This year marks the 25th anniversary of The Bond Buyer 40 Municipal Bond Index, a measure of municipal bond values with an interesting and at times inglorious history.

The index was conceived in 1983 as a vehicle to allow municipal bond traders to hedge against swings in the value of their inventory.

Traders and dealers have long used index futures to protect inventory.

A trader stuck with a batch of bonds is vulnerable to a decline in their value. The idea behind an index future generally is to shelter the value of a bond inventory by taking the opposite position on an index that tracks the type of bonds in the inventory.

That way, if the trader’s bonds go sour, he recoups his losses with gains on the index future, assuming the index actually tracks the bonds faithfully.

The Chicago Board of Trade offers futures and options on other types of debt such as Treasury or agency bonds, and in the early 1980s wanted to add municipals to its suite of products.

For Treasuries, these types of contracts are among the most liquid and widely traded in the world. CME Group, which operates the Chicago Board of Trade and the Chicago Board Options Exchange, reported traders on its floors exchanged an average of two million Treasury futures contracts a day in June. Options on Treasury bonds changed hands an average of 245,000 times a day.

Creating an index that reliably tracked municipal bonds to allow for this kind of hedging proved a far trickier endeavor.

The concept behind The Bond Buyer 40 was that five brokers would quote values for 40 recently issued municipal bonds, and those quotes would form the basis for the value of an index that traders could bet on.

CBOT needed an independent arbiter to collect the brokers’ quotes and calculate the index value. The Bond Buyer seemed an ideal choice.

Five brokers — Cantor Fitzgerald, Chapdelaine, Drake, J.F. Hartfield, and Titus & Donnelly — each day submitted their quotes for the 40 bonds in the index.

The Bond Buyer was responsible for calculating the index value based on those quotes and reporting it each afternoon through a service called Munifacts, a wire service for municipal traders.

The index value was derived from a formula with a number of complexities, which would later bedevil the index itself.

Here is how it worked: The Bond Buyer lopped off the lowest and highest of the five quotes for each bond, leaving three quotes each for 40 bonds.

It would then average the three quotes for each bond, and multiply that value by a “conversion factor” that showed what the bond would be valued at if it had an 8% coupon.

CBOT’s other major indexes converted bonds to what their value would be with an 8% coupon, and it wanted The Bond Buyer 40 Index to be comparable to those.

Because the most inactive bonds in the index were frequently being swapped out in favor of more heavily traded issues, the index would have been subject to the value changing just because new bonds were being introduced.

To address this, the formula calculated a “coefficient” that adjusted the value of the new set of bonds to equal the old set of bonds. That way, the index would have the same value on the day of the switch, with the new or old bonds.

The index actually existed for more than a year before futures contracts on the index began to trade. The index needed to gain market acceptance and establish some sort of track record in order to win government approval for futures contracts.

The index originally had 75 bonds, which in July 1984 was reduced to 50 and in May 1985 cut to 40. It has had 40 ever since.

Before officially launching on the index, CBOT and The Bond Buyer created a partnership to manage the arrangement called CBBB Partnership, with $2,000 in start-up capital — $1,000 from each partner.

Trading in these contracts kicked off in October 1985 and peaked in 1987. CBOT also introduced options on the index in 1987.

CBOT paid The Bond Buyer a small fee for each contract traded, with the size of the fee depending on the overall volume and whether the traders were members of the exchange.

Trading volume never averaged more than 8,000 contracts a day for any 100-day period. Volume peaked in 1987, at 1.6 million contracts. From 1986 through 2002, volume averaged fewer than a million contracts a year.

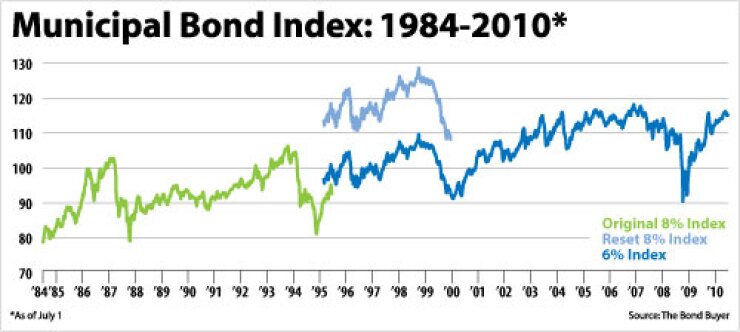

In the early 90s, it became clear that something weird was going on with the index: the value was on a gradual downward slant compared with other bond indexes.

Since municipal bonds were basically holding their historical tether to Treasury bonds, something else must have been up.

The problem was a freakish twist of bond math.

Most municipal bonds — and in fact all bonds eligible for inclusion in The Bond Buyer 40 — enable the issuer to buy the bonds back if it wants to, typically any point after 10 years.

The conversion factor being used to translate bond prices as they were quoted by the brokers into bond prices assuming an 8% coupon assumed the market was pricing the bonds to a par call — essentially assuming the date the issuer could buy back its bonds at par value was the effective maturity date.

In fact, the market is not always pricing to par call. Sometimes, when interest rates decline, people anticipate the issuer will call its bonds before the par call date — which they sometimes can at a penalty. Other times, when interest rates increase, people assume the issuer will not call at par, or call the bonds at all — and the stated maturity date will actually be the maturity date.

By converting the bond values based on an assumption that the market price was discounting from the par call date as the maturity date, the conversion formula was effectively extending maturities when interest rates fell and contracting maturities when they rose — which in either case increases the value of a bond.

Because the conversion factor determined the value of the bonds was higher than it actually was, the index would revise the values down by multiplying by a lower coefficient when new bonds were switched in.

The coefficient, which started at 1, was 0.883 by 1990.

An index drifting steadily down posed a number of obvious problems for traders using the index to hedge or bet on spread changes with Treasury indexes.

The index was readjusted in 1995, to reset the coefficient to 1.

A few years later, a more perilous problem emerged. Traders figured out how to manipulate the index by building positions in or submitting bids on the underlying bonds.

With a little market-moving chicanery, traders could influence pricing in the futures market.

This proved a more insurmountable setback, as far as CBOT was concerned.

The exchange at the end of 2002 dumped The Bond Buyer 40 Index in favor of an index with more bonds that was supposedly harder to game. The index would be valued based on evaluations from a pricing service, rather than broker’s quotes.

That index did not last.

Rather than dissolving The Bond Buyer 40 Index altogether, the Bond Buyer enlisted the pricing service at Standard & Poor’s to evaluate the bonds in the index.

The index has lasted in that form since then, reshuffling the bonds that make up the index twice a month and continuing to multiply by a coefficient to ensure comparability over time.