WASHINGTON - South Carolina Gov. Mark Sanford on Friday released a budget proposal that calls for an optional flat income tax and cuts spending as the state prepares for tough economic conditions in 2009.

The $5.8 billion fiscal 2010 budget does not include any new borrowing. It would spend $800 million less than last year's original budget as state revenue is expected to decline by 8% this year, the largest decline in at least 50 years, according to state estimates.

Sanford's budget resurrected his plan for a flat tax. He proposed a similar measure in last year's budget but it was not passed by the legislature.

The plan would allow for an optional flat income tax of 3.65%. It would reduce taxes by about 50% for earners in the highest tax bracket who currently pay 7%. The flat tax will be optional for those who pay less than 3.65% in income tax on the graduated scale.

The plan would be offset by a 30-cent per pack increase in the cigarette tax, which is currently the lowest in the nation at 7 cents, and a $3-per-ton dumping tax on garbage imports. Sanford said these tax increases would make the flat tax revenue neutral.

"Some incredibly tough choices had to be made in this budget," Sanford said in a statement Friday. "We hope this budget will serve as an impetus to look seriously at some of the restructuring proposals we've put forward, and some of the cost savings we're proposing." The state's general assembly is scheduled to convene today.

The governor also proposed eliminating all corporate income taxes in 10 years. Businesses currently pay a 5% income tax.

Eden Perry, an analyst for Standard & Poor's who has covered South Carolina, said that future ratings would depend on verifying that tax reforms are revenue neutral. Volatility associated with tax changes could also affect a rating, she said.

Standard & Poor's downgraded South Carolina to AA-plus from AAA in 2005. One of Sanford's goals for the budget this year is "retaining the fiscal discipline" required by rating agencies. The state has triple-A ratings from Moody's Investors Service and Fitch Ratings.

The governor's proposed cost-cutting measures include suspending funding for redevelopment authorities in Charleston and Myrtle Beach. Sanford also recommended reducing the legislature's time in session.

The South Carolina governor has the final say on expenditures in the budget. Sanford line-item vetoed $181 million of spending in last year's budget before it was enacted.

The budget allocates $190.5 million for debt service for GO bonds.

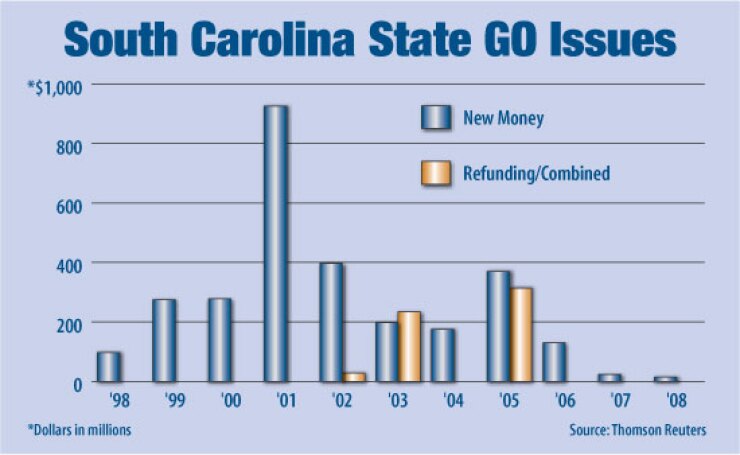

The state's GO issuance has dropped significantly since Sanford began his second term in 2007. Since then, the state has sold just three GO deals worth $38 million, according to data from Thomson Reuters. Sanford, a fervent deficit hawk, has spoken out against wasteful government spending and economic stimulus aid for states.