Part I of five-part series "Austerity on the Island"

Puerto Rico, with more than $70 billion of bonds at stake, has become the latest testing ground of austerity as the right prescription for an economy in decline.

The Oversight Board has embarked on a strategy that leans toward conservative prescriptions to restore fiscal discipline and economic growth as the territory undergoes its historic debt restructuring. In this five part series, The Bond Buyer examines whether the board's approach is likely to succeed, and reviews academic research on economies where the strategy has been applied and the impact austerity has had on vulnerable populations such as Puerto Rico's. It also explores alternative measures that may be needed to guard against a repeat of the crisis that led to the biggest municipal bankruptcy in U.S. history.

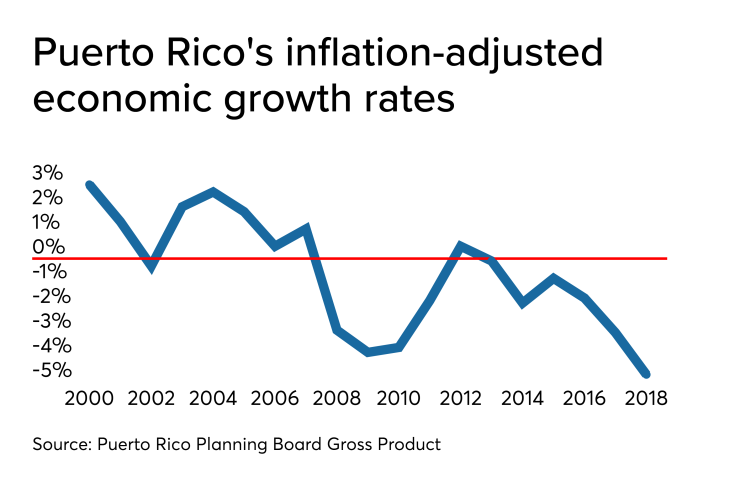

Now, after nearly two years of economic growth following Hurricane Maria’s devastation, reports from the Economic Development Bank for Puerto Rico signal the economy may have resumed the decline experienced from 2006 to Hurricane Maria’s arrival in September 2017. The bank’s economic activity index has declined four out of the last five months on a year-over-year basis.

The negative economic readings have raised concern that the austerity measures may undercut the island’s recovery, putting bondholders on a path for a second round of restructuring in a few years, regardless of any deal they work out in Puerto Rico’s bankruptcy court.

“There’s no reason to assume that long-term population and economic decline won’t resume,” said Matt Fabian, partner at Municipal Market Analytics. “This doesn’t, on its own, mean Puerto Rico will default again, but it suggests Puerto Rico’s finances and infrastructure will still be fragile when the next shock occurs.”

In its fiscal plan the Board outlined a schedule requiring $12.78 billion in spending cuts and revenue-increasing measures from fiscal year 2018 to fiscal year 2024. Most of these adjustments are scheduled to be carried out in coming years. The board, which the Puerto Rico Oversight, Management, and Economic Stability Act established in 2016, also set out to reform governmental policies.

The board’s measures were greeted with skepticism from more liberal economists from the start.

“The proposals that have been put forward [by the board] are likely to make the depression in which Puerto Rico has been, continue,” Nobel Prize-winning economist Joseph Stiglitz said in April 2017. “I’ve seen policies like this in other countries around the world and they have almost never worked. In fact, I can’t think of a single example when it’s worked.”

Though the Oversight Board itself projects its measures will reduce Puerto Rico's growth in the short term, Executive Director Natalie Jaresko said Stiglitz's criticisms were misguided.

“He has to look at where our reality is. This is a sustainability issue,” she said in a Dec. 5 interview with The Bond Buyer. Unlike some countries Stiglitz may be familiar with, Puerto Rico can’t print money or change its interest rates, Jaresko said.

In U.S. Congress, where the committee overseeing U.S. territories is weighing amendments to PROMESA, the Board’s fiscal approach has also come under fire.

“Austerity alone does not work and will only lead to further economic contraction,” said House Natural Resources Committee Chairman Raúl Grijalva, D-Ariz., at a committee hearing concerning Puerto Rico on May 2.

Board policies

From its foundation, the board has had the task of bringing structural balance to a budget that then-Gov. Alejandro García Padilla in 2016 projected to be short $58.7 billion from fiscal year 2017 to fiscal year 2026. The board is supposed to do that without decimating essential social services or cutting too much into pension funding, and ultimately restore access to the capital markets, and to do so in a manner that will open a way to economic growth.

Creating the board’s fiscal plan, which lays out the board’s policies, was “an extraordinarily complex process,” Jaresko said.

Yet there are some indications that the board had decided upon its approach very early in its tenure, without getting expert or public input. At the board’s first meeting in September 2016, board member Andrew Biggs said that he had done a study showing that countries in fiscal crises that focus on cutting spending much more than raising taxes have better outcomes. The first version of the board fiscal plan, released in March 2017, had the same balance of fiscal measures.

Also at the first meeting board member Arthur González said the board members had to present a united front concerning their policies. Consistent with this, board discussions of policy prior to then and largely since then have been held in private.

Jaresko said the creation of the board’s fiscal plan started with then-Governor Alexandro García Padilla’s submission of a proposed fiscal plan in October 2016. Subsequent Governor Ricardo Rosselló submitted his own proposed fiscal plan in early 2017.

However, the board didn’t hold any public meetings on the plan before releasing its first version in March 2017. Most of the board’s overall approach was found in that document, even if the board has revised it several times since then.

According to Jaresko, in creating the plans the board solicited advice from consultants and professional economists and demographers. For ideas on how to promote economic growth, it turned to the local business community, Jaresko said. Board members and Jaresko provided input all along, she said.

After major hurricanes hit the island in late summer 2017, the board held three public hearings to help it revise the plan.

To address the structural deficit Puerto Rico’s government needed to be smaller. The board’s cuts to government spending thus didn’t stem from an ideological belief that island’s government should be smaller, she said.

Nevertheless, the board’s approach to addressing Puerto Rico’s problems is at least partly drawn from conservative prescriptions.

For example, the board plans to introduce a work requirement for recipients to participate in the Nutrition Assistance Program. It also pressed to change Puerto Rico’s employment law to make island employment at-will, though it dropped that measure from the fiscal plan in the face of opposition from the local government.

The board’s approach is also conservative in that its fiscal plan's approach to economic growth is usually to reduce impediments to business. As discussed later, some economists suggest other paths.

The board’s fiscal plan includes a range of steps to ease doing business on the island. Among these are steps to speed construction permits and make it easier to fill out tax forms and register property.

With the cooperation of the local government, the board plans to introduce a local version of the federal earned income tax credit.

The board plans to work with the local government to update a program that trains the workforce. It seeks to take steps to increase electricity reliability and lower electrical prices, to make the island a more competitive place for businesses to work.

In the board’s quest to achieve a balanced budget, it plans to raise taxes and cut spending.

“Such policy actions will generate a contractionary impact on the economy in the short term but are necessary to drive fiscal sustainability in the long term,” the board said in a May 2019 fiscal plan.

By the board’s own reckoning, its taxing and spending policies will cost Puerto Rico 5.3% of gross national product growth from fiscal year 2019 to fiscal year 2024.

In the same period, the board projects expenditure cuts of $11.7 billion offset by spending $1 billion for a new earned income tax credit, for a net expenditure cut of $10.7 billion.

The board’s net spending cuts and tax and revenue increases amount to $13.2 billion in the period, compared with anticipated Puerto Rico government spending of $82.2 billion after the measures.

It anticipates its tax and revenue measures will generate an additional $2.5 billion in the period.

The board usually doesn’t call its measures “austerity.” Instead it describes them as “right-sizing” and “right-rating,” among other things.

However, the fiscal policies follow Wikipedia’s definition of austerity: “Austerity is a political-economic term referring to policies that aim to reduce government budget deficits through spending cuts, tax increases, or a combination of both.”

In December Jaresko cited several examples of political entities in fiscal crises that had pursued policies similar to those of the board and had succeeded. She mentioned Ukraine under her tenure as Minister of Finance in 2014 to 2016, when it had a fiscal, debt, and military challenges.

Jaresko also cited Peru in the early and mid-2000s, Turkey from 2001 to 2007, Colombia in 2003, and the former Soviet state of Georgia from 2014 to the present as examples. Peru’s government reduced spending in the period and saw poverty drop to 21% in 2015 from 58% in 2001. Turkey made budget cuts and introduced performance management and saw gross domestic product increased by an average of 7.1% annually from 2002 to 2007.

Colombia introduced taxes in 2003 and saw GDP growth better than the Latin American average during the period. Finally, Georgia in the period reduced spending and experienced healthy GDP growth rates from 2016 to the present.

But Puerto Rico has its own problems, arguably bigger than most of those political entities Jaresko pointed to. And some say the board's approach isn’t the right way to go.

Next (on 12/24): History provides lessons as austerians battle fiscal crises