Rhode Island lawmakers are considering legislation that would bolster the state’s reserve account.

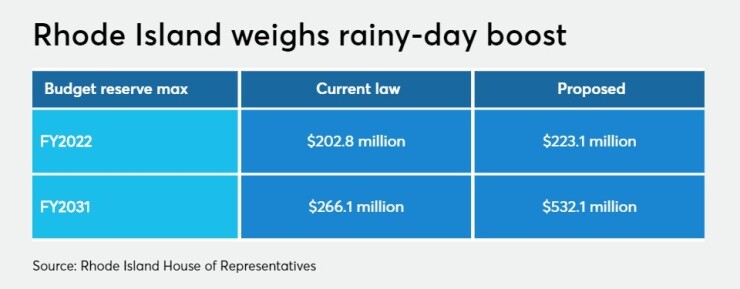

House Speaker Nicholas Mattiello, D-Cranston, has filed bills calling for a referendum doubling the rainy-day balance to 10% of annual general revenue from 5% over a decade, and to lower state spending to 95% of estimated revenues from 97%.

Voters made the rainy-day account a part of the state’s constitution in 1992. In 2006, they approved a change in the threshold to 97% from 98%.

Rep. Marvin Abney, D-Newport, who chairs the House finance committee, is a co-sponsor.

Many states are struggling from the effects of COVID-19.

States “don’t have enough funds in reserve to cover a gap anywhere near this size. This pandemic was not anticipated,” Nick Johnson, senior vice president for the Washington think tank State Fiscal Policy at the Center on Budget and Policy Priorities, said on a webcast sponsored by the Penn Institute for Urban Research and the Volcker Alliance.

Johnson pegged an estimated three-year combined deficit at roughly $555 billion for states alone. “In addition, when you’re looking at cities, counties, transit agencies and other elements of local government as well, the total gap is well over a trillion dollars,” he said.

Rhode Island House fiscal advisor Sharon Reynolds Ferland, using modeling based on state General Treasurer Seth Magaziner's debt affordability study, projected that over 10 years, Rhode Island could double its rainy-day balance to about $532 million.

“Ultimately you would, over time, have a more robust rainy-day account,” she said.

The General Assembly used $120 million in rainy-day funds — roughly 60% of its balance — to close the fiscal 2020 budget. The fiscal year ended June 30.

This left the state with a $77.6 rainy-day balance, according to the nonprofit

Rhode Island’s FY21 spending plan is still in the works, with state officials and legislative leaders awaiting further possible aid from the federal government.

The legislature in late June approved a

In addition, Gov. Gina Raimondo has requested authority to borrow up to $300 million short-term, through tax-anticipation notes.

A budget adjustment Raimondo’s staff filed would rescind borrowing authority, also for $300 million, that the obscure

Coronavirus relief funds can cover the borrowing costs, according to Ferland.

“The governor’s proposal is to return to the standard way in which the state borrows in anticipation of cash flow needs and that is through TANs,” she said.

The state must repay TANs by the end of the fiscal year. Rhode Island last used them in 2012, for $202.4 million.

Moody’s Investors Service rates Rhode Island’s general obligation bonds Aa2. S&P Global Ratings and Fitch Ratings assign them a AA. All three provide stable outlooks.