WASHINGTON - For the second consecutive year, states carried forward less private-activity bond volume cap than the year before, a departure from a decade of growing unused PAB allocations, according to a survey for 2007 compiled by the Council of Development Finance Agencies in conjunction with The Bond Buyer.

Driven by higher issuance of industrial development bonds and continued high demand for housing bonds, the 50 states and the District of Columbia carried forward a total of $16.5 billion of unused volume cap towards 2008, a 27% decline from the prior year, when they rolled over $22.7 billion. That amount was 14% less than 2005's total of $26.3 billion of unused cap, which was the last time the amount of total carry-over grew from one year to the next.

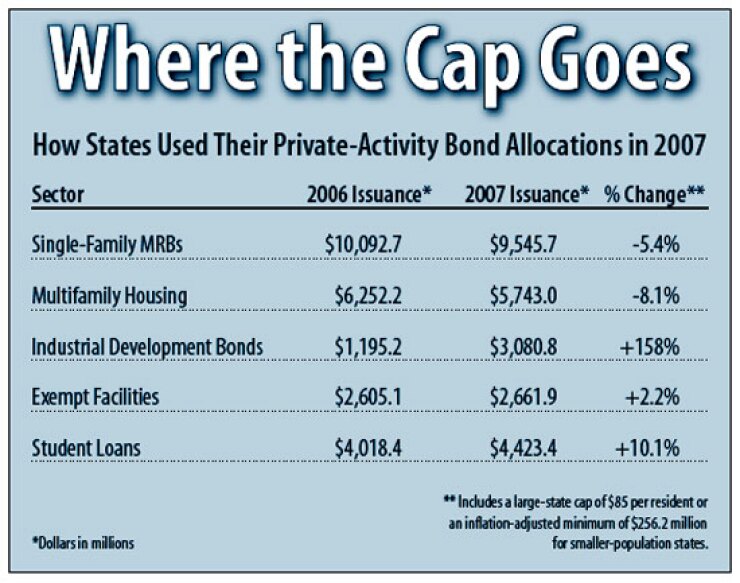

Overall issuance of private-activity bonds grew by $2.8 billion in 2007 to a total of $28.2 billion.

Housing, as in 2006, proved to be the largest area of issuance, accounting for $17.5 billion worth of bonds, or 62% of total issuance. And, once again, single-family mortgage revenue bonds led the way among housing issuances, totaling $9.5 billion and accounting for over half of all housing bonds and 33.7% of total private-activity bonds issued.

However, housing issuance on a whole was down in 2007, as mortgage revenue and multifamily housing bond issuance both decreased. The exempt facilities sector was also down, but issuance was up in industrial development bonds, as well as for student loans.

The total cap carried forward to 2008 makes up 33.9% of states' total capacity of $48.8 billion in 2007, a decrease from the 46.5% share carry forward constituted of 2006's total capacity. The 2007 figure is the sum of the year's aggregate volume cap and any unused cap from the previous three calendar years- 2005, 2006, and 2007 - which federal law permits states to carry forward. The $28.2 billion in aggregate cap, which is determined each year by inflation and state populations, was up 6.7% from 2006's total of $26.4 billion.

Since states are only allowed to carry forward extra PAB cap space for three years due to tax code restrictions, 15 states were forced to abandon a total of $1 billion worth of unused 2004 capacity in 2007, down from the $1.4 billion abandoned by 16 states in 2006. Abandoned cap amounted to just 4.7% of the $21.1 billion carried forward from 2006.

While 11 states reported in 2006 that they did not have enough cap to finance all the requested projects, only six - Arizona, Kansas, Kentucky, Indiana, and Rhode Island - reported no carryforward in 2007. Arizona and Indiana also reported maxing out their allocations in 2006.

However, some of the states said they usually aim to carry forward as little cap as possible. Officials with Rhode Island's Public Finance Department said that the Rhode Island Housing and Mortgage Finance Corp. took all of the state's 2007 volume cap, which it used to issue $256.6 million of single-family mortgage revenue bonds and $81.2 million of multifamily housing bonds. They added that while RIHMFC doesn't always assume all of the state's PAB cap, other organizations have come forward and assumed leftover cap space in previous years, meaning the state rarely carries forward a significant amount of volume cap.

Likewise, Cindy Pierson, program manager at the Indiana Finance Authority,said the state "usually" uses all their cap, and was able to finance all projects requesting PABs in 2007.

Robert Ramsey, a financial analyst with Kentucky's, Office of Financial Management, said it was "one of the first times in a few years" the state used up nearly all its allocated cap, carrying forward only about $1,200 this year. But he said the disappearance of carryforward was mainly due to regulations the state passed in 2005 and enacted in 2006 that reduced the amount of PABs available to local issuers, giving state issuers, who usually can take on larger amounts, more bond authority. He said as a result of the new regulations, the state carried forward just $700,000 in 2006, compared to $21 million in 2005.

Officials with the Arizona Department of Commerce also said they managed to finance all requested projects under their federal cap, and didn't need to pursue any alternatives to make sure all the projects received the appropriate funds.

CAPACITY

Under federal tax regulations, states and the District of Columbia can issue the greater of a fixed per-capita amount determined by population, or a set dollar limit of tax-exempt private-activity bonds, which benefits private businesses and are subject to separate rules than those that apply to governmental bonds.

Congress created the aggregate bond volume cap in 1986 to limit the amount of private-activity bonds sold every year. At first, states were given a $75 per capita annual limit or a minimum of $225 million annually in the years 1986 and 1987. But when the 1986 tax act was passed, the law reduced the limit to $50 per resident, or a minimum of $150 million per state. Those new levels were used from 1988 to 2001.

In late 2000, Congress enacted a two-year increase, which returned the levels back up to their original limits of $75 per capita or $225 million annually by 2002. Beginning in 2003, increases to the two levels were tied to inflation, but the per-capita figure was restricted to increase only in $5 increments.

In 2007, the 21 states and the District of Columbia with populations small enough that they qualified for the minimum level instead of the per-capita level received an increase of 3.9% in capacity to $256.2 million, from $246.6 million in 2006. Larger states also saw a boost in the amount of cap they were allocated per resident, to $85 in 2007 from $80 in 2006 and 2005.

Likely tied to the increased cap space, overall issuance rose in 2007, as greater amounts of bonds were issued in five categories, compared to three that saw decreases in that year.

HOUSING

Housing continued to take home the biggest segment of volume cap, as the sector has in previous years. The category, consisting of single family bonds, multifamily housing bonds, mortgage credit certificates, and other projects, received $17.6 billion in 2007, constituting 62.4% of total issuance.

However, the explosive growth the sector saw in 2006, driven by a 55.1% increase in single family mortgage revenue bonds, largely leveled off in 2007. The bonds, which are typically used to provide low-interest loans to first-time home buyers, actually experienced a 5.4% decrease in 2007, totaling $547 million. Nonetheless, the MRB category still made up the lion's share of all PABs in 2007, as $9.5 billion were sold, 33.9% the total of PABS issued.

Following suit, multifamily housing bonds, which mainly finance large rental complexes, also were issued in a smaller amount in 2007. The category experienced an 8.1% decrease, a drop of $509.2 million, last year. Issuance in that area had risen 12.4% in 2006.

Bonds issued to finance mortgage credit certificates, which can be used by first-time homebuyers to receive a tax credit upon purchasing their home, also shrank by 56% or $314.9 million.

The only category of housing bonds that increased were bonds that were not placed in any of the other categories. Miscellaneous housing issuances grew by $788.1 million or 66% last year.

Charles Giordano, senior director of housing at Fitch Ratings, said that a decrease in the amount of housing bonds issued should not be seen as a decrease in demand.

He said that with struggles facing conventional lenders recently because of the subprime crisis, "The state agency money is really the only thing available to [potential homeowners] right now." He said that the situation for state issuers in 2007 was "very similar" to 2006 and today.

Since the demand for mortgages from state and local housing finance agencies remained the same in both years, the drop in the amount of bonds issued in 2007 is simply due to the lack of available funds, Giordano said. In 2006, the rapid increase in demand for mortgages drove states to tap into their volume cap reserves carried forward from previous years, resulting in a higher amount of bonds issued. The demand for housing bonds was still at a high level last year, but there simply was less cap space for it to go around due to attempts to meet the same growing demand in 2006. "You saw this huge spike in 2006, then 2007 was pretty consistent with 2006, although a lot of the existing caps that they had starts to go away," Giordano said.

John Murphy, the executive director of the National Association of Local Housing Finance Agencies, said that pending legislation could provide an additional boost to private-activity housing bonds. Both the House and Senate are currently weighing comprehensive housing proposals with a number of bond-related provisions.

Bills in the two chambers would raise the private-activity bond volume cap by $10 billion, and also would make those bonds available to refinance mortgages as well as offer new ones. The proposals are currently working their way through Congress, and lawmakers hope to present a large omnibus housing package of some form to President Bush before the end of the summer.

A key proposal, Murphy said, is one that would permanently exempt housing bonds from the alternative minimum tax, which is being pushed by House Ways and Means Committee chairman Charles Rangel, D-N.Y., and is in the House version of the housing bill, but not the Senate's. The Senate bill would only exempt the additional $10 billion from the AMT.

Murphy said a permanent AMT exemption for housing bonds would make them "very attractive" to investors in the future, and could provide a big help to issuers.

Giordano echoed Murphy's support of the AMT exemption, even if it were only temporary.

"The agencies are having a hard time selling [debt] at a low enough price to keep their mortgage rate down. If the AMT goes away for a year or two, their bond cost is going to get much better. They'll issue more, and hopefully get more money to the people who need it, the first-time home buyer," he said. "Passing this bill would be very good for the housing economy."

However, both Murphy and Giordano are unsure what 2008 could hold for housing issuances.

On the multifamily side, analysts anticipate a strong 2008, as former homeowners who were foreclosed on will be seeking rental property, increasing the demand for multifamily units. Also, Giordano said potential homebuyers are much more hesitant now, and are staying in rental properties longer.

"Everybody picks up the paper and they're reading that prices are going to fall, and they're a little bit hesitant," he said.

OTHER CATEGORIES

Industrial development bond issuance grew significantly in 2007, up 158%, compared to a 19.5% increase in 2006.

The increase is due in part to the enacting in 2006 of legislation that sped up the effective date of a doubling in the capital limit - to $20 million from $10 million - on projects financed with the bonds, according to CDFA, the group that lobbies on behalf of state and local governments and municipal authorities that provide economic development financing programs, including those using tax-exempt and taxable bonds.

The capital expenditure limit increase was included in the 2004 corporate tax bill. That provision was originally intended to go into effect on Sept. 20, 2009, but market groups like the CDFA lobbied to move up the date after hearing that projects were already approaching the $10 million limit. The tax reconciliation bill passed in May 2006 moved the date the law took effect to Dec. 31 2006.

Coupled with the legislation, struggles in the private credit sector driven by recent economic slowdown has made some industrial borrowers turn more to tax-exempt financing as an option.

"[IDBs] provide an opportunity for borrowers who don't have access to traditional ways of financing to use these types of bonds and financing programs. In the market and credit conditions we have now, this becomes very attractive alternative," said Jill Hershey, managing director of government affairs at the Securities Industry and Financial Markets Association. "With the legislation that passed, that only increased the appetite."

Issuance of private-activity bonds for student loans increased 10.1% in 2007, or $274.7 million.

However, 2008 will likely show a drop in issuance, according to market participants.

"All signs would point to a decrease in issuance," said Leslie Norwood, SIFMA managing director and associate general counsel. Turmoil in the auction-rate securities market, the mode in a large amount of student loans debt was sold, put major strains on lenders, she said.

However, a new proposal by the Department of Education to essentially advance lenders money on a short-term basis to originate new loans could have a positive impact on 2008's issuance. Under the proposal, the department will offer to buy loans from lenders if they are unable to securitize them once they are originated. It also plans to boost its capacity for direct federal lending and to enhance its "lender of last resort" program. The general terms of the program were announced last month but have yet to be finalized.

"They're trying to implement regulations that essentially allow the Department of Education to be a secondary market and the lender of last resort to buy back student loans if they so choose, because the auction-rate securities market for student loans is really so crippled that there is no liquidity, and lenders are pulling out," said Norwood, who also noted that the speed with which the new program can be implemented will also be a factor for the sector's volume this year.

Separately, bond issuance for exempt facilities - which include airports, solid-waste disposal facilities, sewage facilities, district heating and cooling systems, docks, wharves, and mass commuting facilities - was up slightly in 2007 by $56.8 million, or 2.2%. All told, $2.6 billion were sold in that category last year.

In 2006, exempt facility bond issuance grew 36.1%. However, market participants noted that with the variance of facilities and deals done in this category, it is difficult to attribute the shift to any single substantive trend.