BRADENTON, Fla. – Georgia regulators allowed the private and public power owners of the only nuclear reactors under construction in the United States to complete them.

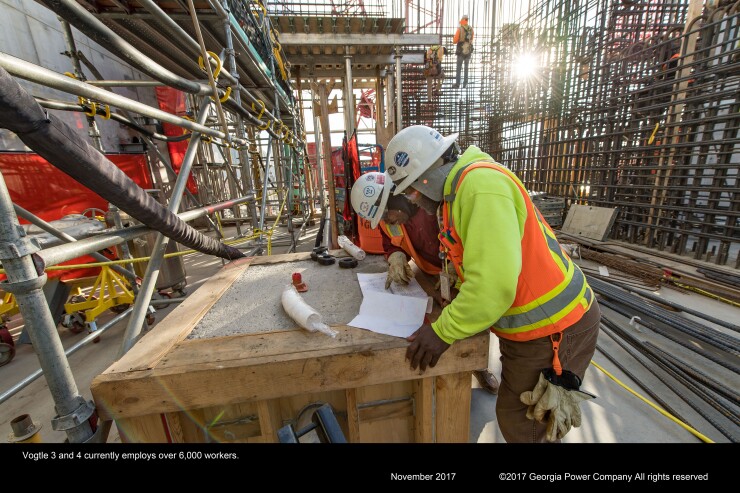

The Georgia Public Service Commission voted unanimously Thursday on a complex motion imposing numerous conditions on the project at Plant Vogtle, where more than 6,000 workers are on the job building the delayed twin reactors whose costs have doubled to $25 billion.

An attorney for Georgia Power Co., the majority owner and the lead agency for the project, immediately accepted the PSC’s terms even though it means the company’s stockholders will receive a lower rate of return on profits.

“I commend the Public Service Commission for its vision and foresight in approving continuation of the Plant Vogtle expansion while holding the owners accountable to ratepayers,” said Gov. Nathan Deal, who added that the project will bring 800 permanent and well-paying jobs to the state upon completion.

The PSC ruling is significant for the three public power owners of the reactors because it means they will have an asset associated with billions of municipal bonds they issued to pay for their share of costs.

The Municipal Electric Authority of Georgia, 22.7% owner of the new units, said it planned to release a market disclosure about the PSC’s decision. MEAG Power has issued $2.85 billion of taxable and tax exempt bonds to fund a portion of its costs.

The other public owners are Oglethorpe Power, with a 30% share, and Dalton Utilities, which owns 1.6% of the project. Oglethorpe has issued $1.5 billion of debt for the project, while Dalton is self-funding its share.

The PSC’s decision came after months of evaluation following the recommendation by GPC and the three public power owners to complete the two reactors after their prime contractor, Toshiba Corp.-owned Westinghouse Electric Co., filed for bankruptcy.

In South Carolina, a similar reactor project

As part of the bankruptcy settlement, Toshiba entered into a parental guarantee for about $3.68 billion to be split proportionately between the owners and paid over several years. After the first payment, Toshiba made a final lump-sum payment of $3.2 billion last week.

As a condition for its approval, the PSC ordered Georgia Power to give its more than 2 million customers three, $25 credits from the Toshiba payment and include a line item on each bill stating that it is a “Vogtle settlement refund.”

The order does not apply to the public power participants because they are not regulated by the PSC.

While the project will move forward, MEAG Power still faces problems with Jacksonville, Fla.’s public JEA utility, which has stated that it wants the project canceled.

JEA has a 20-year, take-or-pay power purchase agreement with MEAG for 206 megawatts of energy, which includes a share of debt service payments and a proportionate share of ownership risk, when Vogtle units 3 and 4 start operating.

MEAG has issued $1.4 billion of bonds designated as Project J, which are tied to the JEA contract, and expects it will need $1.4 billion in additional financing to complete its share of the reactors.

In addition to wanting the project canceled, JEA has identified certain issues that it contends would alleviate its responsibility under the Project J power purchase agreement and requested that MEAG or a third party replace it in the take-or-pay contract obligation, said Moody's Investors Service analyst Dan Aschenbach.

“These actions by JEA are credit negative for the MEAG Power Project J revenue bonds because both political and legal risks have heightened towards a potential challenge to the take-or-pay contract between JEA and MEAG Power,” Aschenbach said.

The Project J bonds constitute 41.17% of MEAG Power’s 22.7% financing interest in Vogtle 3 & 4, he said. After JEA’s contract expires, 39 of MEAG Power’s participants are then responsible for those expenses.

“We understand that JEA conveyed all decision-making to MEAG Power concerning this investment as part of an arrangement between JEA and MEAG Power,” Aschenbach said. “As such, JEA remains obligated under the terms of the take-or-pay arrangement, notwithstanding its views on continuing construction of the project.”

MEAG Power’s take-or pay contracts are bond security for the Project J bonds, which he said were validated in Georgia’s Fulton County Superior Court before issuance. The court also determined that the obligation was binding.

JEA did not respond to recent questions from The Bond Buyer about its commitment to the nuclear project contract. A study is underway to determine the feasibility of privatizing the municipal electric, water and sewer utility.