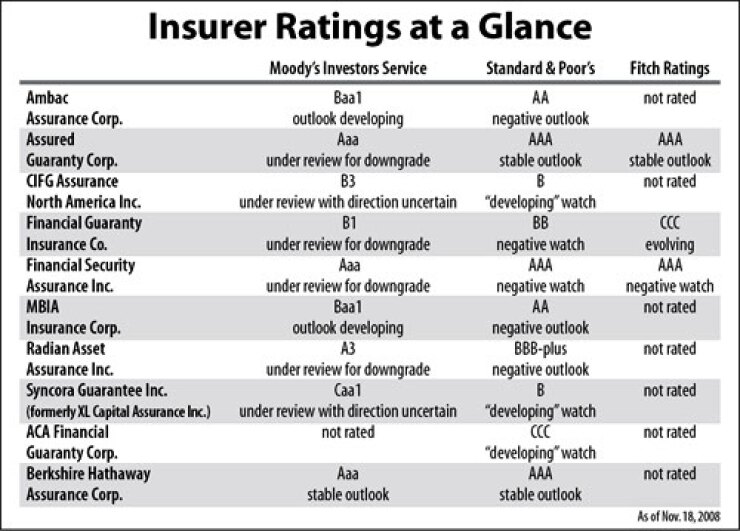

Standard & Poor's yesterday lowered the financial strength rating of Syncora Guarantee Inc. five notches to B from BBB-minus, one day after parent Syncora Holdings Ltd. reported a third-quarter net loss of $1.3 billion.

The rating agency attributed the downgrade to delays in Syncora's restructuring plan. It suspended ratings on public finance and corporate transactions insured by Syncora without underlying public ratings.

"The downgrade is the result of the company's delay in implementing its restructuring plan and slow progress in its negotiations with counterparties of its [collateralized debt obligations] of [asset-backed securities] exposure," Standard & Poor's analyst David Veno said in a statement.

The rating's CreditWatch status was changed to developing from negative.

Syncora Holdings' third-quarter net loss was in line with what it expected last week when it said it would delay the release of its 10-Q filing. Syncora said the loss was primarily due to a $1.058 billion loss in the net change in the fair value of derivatives and $213 million in net losses and loss-adjustment expenses mostly related to exposures to residential mortgage-backed securities.

"During the third quarter of 2008 U.S. residential mortgage performance continued to deteriorate, negatively impacting the company's insured RMBS and ABS CDO portfolios and overall operating results," acting chief executive officer and general counsel Susan Comparato said in a statement. "However, as previously announced, with the closing of the Master Transaction Agreement during the quarter, Syncora made progress in its restructuring."

Although the company issued an earnings release it did not hold its customary conference call for investors.

Syncora also said bond insurer subsidiary Syncora Guarantee Inc. would have fallen below the New York Insurance Department's required $65 million minimum statutory policyholder surplus if the department had not approved an accounting move, which allowed Syncora to release statutory-basis contingency reserves on terminated policies and on policies in which it had established case-based reserves.

The accounting treatment - which differs from those in the National Association of Insurance Commissioners Accounting Practices and Procedures Manual - boosted Syncora's statutory surplus as of Sept. 30 to $83.3 million from $19.1 million.

If the Syncora's statutory capital level had fallen below the minimum $65 million but remained positive, Syncora would have had 90 days to remedy its shortfall before the New York Insurance Department would have had the right to intervene.

Earlier this year it had held off on placing the insurer into rehabilitation - even though Syncora reported a negative statutory surplus as of June 30 - because of deals Syncora signed with former parent XL Capital Ltd. and Merrill Lynch & Co. and the expectation it would commute other structured finance exposures.

Comparato said in the second-quarter earnings call that commuting $52.9 billion in credit-default swap exposures was the company's "primary objective" in the near term, but an already extended negotiation period expired Oct. 31. Syncora continues to negotiate with its counterparties, although it says it cannot guarantee an extension will be granted or that a deal will be made.

As in its previous quarterly filing, Syncora said there is still "substantial doubt about the ability of the company to continue as a going concern." Analysts from Fox-Pitt Kelton Cochran Caronia Waller yesterday wrote in a research note that "there is substantial doubt whether the company will survive with any positive value remaining for common shareholders."

Syncora stock closed at $0.43, down 18.87% in trading yesterday.

Syncora on Monday also announced that its chief financial officer, Elizabeth Keys, was leaving to pursue a position with another financial services company. The company said its board chose not to name a replacement at this time.

Syncora also said Mary Hennessy had resigned from the board of directors effective Nov. 15. She left due to a "combination of factors," including an increased time demand from the board and her own work commitments.