As equities continued to plunge, municipal bonds remained stronger along with Treasurys.

The stock market volatility left investors hungry for a safe haven before the Thanksgiving holiday, and municipal analysts said the tax-exempt market has a winning recipe for the remainder of the year.

Secondary market

Municipal bonds were stronger on Tuesday, according to a late read of the MBIS benchmark scale. Benchmark muni yields dipped as much as two basis points in the one- to 30-year maturities.

High-grade munis were also stronger, with yields calculated on MBIS' AAA scale decreasing as much as two basis points across the curve.

Municipals were stronger on Municipal Market Data’s AAA benchmark scale, which showed the yield on the 10-year muni general obligation falling two basis points while the yield on 30-year muni maturity dropped three basis points.

Treasury bonds were stronger as stocks traded sharply lower. The Treasury 10-year stood at 3.051% while the Treasury three-month bill was at 2.387%.

The Dow Jones Industrial Average was off 2.2% while the Nasdaq Composite Index fell 1.9% and the S&P 500 Index lost 1.8%.

On Tuesday, the 10-year muni-to-Treasury ratio was calculated at 85.9% while the 30-year muni-to-Treasury ratio stood at 99.2%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Supportive tone for munis

“Now that the election is over, we are starting to see a more supportive tone for munis since prospects for further tax cuts have dimmed considerably,” Jeffrey Lipton, managing director of credit research at Oppenheimer & Co. Inc. said in a weekly report.

With ample cash on the sidelines and good demand, market technicals will drive performance going forward, according to Lipton. He pointed to fund flow activity as a test of future support, on the heels of seven straight weeks of orderly and mostly manageable outflows according to Lipper U.S. data.

“If we can see a reversal in this trend, then perhaps the asset class can stage a rally through year end,” Lipton said, while acknowledging that seasonal factors such as tax loss harvesting could present offsetting forces.

While persistent outflows through year-end could set up a weaker backdrop going into 2019, he also said volume could be an offsetting factor.

“The supply part of the equation has likely contained the outflows and overall performance weakness,” he wrote. “New issue supply is down about 15% YTD and we continue to expect moderating volume through year-end.”

As result, banks and property and casualty insurance companies, historically active buyers of munis, “have significantly reduced their visibility in the primary market with many being net sellers in the secondary,” Lipton wrote.

“As of now, we have not experienced overwhelming selling of municipal securities by P&C insurance companies in response to recent hurricane related claims, although we have seen an uptick in liquidation lists,” he added. “The California wildfires may add to this activity.”

The possibility of potentially heavier municipal liquidations exists, but municipals are not necessarily the first asset class to be sold in the overall decision-making process, he said.

“We will be paying very close attention to the long-end as further cheapening could attract cross-over and foreign buyer interest,” he wrote.

“As we continue to think about how 2018 will conclude and our outlook for 2019, we believe that next year will be a better year for munis,” he said. “There is not likely to be any further federal tax cuts and while there could be renewed noise surrounding private activity bonds, we do not envision passage of any legislation that would attack this segment of the market.”

Stabilization of fund flows and solid demand from individuals is also in his forecast, according to Lipton.

“We expect a greater appetite for quality-centric investments as concerns over a weakening global economy advance and near-term evidence of softening U.S. economic performance could give rise to greater interest in fixed income investments,” he wrote.

“Munis could be more actively placed under the microscope as investors search for value opportunities and those credits that will help insulate the portfolio from the next down-cycle,” Lipton added.

Previous session's activity

The Municipal Securities Rulemaking Board reported 44,457 trades on Monday on volume of $10.84 billion.

California, New York and Texas were the municipalities with the most trades, with the Golden State taking 18.659% of the market, the Empire State taking 12.06% and the Lone Star State taking 10.215%.

Looking at fund flows

After seven weeks of municipal mutual fund outflows, portfolio managers are raising cash by reducing positions, according to Alan Schankel, managing director at Janney.

“The impact of $5.7 billion in mutual fund outflows since late September is mitigated by light primary supply and a projected pick-up in seasonal reinvestment flows in the next two months,” Schankel wrote in a Tuesday market comment. “The outflow pace hardly compares to late 2016 post-election outflows, which ran for 10 weeks and totaled $28.2 billion.”

He said exchange traded funds are beginning to receive more investor interest.

“ETFs have experienced flat net issuance since September. That may be changing. MUB, the largest municipal ETF, had $343 million of new shares created over the past four trading sessions, to reach a market cap exceeding $10 billion,” he wrote.

Primary market

JPMorgan Securities priced and repriced the North Carolina Turnpike Authority’s $400 million of Series 2018 senior lien turnpike revenue refunding bonds for the Triangle Expressway System.

The deal is rated BBB by S&P Global Ratings and BBB-minus by Fitch Ratings except for the 2032-2038 and 2041 maturities which were insured by Assured Guaranty Municipal and rated AA by S&P.

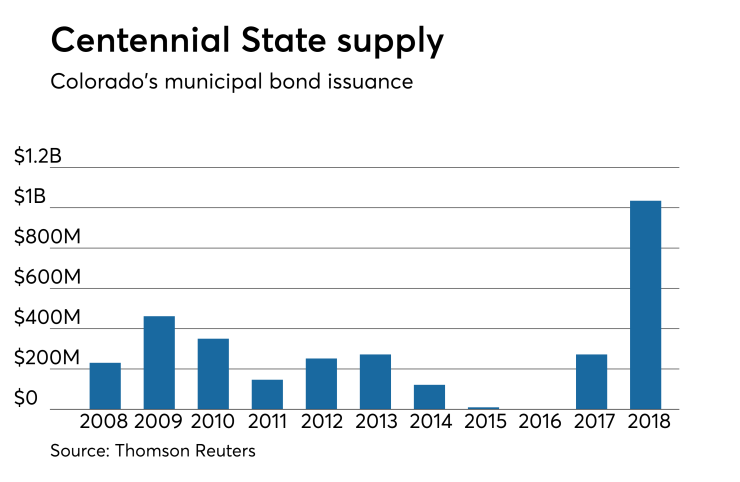

RBC Capital Markets priced Colorado’s $234 million of Series 2018N tax-exempt certificates of participation for the Building Excellent School Today program.

The deal is rated Aa2 by Moody’s Investors Service and AA-minus by S&P.

Since 2008, the state has sold about $3 billion of bonds, with the most issuance prior to this year happening in 2009 when it offered $462 million of bonds. It did not come to market in 2016.

Late Monday, Citigroup received the official award on the Charlotte Mecklenburg Hospital Authority, N.C. (doing Business as Atrium Health) $100 million of Series 2018F variable-rate healthcare revenue bonds.

The deal has is rated Aa3/VMIG1 by Moody’s and AA-minus/A1-plus by S&P.

Bond sale results

North Carolina

Colorado

Bond Buyer 30-day visible supply at $4.30B

The Bond Buyer's 30-day visible supply calendar increased $924.3 million to $4.30 billion for Tuesday. The total is comprised of $1.66 billion of competitive sales and $2.65 billion of negotiated deals.

Year-end opportunities

Positive market technicals amid rising rates as well as outflows in the high-yield sector that have created spread widening are producing some buying opportunities as 2018 comes to an end, according to Peter Block, managing director of credit strategy at Ramirez & Co.

“We are generally bullish on munis for the next several months due to market technical factors, including higher absolute yields, cheaper-to-fairly valued ratios, slightly negative net supply, and November to January reinvestment,” he wrote in a Nov. 19 weekly municipal report.

While Block generally prefers a more defensive posture as rates are likely to head higher in 2019 and 2020, he said select A-rated bonds could also offer some opportunity.

Due to outflows in high-yield municipal funds, which have sold A-rated bonds versus less-liquid, non-investment grade credits to fund redemptions, there has been spread widening -- most notably for A-rated healthcare and/or hospital credits, according to Block.

“The 5-year sector looks cheap on a 1-year basis at 77.8%, following last week’s underperformance, and Cal names continue to read slightly cheaper versus the last 12 months as investors continue to push back on sub-MMD pricing,” Block wrote.

Overall, however, he prefers the short-to-intermediate part of the curve with five to seven years of effective duration, shorter calls in five to eight years, and 5%-plus coupons. “These structures capture about 90% of the MMD yield curve, have optimal roll down of 50 basis points, and are generally cheaper versus shorter call structures of two to four years,” Block noted in the report.

“We also like ‘AA’ or better general market names since higher quality generally outperform amidst rising rates, particularly on sub-5% coupon structures,” he added.

Treasury sells bills

The Treasury Department Tuesday auctioned $50 billion of four-week bills at a 2.200% high yield, a price of 99.847222.

The coupon equivalent was 2.234%. The bid-to-cover ratio was 2.90. Tenders at the high rate were allotted 24.13%. The median rate was 2.170%. The low rate was 2.150%.

Treasury also auctioned $30 billion of eight-week bills at a 2.300% high yield, a price of 99.661389.

The coupon equivalent was 2.340%. The bid-to-cover ratio was 3.48. Tenders at the high rate were allotted 89.31%. The median rate was 2.290%. The low rate was 2.260%.

Gary Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.