DALLAS – Texas lawmakers achieved positive traction on transportation spending but veered into negative territory on Medicaid funding, according to an S&P Global Ratings “report card” on the 85th Legislature.

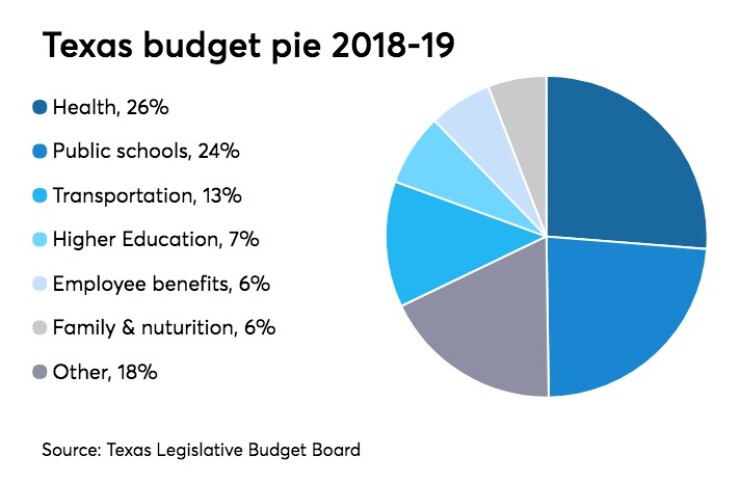

The $217 billion biennium budget signed into law June 12 is about $360 million higher than in the prior two years, representing an increase of 0.2%, S&P noted. The general revenue funded portion, representing nearly $107 billion of the total, is $1.3 billion less than the current biennium for a decline of 1.2%.

The legislature's collective effort balances the budget by infusing nearly $1 billion from the rainy day fund and delaying about $2 billion in sales tax collections required to be transferred to the State Highway Fund from fiscal 2019 to fiscal 2020.

Analysts Nora Wittstruck, Oscar Padilla, Horacio Aldrete-Sanchez and Eden Perry took a neutral view of the new budget overall, but positive in regard to transportation spending and very slightly negative in regard to Medicaid spending.

"We believe Texas' economy has turned the corner following the prolonged oil and gas downturn," said Wittstruck. "We believe accelerated job growth will drive improved revenue collections for fiscal years 2018 and 2019."

The report did not comment on potential legislation in a special session that Gov. Greg Abbott has called for July 18. Abbott created a wide field for lawmakers to consider, ranging from transgender bathroom regulation to property tax reform. Lawmakers could also reconsider school vouchers, shifting property tax revenue to private schools.

Before signing the budget, Abbott line-item vetoed about $120 million of spending.

The approved budget includes $26.6 billion allocated across all funds for transportation, of which $23 billion is earmarked for highway planning and design, right-of-way acquisition, construction and maintenance, and preservation.

"In our opinion, the dollars in the budget for transportation is a credit positive," said Padilla. " Other states have delayed or reduced infrastructure investment when tight budgets are squeezed to support other fixed costs.”

The new budget reduces Medicaid funding by $1.9 billion across all funds.

“Of concern, the funding supports caseload growth at fiscal 2017 levels in 2018 and maintains flat funding for caseload growth in 2019,” analysts said. “We believe zero-growth assumptions are not particularly conservative given the state's in-migration patterns. Furthermore, the $62.4 billion included in the budget also assumes $1.0 billion in cost containment for Medicaid client services.”

The reduction in funding is compounded by uncertainly at the national level in the structure of Medicaid, analysts said. The mechanism could switch from reimbursement to block grant.

“We believe this policy area is a credit negative as the fiscal 2019 supplemental budget will likely require additional funding for the program,” the report card said.

While the Texas Supreme Court ruled the school funding system constitutional, the legislature failed to respond to the court’s recommendation for wholesale reform rather tha the “Band-Aid on top of Band-Aid" approach used over the years.

“Texas' school age population has grown significantly, pressuring the state's budget to allocate additional resources to the funding formula,” S&P said.

In the upcoming biennium, the state allocated $42.7 billion across all funds, reflecting a foundation school funding program increase of roughly $274 million stemming from additional revenues from the Property Tax Relief Fund and recapture payments.

“Formula funding assumptions presume property values increase 7.04% and 6.77% in tax years 2017 and 2018 (corresponding to fiscal years 2018 and 2019), respectively,” the analysts said.

“With the state's school age population continuing to grow, particularly in the metro areas, local property tax base growth remains key to stable credit quality for Texas school districts and ensuring adequate resources are available to fund this growing demographic,” they added.

Analysts also drew attention to the state’s pension liability and other post-employment benefits.

“Positively, the budget includes $40.4 million in additional funding to the Employee Retirement System (ERS) and the state continued its practice of setting the employer contribution rate at 10% of payroll, the maximum amount currently allowed by the Texas Constitution,” the report card said. “Additionally, we note appropriations for the ERS assumes annual 4.7% growth in retiree membership, which we view favorably.”

Teacher retiree health insurance costs are the largest component of the state's OPEB liability and the budget boosts funding by nearly $417 million or nearly 72% over the current biennial base level funding.