Municipal bond buyers will see almost $11 billion of new supply hit the screens in a scenario that features a variety of issuers, credits and ratings in the upcoming week.

Ipreo forecasts weekly bond volume will jump to $10.8 billion from a revised total of $3 billion in the past week, according to updated data from Thomson Reuters. The calendar is composed of $7.3 billion of negotiated deals and $3.5 billion of competitive sales.

“It will be interesting with the issuance and how it will be received,"Dan Heckman, senior fixed-income strategist at U.S. Bank Wealth Management, said on Friday. "With the stock volatility recently, I think there will be renewed interest in tax-exempt munis. Demand should be good, as long as everything is priced right. It will be a good test of the market coming up next week.”

Heckman said munis will still outshine other asset classes.

“The muni market has weakened over the past few weeks," he said. "Although munis could continue to be under pressure, they will still continue to outperform other markets. In our opinion, the long-end is cheap and we don’t think the short-end is cheap enough and its needs to be cheaper.

“Long-term munis appear really cheap, but investors won’t go out long until we get a change in sentiment,” Heckman said. “Right now, it’s hard to advocate duration extension and it’s easy to stay short and buy a lot of variable rate but we feel that in the long-term, investors who have extended duration – they will be rewarded. They could lock in 3% and greater rates, sometimes up to even 4% and historically that is a good level for muni investors, we are talking about equity type returns in munis and you don’t have all that risk that comes with equities.”

Primary market

Barclays Capital is expected to price the Ohio's Toledo Hospital's $1.2 billion of taxable corporate CUSIP Series 2018B bonds on Thursday.

The deal is rated Baa1 by Moody’s Investors Service, BBB by S&P Global Ratings and AAA-plus by Fitch Ratings.

Ramirez & Co. is slated to price the New York City Transitional Finance Authority’s $1.2 billion of Fiscal 2019 Series S3 Subseries S3A building aid revenue bonds on Wednesday after a two-day retail order period.

The BARBs are expected to be rated Aa2 by Moody’s and AA by S&P and Fitch.

The TFA is also competitively selling $199.57 million of taxable Fiscal 2019 Series S3, Subseries S3B BARBs on Wednesday.

Raymond James & Associates is set to price Connecticut’s $850 million of Series 2018B&C special tax obligation bonds for infrastructure purposes.

The deal is rated AA by S&P and A-plus by Fitch.

Goldman Sachs is expected to price Salt Lake City, Utah’s $845 million of airport revenue bonds for the Salt Lake City International Airport consisting of Series 2018 bonds subject to the alternative minimum tax and Series 2018 non-AMT bonds.

The deal is rated A2 by Moody’s and A-plus by S&P.

Bank of America Merrill Lynch is set to price the Essentia Health Obligated Group’s $707 million of healthcare facilities revenue bonds consisting of $667 million from the Duluth (Minnesota) Economic Development Authority and $40 million from Cass County, North Dakota.

The deal is rated A-minus by S&P and Fitch.

In the competitive sector, the Metropolitan Government of Nashville and Davidson County, Tennessee, is selling $724.39 million of general obligation bonds on Tuesday.

The deal is rated Aa2 by Moody’s and AA by S&P.

Also on Tuesday, Illinois will sell $250 million of Build Illinois sales tax revenue bond in three sales consisting of $125 million of Junior Obligation Tax-Exempt Series B of October 2018, $115 million of Junior Obligation Tax-Exempt Series A of October 2018, and $10 million of Junior Obligation Taxable Series C of October 2018.

The deals are rated AA-minus by S&P and A-minus by Fitch.

On Wednesday, California is selling $866 million of GOs consisting of $445 million of Bid Group A various purpose GOs and $421.02 million of Bid Group B various purpose GOs.

Bond Buyer 30-day visible supply at $11.96B

The Bond Buyer's 30-day visible supply calendar increased $2.05 billion to $11.96 billion for Friday. The total is comprised of $4.25 billion of competitive sales and $7.71 billion of negotiated deals.

Secondary market

Municipal bonds were stronger on Friday, according to a late read of the MBIS benchmark scale. Benchmark muni yields fell as much as two basis points in the one- to 30-year maturities.

High-grade munis were mostly stronger, with yields calculated on MBIS' AAA scale declining as much as two basis points in the one- to 25-year maturities, rising less than a basis point in the 27- to 30-year maturities and remaining unchanged in the 26-year maturity.

Municipals were steady on Municipal Market Data’s AAA benchmark scale, which showed the yield on both the 10-year muni general obligation and the yield on 30-year muni maturity remaining unchanged.

Treasury bonds were slightly stronger and stocks traded higher.

On Friday, the 10-year muni-to-Treasury ratio was calculated at 87.2% while the 30-year muni-to-Treasury ratio stood at 102.7%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Previous session's activity

The Municipal Securities Rulemaking Board reported 46,281 trades on Thursday on volume of $17.69 billion.

California, New York and Texas were the municipalities with the most trades, with the Golden State taking 20.537% of the market, the Empire State taking 17.283%, and the Lone Star State taking 9.121%.

Week's actively traded issues

Some of the most actively traded munis by type in the week ended Oct. 12 were from New York, New Jersey and California issuers, according to

In the GO bond sector, the New York City zeros of 2042 traded 15 times. In the revenue bond sector, the New Jersey Transportation Trust Fund Authority 4s of 2037 traded 44 times. And in the taxable bond sector, the California 7.3s of 2039 traded 11 times.

Week's actively quoted issues

Puerto Rico, New Jersey and California names were among the most actively quoted bonds in the week ended Oct. 12, according to Markit.

On the bid side, the Puerto Rico Commonwealth GO 5s of 2041 were quoted by 38 unique dealers. On the ask side, the New Jersey Transportation Trust Fund Authority revenue 4s of 2037 were quoted by 291 dealers. And among two-sided quotes, the California taxable 7.3s of 2039 were quoted by 21 dealers.

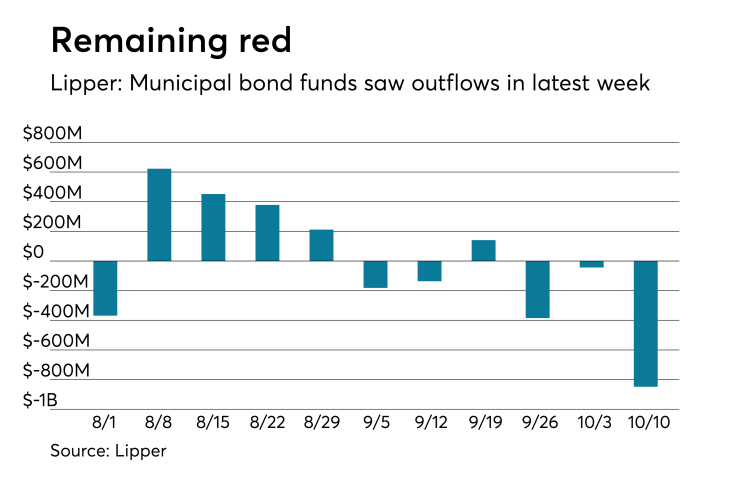

Lipper: Muni bond funds saw outflows

Investors in municipal bond funds remained cautious and once again pulled cash out of the funds during the latest reporting week, according to Lipper data released on Thursday.

The weekly reporters saw $847.858 million of outflows in the week ended Oct. 10 after outflows of $43.626 million in the previous week.

Exchange traded funds reported outflows of $211.389 million, after inflows of $116.152 million in the previous week. Ex-ETFs, muni funds saw $636.468 million of outflows, after outflows of $159.778 million in the previous week.

The four-week moving average remained negative at -$283.857 million, after being in the red at $106.017 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds had outflows of $933.968 million in the latest week after inflows of $91.187 million in the previous week. Intermediate-term funds had outflows of $72.567 million after outflows of $140.647 million in the prior week.

National funds had outflows of $704.697 million after inflows of $28.651 million in the previous week. High-yield muni funds reported outflows of $500.423 million in the latest week, after outflows of $113.789 million the previous week.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.