A Lackawanna County, Pa., court is scheduled to resume the case of a Scranton taxpayer group challenging the distressed city’s authority to collect certain taxes.

Court of Common Pleas Judge Joseph Gibbons has scheduled a session for 8:30 a.m. Monday in downtown Scranton.

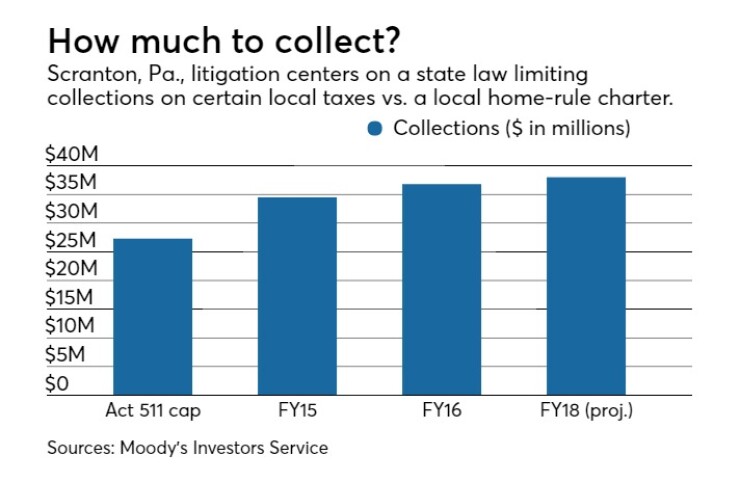

Gibbons on Aug. 4 issued a preliminary ruling against the city in early preliminary hearings. The suit, filed March 2 by eight local taxpayers and led by mayoral candidate Gary St. Fleur, contends that the city has been illegally hiking local taxes beyond the state limit.

The city, through attorney Kevin Conaboy, asked Gibbons to reconsider. Conaboy also wants Gibbons to allow the city to immediately appeal to the Commonwealth Court of Pennsylvania, should the judge rule in favor of the taxpayers.

Gibbons held a previous hearing on May 30.

Moody’s Investors Service called the preliminary ruling a credit negative for Scranton, a 77,000-population city that has operated since 1992 in Pennsylvania’s workout program for distressed communities, known commonly as Act 47.

"While cities like Scranton continue to struggle with their fiscal issues, the priority should be to get their fiscal situation under control," said David Fiorenza, a Villanova School of Law professor and former chief financial officer of Radnor Township, Pa.

"Pension and unfunded liabilities continue to be a concern as does issuing bonds rated by the agencies as junk status."

According to Fiorenza, Scranton Tomorrow, the city's main street program, will need to continue its efforts to attract sustainable businesses.

"Also, city officials should continue a staunch effort to alleviate pressure on the growing debt and unfunded liabilities," he said.

Scranton officials, in an Aug. 22 court filing, argued that the city's home-rule charter supersedes Act 511, a state local tax enabling act. They called for Gibbons to dismiss the case because it could jeopardize their planned exit from Act 47.

On Tuesday, the taxpayer group’s lawyer, John McGovern, filed a response to the city's motion.

“If the city needs to illegally tax to operate the government, than it has a serious spending problem and needs to cut spending in addition to lowering taxes across the board,” said St. Fleur, who has said Scranton should file for bankruptcy. He favors a referendum on whether the city should file under Chapter 9.

The lawsuit, or mandamus action, would force Mayor Bill Courtright to comply with Act 511. The state law caps how much a locality can raise through taxes. The cap is determined by taking the value of the properties and multiplying them by 1.2%.

How Gibbons rules could resonate statewide.

"In the state of Pennsylvania, finance directors whose jurisdictions impose these Act 511 taxes watch all the court cases because these taxes could be a significant portion of their general fund budget," said Fiorenza.

"The Act 511 taxes help in keeping the residential real estate taxes stable."

Moody’s does not rate Scranton. S&P last month upgraded the city’s general obligation rating to a still-junk BB-plus, citing revenue from a sewer-system sale.

S&P, which assigned a stable outlook, cited the city’s improved budget flexibility and liquidity, stemming largely from a sewer-system sale that enabled it to retire more than $40 million of high-coupon debt.

The city also suspended its cost-of-living-adjustments and intends to apply a portion of sewer system sale proceeds to pension funding.