

Shahid Ladha, head of strategy for G10 Rates, Americas, said the yield curve is likely to stay flat and continue to flatten going forward. BNP expects 25 basis point rate cuts in September, December, March and June, which would bring the fed funds rate target to 1%-1.25%.

With low or negative yields across the globe, “continued stickiness” will remain “on front-end rates,” he said. In addition to trade and the possibility of a “hard Brexit,” concern about corporate earnings and economic data will contribute to the soft patch.

“A dovish shift [by the Fed] isn’t likely to move market expectations lower,” Ladha said, which “makes steepening [the yield curve] very difficult.”

But Ahn said the “yield curve is distorted” and isn’t the powerful signal of an upcoming recession.

Consumer spending has been fueling economic growth, Ahn said, and while he sees “a slowdown in U.S. consumption,” it would take a “sharp” decline in stock prices to stop consumers. “The U.S. consumer will slow down a bit but not retrench.”

Besides expectations of continued strength in consumption, Ahn said, wage growth and consumers not being as leveraged as economists thought offer reasons for optimism about the economy.

Consumer credit

Indeed, Monday’s consumer credit report, which showed credit grew $23.3 billion in July, offers proof that consumers are still spending and are confident about their jobs and wages.

The jump surpassed the $16.0 billion rise expected by economists polled by IFR Markets.

The June data were revised to a $13.8 billion gain from the originally reported $14.6 billion increase.