Puerto Rico Thursday will price $250 million of new-money debt in the commonwealth's annual general obligation deal to help support infrastructure projects throughout the island.

The bonds will offer 30-year, fixed-rate maturities with level debt service, but the debt will be unenhanced, with the commonwealth issuing the bonds solely on its triple-B credit rating.

Luis Alfaro, executive vice president and financing director at the Government Development Bank for Puerto Rico, the island's financial adviser, said two remaining triple-A monolines, Assured Guaranty Corp. and Financial Security Assurance Inc., are not only too expensive, but the insurers are limited in what they can enhance.

"The market will look at the underlying credit now more than ever," Alfaro said. "Insurance is only effective if we use Assured or FSA, and neither have capacity."

Last year, the commonwealth sold $408 million of new-money GO debt via competitive bid without insurance. In addition, Puerto Rico issued $735 million of GO refunding debt on April 25, with all of the bonds pricing without insurance except for $200 million of debt maturing in 2014 through 2016 that was enhanced with Assured insurance.

Standard & Poor's and Moody's Investors Service rate the commonwealth BBB-minus and Baa3, respectively. Fitch Ratings does not rate the credit.

While the island is one notch above non-investment grade, the credit benefits from its triple-tax exemption, consistent demand, and name recognition, according to Matt Fabian, managing director at Municipal Market Advisors.

"It's very hard to take a position in a bond where you don't know how much it's going to be worth in three days or two days because the whole market is so up and down, and insurance used to help stabilize that," Fabian said. "Without the insurance and just with this market, very few bonds have a reliable price trend. Puerto Rico, because it's so commonly traded, will have a more reliable price trend, so it should attract a bit more demand. People should be willing to extend a little more capital for this because they have a better idea of what those bonds might be worth in a week."

Morgan Stanley will lead a syndicate of 18 bankers on the deal. There is no retail-order period, according to Alfaro.

Sidley Austin LLP is bond counsel.

Bond proceeds will help finance capital projects including a medical center in San Juan, a new trauma center on the west coast of the island, school construction, road repair work, and infrastructure improvements for municipalities.

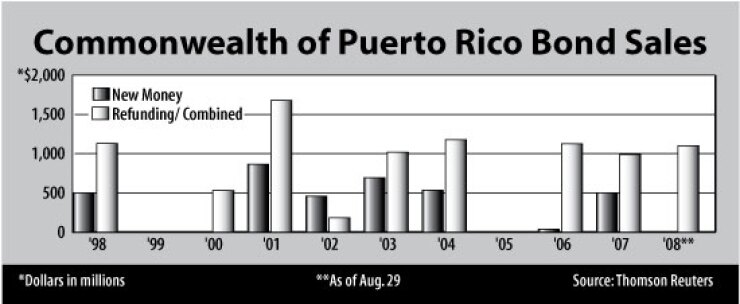

The $250 million offering stems from a delayed bond bill for fiscal 2008, which ended June 30. Puerto Rico typically sells $400 million to $450 million of new-money GO bonds each year, but the Legislature chose to cut this year's bond deal by $175 million.

That strategy stalled the bond bill in the House as lawmakers debated on the size of the deal. Gov. Anibal Acevedo Vila, a member of the Popular Democratic Party, favored issuing the full $425 million, while the New Progressive Party, which controls the House and the Senate, pushed for a smaller bond bill.

Puerto Rico's last new-money GO deal priced competitively on Sept. 19, 2007, with Merrill Lynch & Co. the winning bidder. Yields ranged from 4.34% with a 5% coupon in 2018 to 4.80% with a 5.25% coupon in 2034.

Among those bonds that carried a 5% coupon, debt maturing in 2023, 2026, 2027, and 2028 offered yields 50 basis points over that day's Municipal Market Data's triple-A curve. Bonds maturing in 2029 offered yields 40 basis points higher.

GDB officials are set to follow the GO deal with a $150 million Puerto Rico Public Buildings Authority transaction, which will refinance variable-rate debt insured by MBIA Insurance Corp. into fixed-rate bonds. That refunding will price next week with Lehman Brothers and Banc of America Securities LLC serving as co-senior managers on the deal.

October borrowings include a $400 million, new-money Puerto Rico Municipal Finance Agency sale with Merrill Lynch as senior underwriter. The commonwealth will also sell $1 billion of tax and revenue anticipation notes next month in its yearly short-term borrowing. The Bank of Novia Scotia will lead a syndicate of letter of credit providers.