DALLAS - Phoenix Sky Harbor International Airport will finance the first phase of a planned $1.47 billion, five-year capital improvement program with proceeds from this week's negotiated sale of $423 million of senior-lien revenue bonds by the Phoenix Civic Improvement Corp.

The sale includes $250 million in two new-money tranches and two refunding pieces totaling $173.2 million.

The schedule calls for a one-day retail period on Wednesday, followed by institutional sales on Thursday, said Jeff DeWitt, assistant finance director for Phoenix, which owns and operates Sky Harbor and two general aviation airports.

The airport improvement program includes $1.4 billion of work at Sky Harbor and $54.7 million at the two smaller airports. All projects are expected to be under contract by 2012, although some will not be completed until 2020.

The Phoenix City Council approved the airport improvement program in early 2007, DeWitt said.

"These bonds have been a long time coming to market because we wanted to ensure we had an issue that was fiscally healthy and able to take whatever the market could throw at us," he said. "We stress-tested it pretty harshly. The market looks pretty good right now, and we hope it stays that way."

The airport bonds are rated Aa3 by Moody's Investors Service and AA-minus by Standard & Poor's.

DeWitt said a decision on bond insurance for the issue will be made closer to the pricing period.

"We may insure it, but we're going to look at the spread," he said. "If it makes sense we'll insure it. If it doesn't, we won't. We feel confident we can market the issue either way."

Lehman Brothers is the senior underwriter on the transaction. Co-seniors are Banc of America Securities LLC and Citi. Others on the underwriting team are Piper Jaffray & Co., Siebert Brandford Shank & Co., UBS Securities LLC, Estrada Hinojosa & Co., and Peacock, Hislop, Staley & Given Inc.

Greenburg Traurig LLP is serving as bond counsel. The financial adviser is Public Resources Advisory Group of New York.

With the sale, the airport will have $732.2 million of outstanding senior-lien debt and $13.4 million of outstanding general obligation debt that will mature soon. Sky Harbor's outstanding excise tax debt will be eliminated with the refunding.

The 2008 bonds will refund $30.4 million of senior-lien excise tax bonds, $31.0 million of subordinate-lien excise tax bonds, $3.8 million of GO bonds, and approximately $100 million of outstanding airport revenue bonds issued in 1994 and 1998.

DeWitt said the city's refunding strategy calls for clearing the airport's outstanding excise tax debt from the books as it begins financing the 2008-2013 airport capital improvements program.

"We're looking at a 3% savings with the refunding, but the main reason is not the savings," DeWitt said. "That's relatively minor. We'll take the savings, and the more the better, but our intention is to establish good, strong, long-term credit by relying entirely on senior-lien debt as the base."

"Over the past couple of years, the finance and aviation departments went through a process of long-term financial capacity planning," he added. "We wanted to make sure we had a capital improvement program that was flexible and financially responsible."

DeWitt said Phoenix plans to finance the current capital improvement program, which will not be completed until 2020, with another senior-lien revenue bond issue in 2010 of $155 million. The city will also anticipates issuing $425 million of debt in 2010 supported by the airline passenger facility charge collected by the airport, and another $220 million of passenger facility charge bonds in 2012.

In addition to the revenue and PFC bonds, the five-year program will be financed with $278 million from revenues that flow into the airport improvement fund, $136 million from airline improvement program funds, $135 million of pay-as-you-go passenger facility charges, and $6 million in customer facility revenues.

"We'll finance about 50% of the total cost of the capital improvement program with airport passenger facility charge revenues," DeWitt said.

DeWitt said the airport has a strong and diverse revenue base, with just 31% of total airport revenues coming from the airlines. The other 69% is generated from parking fees, lease of facilities to rental car companies, concessions, and other non-airline sources.

Paul Blue, Phoenix's assistant aviation director, said the five-year improvement plan focuses on ways to get an ever-increasing number of passengers into and out of the airport rather than on aviation-related facilities.

"We have plenty of runway and terminal capacity, so this program really doesn't deal with that," he said. "There are some minor terminal projects and some additional taxiways, but we're concentrating on ways to improve the customer experience."

Blue said Sky Harbor's current road system is expected to be at its capacity limit within six to eight years. The airport is located about four miles from downtown Phoenix.

Enplanements at Phoenix Sky Harbor have grown at a compound average annual rate of 3% per year over the past 10 years, to 20.8 million in fiscal 2007. Enplanements are forecasted to grow at 2% per year during the period covered by the capital improvement program, to a total of 23.4 million in fiscal 2013.

The airport handled 90% of total airline passengers in the state in fiscal 2007, far outpacing the Tucson International Airport's 9%. It was the third-busiest airport in the country that year.

"We continue to be one of the fastest-growing areas in the country," Blue said. "We want to be sure we can accommodate the growing number of passengers who use this airport."

Terminal areas will be renovated to provide easier transit for airline passengers through checkpoints without compromising security, according to Blue.

"Part of the improvements will be to provide more space for security so there will be more screening lines and shorter lines," he said. "We're also going to move some of the screening technology out of the lobbies and get it back behind the scenes."

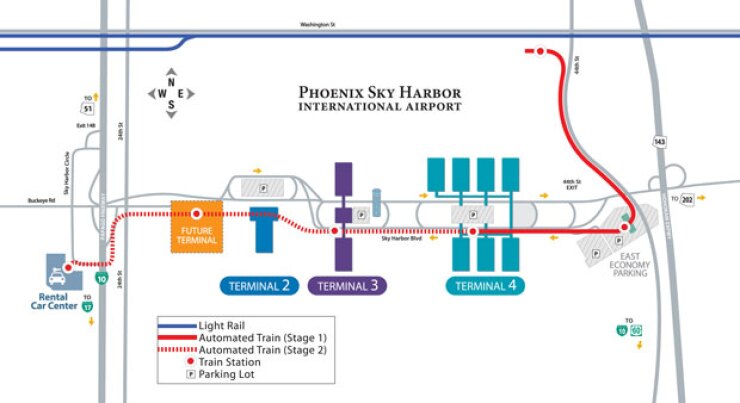

The single most expensive project in the program is an automated train, expected to cost $640 million, which will connect public transportation, parking areas, and airport terminals. Sky Harbor will also spend $280 million to acquire land for the train system, employee parking, and for noise mitigation. Other projects in the program include $93.5 million for security facilities, and $91 million of runway and taxiway improvements.

"Unlike some of the train systems at other airports, this one will not simply shuttle passengers between terminals," Blue said. "It will connect with the area's light-rail system that is going to open later this year, and will serve the rental car facilities and remote parking lots."

The train is expected to reduce the number of vehicles entering the airport by some 20,000 per day, or about 20% of the total traffic.

The first two-mile segment is scheduled to open in 2013, beginning at a light-rail station and extending to a remote parking lot on the east side of the airport before terminating at Terminal 4.

Phase 2 of the automated train system - which will begin construction in 2016 and is expected to open in 2020 - will serve terminals 2 and 3, a planned new terminal, a parking lot on the western edge of the airport, and the rental car center.