The Puerto Rico Oversight Board filed a proposed plan of adjustment Friday that would reduce the commonwealth’s debt obligations by 60% and establish a roadmap to exit bankruptcy.

The plan filed Friday, if approved by the U.S. District Court, would cut the Commonwealth of Puerto Rico’s total liabilities from bonds and other claims down to $12 billion from $35 billion. The restructuring proposal, which would cut debt service to 9% of government revenue from 28%, is expected to face a legal battle from bondholders who face losses on their initial investments.

Under the plan, owners of bonds issued by the Employee Retirement System would suffer an 87% reduction while holders of general obligation debt issued before 2012 would see a 36% drop. Public Building Authority investors' holdings will see a 28% reduction if the plan is approved.

The board is also seeks a settlement path for bonds issued after 2011 that were challenged after a determination that they were sold in violation of the island’s constitutional debt limit. The settlement option would include a 55% to 65% reduction for holders of challenged GO bonds and Commonwealth guaranteed claims as well as a 42% haircut for owners of PBA bonds.

“Today we have taken a big step to put bankruptcy behind us and start envision what Puerto Rico’s future looks like under fiscal stability and economic sustainability,” José Carrión, chairman of the oversight board, said in a statement. “A Plan that has the support of certain bondholders, retirees and public employees is the best Plan to remove the cloud that has been hanging over Puerto Rico’s economy.”

Shaun Burgess, portfolio manager at Cumberland Advisors, which owns insured Puerto Rico bonds, said the plan filed Friday looks little different from an original proposal laid out in June, even though commonwealth revenues have flowed in faster than expected. Burgess said holders of later-issued GO debt are not likely to accept the plan’s terms, which could set up a “contentious” legal fight.

“The parties were supposed to be working things out in mediation but it is pretty clear the board is just continuing their divide and conquer strategy,” Burgess said. “The FOMB is essentially negotiating with a gun to the head of bondholders demanding they take “a” or risk getting nothing.”

The June plan support agreement involved PBA bondholders receiving 68.2% of their money with GO bonds issued before 2012 seeing 68.2%, if courts determine the debt to be valid. If courts ruled that the bonds are invalid, the PBA bonds would get 87.3% with earlier-issued GOs seeing 83.4%, according to the June plan agreement.

The oversight board also addressed Puerto Rico’s more than $50 billion pension burden. The plan involves an 8.5% pension reduction for retirees earning over $1,200 per month, which would hit about 40% of retirees, according to the board.

“The Plan of Adjustment we filed and the support we negotiated with retirees, unions and certain bondholders is an important first step towards restoring solvency and creating the kind of certainty businesses need to invest and the kind of stability the people of Puerto Rico need to achieve prosperity,” Natalie Jaresko, executive director of the oversight board, said in a statement. “The Plan of Adjustment, together with the fiscal discipline PROMESA mandates and the significant structural reforms outlined in the Fiscal Plan that will enhance Puerto Rico’s quality of life and economic competitiveness, allow us to work towards stable and sustainable growth.”

Assured Guaranty, which insures $4.79 billion of Puerto Rico debt, came out against the plan.

“Assured Guaranty does not support this plan of adjustment as it is premised on a number of terms that violate Puerto Rico law, its constitution and PROMESA," said Assured spokesperson Ashweeta Durani.

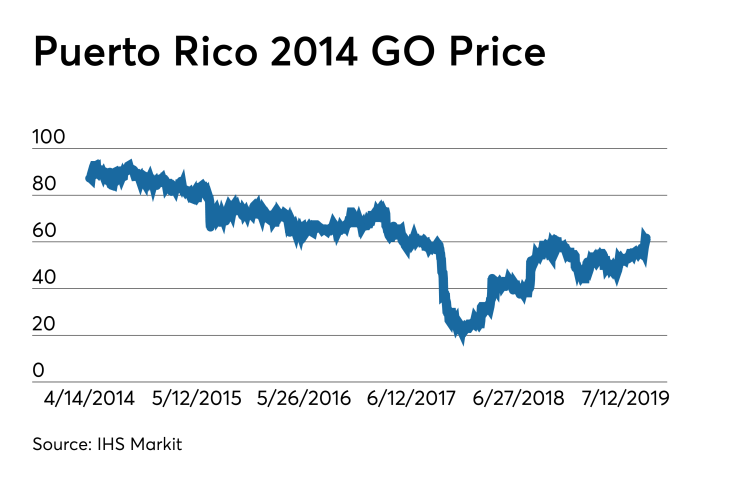

Puerto Rico bonds were trading lower Friday on the news, according to data from the Municipal Securities Rulemaking Board.

The Commonwealth’s benchmark Series 2014A 8% general obligation bonds of 2035 were trading down 0.75 cents on the dollar at 61 on volume of $15.26 million, according to the MSRB’s EMMA website. On Thursday, the 8% GOs were trading at 61.75 cents on the dollar on volume of $5.6 million.

“Puerto Rico’s proposed plan of adjustment is an important milestone in its restructuring process, but unlikely to be the final say on recoveries,” said Moody’s Investors Service senior analyst Genevieve Nolan. “Currently, pensioners’ losses are far less than bond creditors, as expected. The road to approval is long, and could result in changes to the current terms, similar to what played out in Detroit.”

Members of Congress including Rep. Nydia Velazquez, D-N.Y. have challenged the the Puerto Rico Oversight, Management, and Economic Stability Act (PROMESA), objecting to creditors receiving priority over island residents. A spokesperson for Congresswoman Velazquez said Friday, "While we are still reviewing the Plan of Adjustment, the Congresswoman has significant concerns about how pensioners and other vulnerable Puerto Ricans might be affected."

Meanwhile, Moody's Investors Service called the proposed plan of adjustment an important milestone in its restructuring process, "but unlikely to be the final say on recoveries. Currently, pensioners’ losses are far less than bond creditors, as expected," said Moody’s Vice President and Senior Analyst, Genevieve Nolan. "The road to approval is long, and could result in changes to the current terms, similar to what played out in Detroit.”