LOS ANGELES — Investors say California's general obligation bonds will receive a warm welcome when the state prices $2.3 billion into a busy primary market next week.

The arrival of the tax-exempt California GOs within days of a $1.2 billion GO sale by the Los Angeles Unified School District is not expected to dampen investor enthusiasm.

"California has come back from the dead and people feel positive about the state's finances," said Marilyn Cohen, chief executive officer of Envision Capital Management, based in Los Angeles' South Bay area.

When the state brings the sale comprised of $1.15 billion of new issuance and a $1.155 billion refunding, it will do "splendidly," Cohen said.

The combination of the supply-demand imbalance in the muni market and the state's strength as a credit means the state should not have any problem getting attractive rates, said Tom Schuette, co-head of credit research and co-heard of portfolio management for Gurtin Fixed Income Management LLC.

"Generally there is just a ton of demand for anything you see," Schuette said. "Even names that have negative marks from a credit standpoint are not having problems selling in the primary market."

The state's ratings were affirmed at Aa3, AA-minus and A-plus from Moody's Investors Service, Standard & Poor's and Fitch Ratings ahead of the sale. All assign a stable outlook.

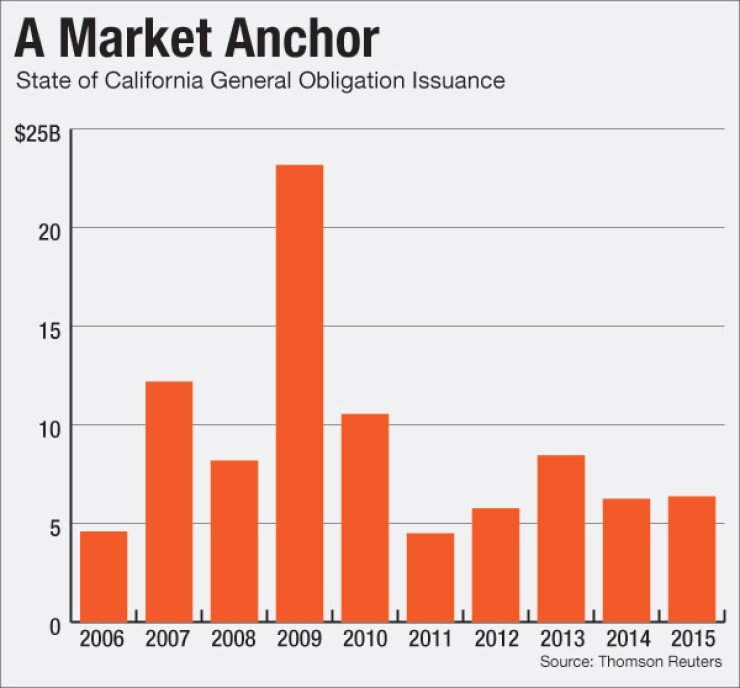

The picture is much different from the dark days of 2009 when the state's ratings dropped to as low as BBB from Fitch. It received one-notch upgrades from both Fitch & S&P to current levels just last year.

"Since then, economic and revenue gains, the state's disciplined approach to limiting spending growth, and voter approval in 2012 of temporary personal income and sales tax increases have enabled the state to move to structural budget balance while repaying billions in past budgetary borrowing."

California officials demonstrated a commitment in five consecutive budgets to aligning recurring revenues and expenses while paying down budgetary debts and building reserves, S&P said in its ratings report.

"The state has adopted five consecutive budgets on a timely basis, a marked contrast to historical behavior and one that reflects the benefit of the change to requiring a simple majority to enact a budget," Fitch said in its rating report.

The state legislature previously required a two-thirds majority to pass a budget.

"We view the state's budgetary management in recent years as in no small way helping to bring about structural fiscal alignment – and directly related to this – improvement in its credit quality," S&P said in its report.

The state used a temporary increase in sales tax and an income tax hike on high-income residents to catch up on $10.6 billion in deferred payments to school districts, rather than increasing ongoing spending, so the state budget won't not be harmed as the tax hikes phase out, according to S&P.

Factors analyst Gabriel Petek cited that prevent S&P from giving the state another ratings boost are its unfunded retiree benefit liability and the state's propensity for revenue volatility.

The state's reliance on capital gains taxes paid by affluent residents as a primary revenue source means the state's fortunes rise and fall with the stock market.

"Stock market corrections can have a significant and immediate impact on the state's fiscal position," Petek said. "It makes it harder to see it at a higher rating right now."

The state needs to take steps to alter that revenue volatility and adopt more formal mid-year budget correction process before S&P would consider a ratings boost, Petek said. Currently, once the legislature passes the budget and the governor signs it in June, it is set, he said.

"In other states, there is more executive authority to trim back spending allotments to save on the expense side of the budget," Petek said.

The state plans to take retail orders Monday, followed by institutional orders on Tuesday.

The bonds will be sold in four series: the $1.155 billion of refunding bonds; $830 million of various purpose GOs; $65 million of GOs for school facilities; and $250 million of mandatory put GO bonds.

Joint senior managers Citi and Goldman Sachs head a 29-member underwriting syndicate. Public Resources Advisory Group is financial advisor.

Orrick, Herrington & Sutcliffe is bond counsel. Orrick and Nixon Peabody are co-disclosure counsel, except for Appendix A, for which Orrick and Stradling, Yocca, Carlson & Rauth are co-disclosure counsel.

The state anticipates savings of roughly $288 million on the refunding if it achieves the hoped for 2.99% true interest costs, said H.D. Palmer, a California Department of Finance spokesman. The various purpose GOs being refunded have maturities from 2018 to 2037.

The GO put bonds have a nominal final maturity in 2031, but will be subject to a mandatory tender date, according to S&P's rating report. A failed remarketing of the mandatory tender bonds on the put date will not result in an event of default, but a stepped-up interest rate, the report said.

Rating agencies say the state has a moderate debt burden with $75 billion in outstanding general obligation bonds, but it also has a massive list of infrastructure needs.

California Forward, a think tank, estimated the state needs to spend $853 billion on water, transportation and K-12 school infrastructure improvements over the next 10 years but will face a funding gap of $358 billion.

The state plans to continue the pay-as-you-go route to fund infrastructure that Gov. Jerry Brown has championed during his time in office, Palmer said.

The DOF spokesman pointed to the governor's budget proposal of transferring $1.5 billion of one-time funds to pay for maintenance projects on the state's buildings.

"We are cognizant of the need for infrastructure, but we have one eye on infrastructure needs and the other eye on the role of debt service in the state's fiscal picture," Palmer said.

The state's annual debt service payments have grown to $7.7 billion in fiscal 2015-16 from $2.9 billion in 2001, he said.

Muni primary supply is anticipated to be between $10 billion and $12 billion next week, which is even higher than the $10 billion brought this week, which was the busiest week in almost a year.

Cohen says retailers may balk at what are anticipated to be high prices for the bonds, but they will go ahead and buy.

As much as her clients hate high coupon structures, she says they will go after it like a "junkyard dog," because supply has been scarce and she is in the market every day looking for California municipal bonds to purchase with little success.

Though the state hasn't revealed the bond structure yet, she expects the bonds to sell at a premium.

"Depending on the structure, retail may choke," Cohen said. "It will be rich, but it will be fine."

Cohen, who represents retail clients, said issuers have been coming out with 5% coupons at a 125% offering price.

Her clients want California paper, so they are paying those prices, but they don't understand why they are paying a huge premium for a paltry net yield, she said.