Raymond James Financial Inc. has reached an agreement to acquire SumRidge Partners LLC, a technology-driven fixed income market maker specializing in investment-grade and high-yield municipal and corporate bonds.

Financial details about the transaction, which is still subject to certain regulatory conditions, were not revealed on Monday.

Founded in 2010, SumRidge Partners

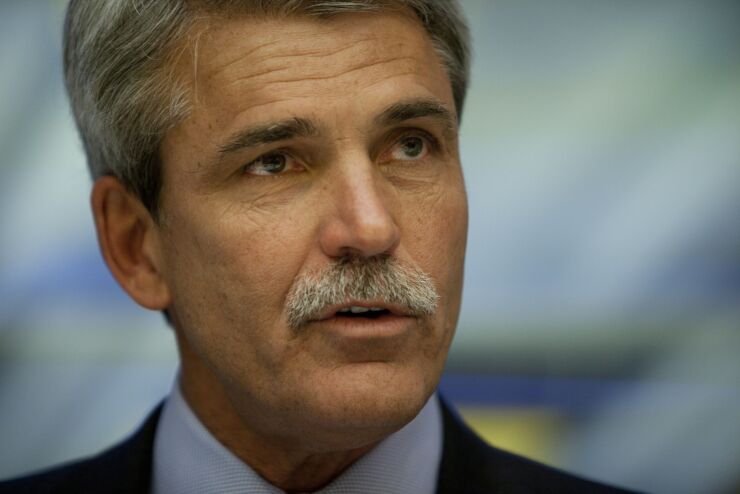

“This acquisition is further evidence of our commitment to provide cutting-edge technology to advisors, clients and stakeholders,” Paul Reilly, CEO of Raymond James, said in a statement. “In addition to being a strong strategic fit, SumRidge Partners has a culture that closely resembles our own."

SumRidge Partners addition to the Raymond James’ Fixed Income Capital Markets division is expected to combine an innovative institutional market-making operation with sophisticated trading technologies and risk management tools.

“SumRidge is an exciting combination of a strong team and advanced technology that will only enhance Raymond James’ position in a rapidly evolving fixed income and trading technology marketplace,” said Horace Carter, executive vice president and head of fixed income capital markets at Raymond Dames.

Based in Jersey City, New Jersey, SumRidge will operate within fixed income capital market under its co-founders, CEO Tom O’Brien and Chairman Kevin Morano, who will both become senior managing directors at Raymond James.

"We share a common vision for how to grow our business and we see tremendous opportunity for both firms in this partnership," said Morano. "Leveraging SumRidge’s technological strengths with Raymond James’ robust distribution will allow us to compete at the highest level.”

Piper Sandler was financial advisor for SumRidge while Gunderson Dettmer was legal counsel on the transaction.