Retail investors lined up to get first crack at the New York City Transitional Finance Authority’s future tax secured subordinate bonds as underwriters opened a two-day order period.

Primary market

Weekly bond volume is estimated to total $3.6 billion, consisting of $1.6 billion of negotiated deals and $2 billion of competitive sales. The NYC TFA tops the slate with its issue of more than $1.4 billion of future tax secured subordinate fiscal 2019 bonds.

On Tuesday, Loop Capital Markets opened the retail order period on the TFA’s $902.47 million of tax-exempt fixed-rate bonds ahead of the institutional pricing on Thursday.

The deal was warmly received as buyers snapped up the bonds, prompting the underwriter to curtail orders in the 2023, 2028 and 2029 maturities.

Additionally, the TFA is set to sell $500 million of taxable bonds in two competitive sales on Thursday. The financial advisors are Public Resources Advisory Group and Acacia Financial Group. Bond counsel are Norton Rose and Bryant Rabbino.

The deals are rated Aa1 by Moody’s Investors Service and AAA by S&P Global Ratings and Fitch Ratings.

Proceeds will be used to fund capital projects, with the exception of proceeds from about $150 million of the tax-exempt fixed-rate bonds, which will be used to convert outstanding floating-rates into fixed-rates.

On Wednesday, Wells Fargo Securities is expected to price the University of Chicago’s $400 million of Series 2018C taxable fixed-rate bonds.

The corporate CUSIP deal is rated Aa2 by Moody’s, AA-minus by S&P and AA-plus by Fitch.

Tuesday’s bond sale

New York:

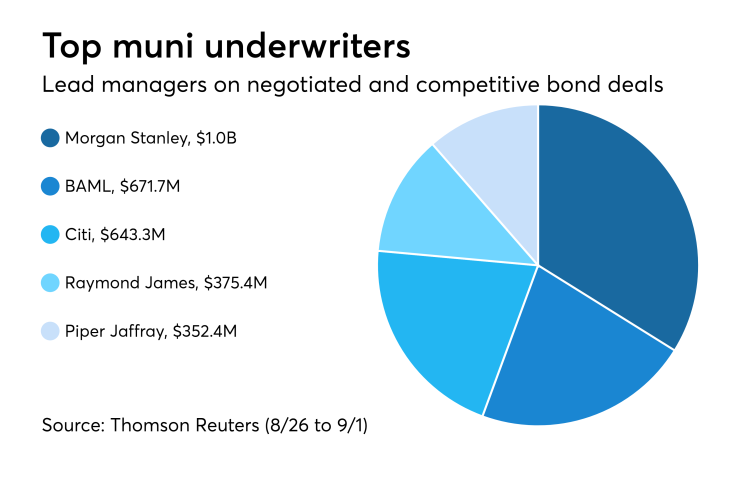

Prior week's top underwriters

The top municipal bond underwriters of last week included Morgan Stanley, Bank of America Merrill Lynch, Citigroup, Raymond James & Associates and Piper Jaffray, according to Thomson Reuters data.

In the week of Aug. 26 to Sept. 1, Morgan Stanley underwrote $1.0 billion, BAML $671.7 million, Citi $643.3 million, Raymond James $375.4 million and Piper Jaffray $352.4 million.

Bond Buyer 30-day visible supply at $8.90B

The Bond Buyer's 30-day visible supply calendar increased $809.5 million to $8.90 billion for Tuesday. The total is comprised of $4.24 billion of competitive sales and $4.66 billion of negotiated deals.

Prior week's top FAs

The top municipal financial advisors of last week included PFM Financial Advisors, FTN Financial Capital Markets, Kaufman Hall & Associates, Piper Jaffray and Montague DeRose & Associates, according to Thomson Reuters data.

In the week of Aug. 26 to Sept. 1, PFM advised on $1.1 billion, FTN $298.2 million, Kaufman $271.6 million, Piper Jaffray $268.5 million, and Montague $250.9 million.

Steady as she goes: Slope of the muni yield curve

For the first time in 11 years the yield differential between two-year and 10-year Treasury bonds fell below 20 basis points, leading to speculation of a possible recession ahead, Janney Managing Director Alan Schankel wrote in a Tuesday market comment.

“History tells us that an inverted yield curve (short-term yields higher than long-term yields) is often a predictor of upcoming recession,” Schankel said. “According to research from the San Francisco Federal Reserve Bank, every recession since at least 1955 (nine in total) was preceded by an inversion of the yield curve, with only one false positive in the mid-1960s. The curve is not inverted yet and may not reach that point anytime soon, but it bears watching.”

Tax-exempt yields typically track Treasury yields, but recent months have seen a divergence in shorter maturities.

The two-year maturity Treasury yield has risen from 1.88% in January to 2.68% recently, pushed higher by two increases in the Fed Funds target rate this year and one last December. However, Schankel says the two-year municipal benchmark yield has been relatively steady, rising from 1.56% to 1.69%, suggesting muni investors are buying shorter maturities.

“Despite the ongoing economic expansion, we continue to see minimal upside pressure on long term interest rates, and so encourage municipal bond investors to take advantage of the steeper muni curve slope and focus on the five-year to 15-year portion of the curve rather than staying short,” Schankel said.

Secondary market

Municipal bond traders returned to work on Tuesday after the long Labor Day holiday weekend.

Municipal bonds were mostly weaker, according to a late read of the MBIS benchmark scale. Benchmark muni yields rose as much as two basis points in the four- to 30-year maturities and fell 12 basis points in the one-year maturity, six basis points in the two-year maturity and two basis points in the three-year maturity.

High-grade munis were mixed, with yields calculated on MBIS’ AAA scale rising as much as three basis points in three- to eight-year, 10- to 17-year and 24- to 30-year maturities, falling as much as a basis point in the one- and two-year, nine-year and 19- to 22-year maturities and remaining unchanged in the 18-year and 23-year maturities.

Municipals were weaker on Municipal Market Data’s AAA benchmark scale, which showed the yield on the 10-year muni general obligation rising two basis points while the yield on 30-year muni maturity increased one basis point.

Treasury bonds were weaker as stock prices traded slightly lower.

On Tuesday, the 10-year muni-to-Treasury ratio was calculated at 84.7% while the 30-year muni-to-Treasury ratio stood at 98.7%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Previous session's activity

The Municipal Securities Rulemaking Board reported 24,652 trades on Friday on volume of $6.65 billion.

California, Texas and New York were the municipalities with the most trades, with Golden State taking 15.212% of the market, the Lone Star State taking 12.028% and the Empire State taking 11.694%.

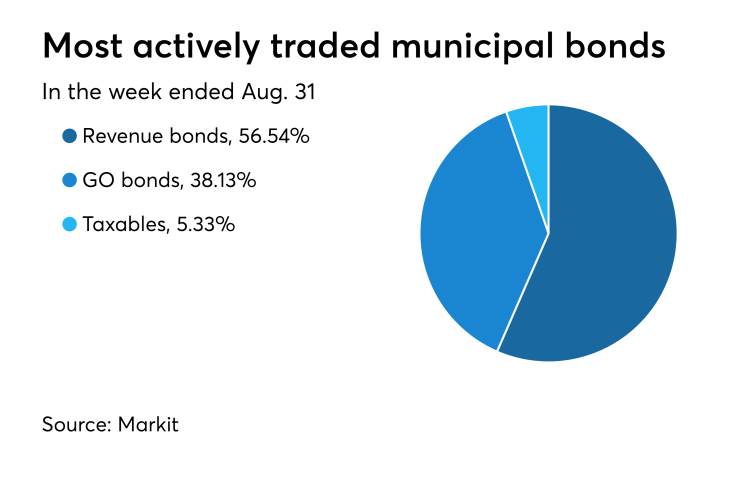

Prior week's actively traded issues

Revenue bonds comprised 56.54% of total new issuance in the week ended Aug. 31, up from 56.53% in the prior week, according to

Some of the most actively traded munis by type were from Puerto Rico and Texas issuers. In the GO bond sector, the Puerto Rico 8s of 2035 traded 39 times. In the revenue bond sector, the Texas 4s of 2019 traded 238 times. And in the taxable bond sector, the Puerto Rico Sales Tax Financing Corp. 6.35s of 2039 traded 18 times.

Treasury auctions discount rate bills

Tender rates for the Treasury Department's latest 91-day and 182-day discount bills were higher, as the $48 billion of three-months incurred a 2.095% high rate, up from 2.080% the prior week, and the $42 billion of six-months incurred a 2.240% high rate, up from 2.210% the week before.

Coupon equivalents were 2.135% and 2.297%, respectively. The price for the 91s was 99.470431 and that for the 182s was 98.867556.

The median bid on the 91s was 2.075%. The low bid was 2.050%. Tenders at the high rate were allotted 25.14%. The bid-to-cover ratio was 2.88.

The median bid for the 182s was 2.220%. The low bid was 2.200%. Tenders at the high rate were allotted 40.90%. The bid-to-cover ratio was 3.03.

Treasury sells $55B 4-week bills

The Treasury Department Tuesday auctioned $55 billion of four-week bills at a 1.970% high yield, a price of 99.846778.

The coupon equivalent was 2.000%. The bid-to-cover ratio was 2.68. Tenders at the high rate were allotted 61.33%. The median rate was 1.930%. The low rate was 1.910%.

Gary Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.