U.S. states' credit quality is continuing a steady decline, according to Conning’s

In its bi-annual survey, the investment management firm said it found states haven't made much progress in solving fiscal issues that they faced last year -- slow economic growth, high legacy costs, and growth in expenses that outpaces growth in tax revenue.

“Measures of state credit strength have worsened since Conning’s last report in October of 2016,” said Paul Mansour, Managing Director and head of municipal research at the investment management firm. “State revenue growth is falling short of the expenditure growth, and as a result, state budgets are under pressure.”

Last October, Conning lowered its outlook on the municipal credit of U.S. states to declining from stable as state tax revenue growth turned negative in the first extended decline since the Great Recession.

Mansour said Conning is also keeping a close eye on policies proposed by the President Trump.

“The Trump administration is adding new challenges for the states,” he said.

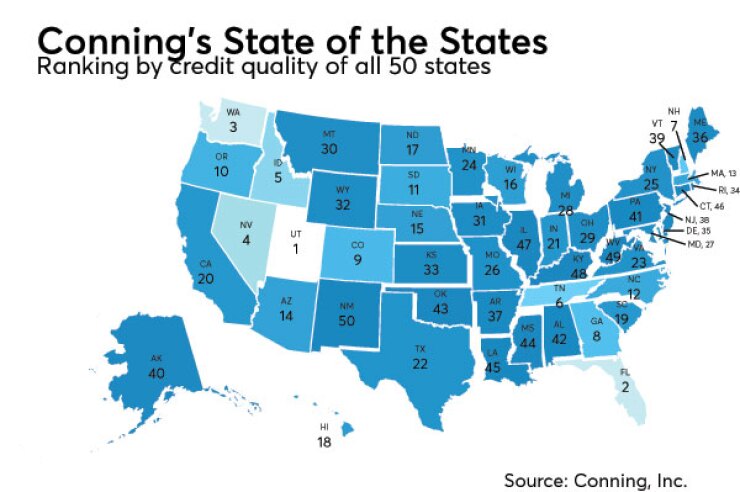

The report uses a proprietary model that employs several economic factors to rank states in order of credit health.

The top five states rated in the report were Utah, Florida, Washington, Nevada and Idaho. The bottom five ranked states were New Mexico, West Virginia, Kentucky, Illinois and Connecticut.

“It seems not much has changed since our last report. State credit quality has been declining,” Mansour said. “State revenue in 2016 was lagging – basically the whole year was flat. And early indications for 2017 are not very encouraging either.”

Conning found significant improvement in New York and Rhode Island in the last six months. Common factors among the top-ranked states include strong employment and personal income growth, as well as rising GDP, population, and home prices.

States with lower rankings faced issues with unemployment, high debt levels, persistent legacy costs, and steep declines in tax revenue. Low oil prices also continued to have a negative effect on oil-reliant states, according to the report.

Though Conning’s outlook was overall negative, there were some positive improvements in some individual states, with Idaho, Utah and Nevada being the percentage leaders in employment growth in the past year.

“Home prices have increased by more than 10% in 2016 in Oregon, Colorado, Florida and Washington. A common thread for all of top-ranked states is a favorable business climate as measured by regulations, state tax policies and state leadership,” Mansour said. “We expect that strong economic indicators will lead to future credit upgrades for many of the states in these regions.”

The report said many states will continue to face common challenges including:

Political uncertainty: Unclear federal policies from the Trump Administration complicate the outlook for state budgets and creditworthiness;

Expenditures growing faster than inflation: While state tax revenue growth has stalled, state expenditures were up 3.8% in 2016 -- the sixth consecutive year they have risen more than Consumer Price Index;

Stalled revenue growth: In 2016, on average, states tax revenues increased only 0.4%. This was caused by depressed oil prices, weak equity markets and lower corporate profits; and

Poor job growth in oil states: Employment losses during the past year were concentrated in the oil-patch states, and as newer drilling technologies require fewer workers, employment may never recover even if oil and gas prices rise.

Additionally, Conning said that many states are failing to make their full annual contribution to their pension funds, which have performed poorly for years.

“While pension underfunding has been an issue for years, states are not doing enough to fix the problem. The aggregate funded ratio of 75% is virtually unchanged since last year,” the report stated. “States such as New Jersey and Illinois continue to fall behind, having failed to fund or choosing to delay essential contributions. Such decisions make liabilities even greater, and negatively affect states’ financial health.”

The states have not made a lot of progress in making changes to their pension benefits and expenses, he said.

“There’s no magic bullet to make [payment’s] less part of states expenses,” he said. “The best solution is economic growth – increased revenue will gradually make the contributions a smaller and smaller percent of state revenues.”

“It’s a little discouraging, disheartening from a credit pint of view, that this appears to be a problem that will be with us for year to come,” he said.

He said pension problems were not evenly distributed across the country.

“It’s interesting to see the big differences between states like Nebraska and the Dakota and Illinois and New Jersey,” he said. “The deficits in some of these type states are amazing.”

The State of the States report uses indicators that include measures of economic activity, such as income levels, housing prices, foreclosure rates, as well as a state’s overall business environment.

Conning is a global investment management firm with about $113 billion in assets under management as of March 31. It has offices in Hartford, New York, Boston, London, Cologne, Hong Kong and Tokyo.