Standard & Poor's upgraded Nassau County, N.Y., a single notch to A-plus from A yesterday as the county readied a $110 million revenue anticipation note deal and a $191 million general obligation bond sale. The outlook is stable.

The Rans will competitively price today, and the county expects to price the GOs by the end of the month. The GO deal will include about $41 million of refunding and $150 million of new money for various capital projects. The new-money portion would have maturities that go out to at least 20 years, county debt manager Jeffrey Nogid said.

Nassau has requested permission from New York Comptroller Thomas DiNapoli to sell the bonds through negotiated sale rather than through the usual practice of competitive bidding for counties, Nogid said. One reason cited for a negotiated sale is that the county's last deal its first fixed-rate offering since 2000 had a very wide range of bids.

"We're worried that there may some kickback, that [bidders] may not be as aggressive the second time around because of the newness of the credit and the choppiness of the market," Nogid said.

In addition, the Nassau County Legislature could approve a $141 million Nassau County Sewer and Storm Water Authority bond deal as soon as today that would refinance outstanding auction-rate debt and include $20 million of new money.

Public Financial Management, Inc. is financial adviser and Orrick, Herrington & Sutcliffe LLP is bond counsel. Financial Security Assurance Inc. was selected to insure the sewer bonds.

The upgrade puts the county at its highest Standard & Poor's rating since 1993.

Standard & Poor's director Eden Perry said the upgrade was primarily due to "the strong management of the county budget [and] the strong financial policies that they've adopted policies since the financial crisis."

Those policies include measures like doing multi-year financial plans, monthly and quarterly budget reporting, maintaining their fund balance at a certain level, and creating a detailed debt policy, she said.

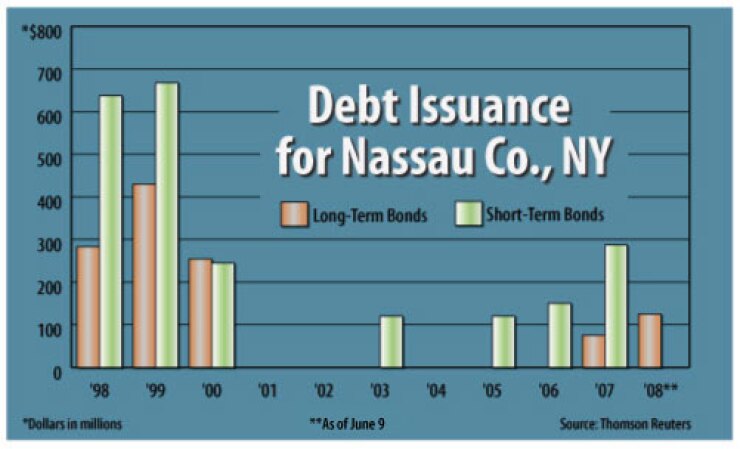

Nassau hit a financial crisis in 1999 and saw its Standard & Poor's rating plunge to BBB from A-minus. That led to the creation of the Nassau County Interim Finance Authority in 2000 to give the county access to the bond market. The county's rating fell even further in 2001 to BBB-minus. Since 2002, the county has slowly built its credit rating back up and returned to the bond market last year for the first time since 2000 with a single $75 million variable-rate deal.

Some of the positive financial policy changes were "implemented due to NIFA, but now it seems like it's much more institutional in county policy to have these financial practices," Perry said.

Another factor in the upgrade was the application of the rating agencies' recent general obligation ratings criteria that was updated in April, she said. Under the new criteria, Nassau's fund balance level, which had been considered low when measured against other counties of a similar size, was instead measured in terms of what the county government needed in terms of those balances and came out as positive, Perry said.

The county's negatives include using non-recurring revenues to balance the budget and having issued debt through NIFA to pay tax certiorari judgments and settlements against the county, she said.

Fitch Ratings assigns the county its A-plus rating and Moody's Investors Service rates it A2.