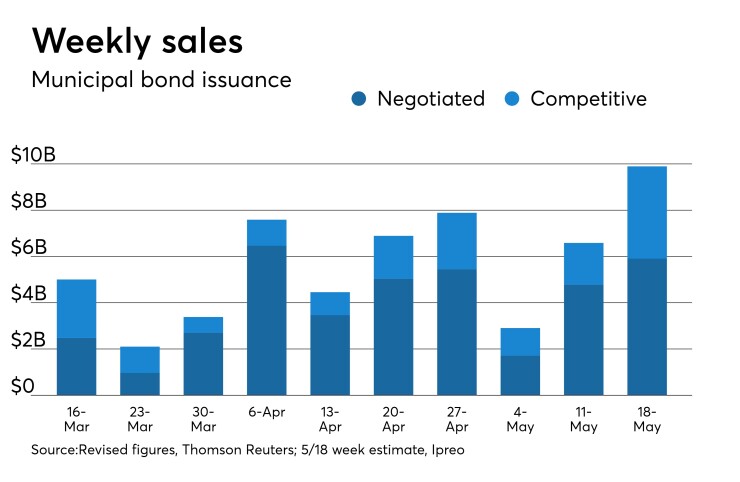

Municipal bond volume will jump to almost $10 billion next week, the biggest slate so far this year.

Average weekly volume has been about only about $4.5 billion in 2018, off from 2017’s average of over $6 billion a week.

Ipreo estimates next week’s supply at $9.9 billion, up from a revised total of $6.6 billion in the prior week, according to updated data from Thomson Reuters. Next week’s calendar is composed of $5.90 billion of negotiated deals and $3.99 billion of competitive sales.

Primary market

The New York City Transitional Finance Authority will competitively sell $1.1 billion of Fiscal 2018 Series C tax-exempt and taxable fixed rate bonds on Tuesday in five subseries.

The deals include $122.09 million of Subseries C-1 tax-exempt bonds; $329.22 million of Subseries C-2 tax-exempt bonds; $398.9 million of Subseries C-3 tax-exempt bonds; $137.4 million of Subseries C-4 taxable bonds; and $112.6 million of Subseries C-5 taxable bonds.

On Wednesday, Pennsylvania will competitively sell $1.25 billion of its First Series of 2018 general obligation bonds. Proceeds will be used to finance various capital projects.

In the negotiated sector, Citigroup is expected to price the city and county of San Francisco Airport Commission’s $914 million of second series revenue and revenue refunding bonds on Wednesday.

And Goldman Sachs is set to price $911 million of subordinate tier toll revenue bonds and $610 million of bond anticipation notes for the Grand Parkway Transportation Corp. in Texas on Wednesday.

Bond Buyer 30-day visible supply at $12.97B

The Bond Buyer's 30-day visible supply calendar increased $1.13 billion to $12.97 billion on Friday. The total is comprised of $6.62 billion of competitive sales and $6.35 billion of negotiated deals.

Secondary market

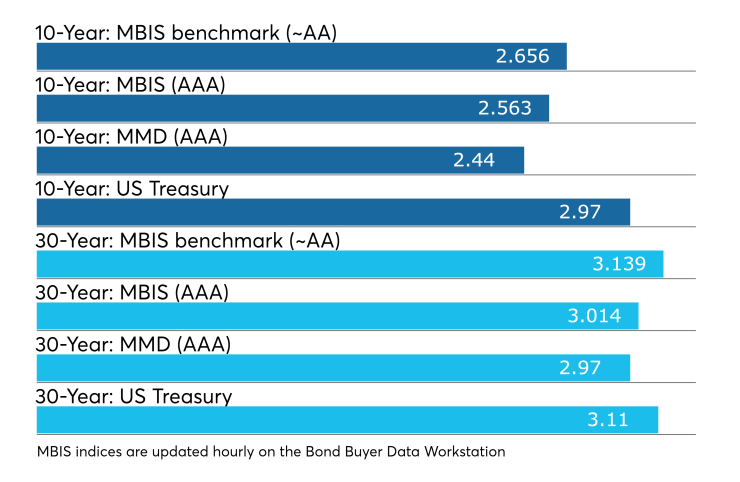

Municipal bonds were stronger on Friday, according to a midday read of the MBIS benchmark scale.

Benchmark muni yields fell as much as one basis point in the one- to 30-year maturities. High-grade munis were also stronger with yields calculated on MBIS’ AAA scale falling by as much as a basis point all across the curve.

Municipals were also stronger according to Municipal Market Data’s AAA benchmark scale, which showed yields falling one to three basis points in the 10-year general obligation muni and dropping two to four basis points in the 30-year muni maturity.

Treasury bonds were slightly stronger, too, as stocks were mixed.

On Thursday, the 10-year muni-to-Treasury ratio was calculated at 83.3% while the 30-year muni-to-Treasury ratio stood at 96.2%, according to MMD.

Previous session's activity

The Municipal Securities Rulemaking Board reported 45,764 trades on Thursday on volume of $15.81 billion.

California, New York and Texas were the states with the most trades, with the Golden State taking 16.527% of the market, the Empire State taking 14.174% and the Lone Star State taking 10.108%

Week's actively traded issues

Some of the most actively traded bonds by type in the week ended May 11 were from Kansas, Virginia and New York issuers, according to

In the GO bond sector, the Wyandotte USD No. 203, Kan., 4s of 2048 traded 27 times. In the revenue bond sector, the Norfolk Economic Development Authority, Va., 4s of 2048 traded 57 times. And in the taxable bond sector, the DASNY 4.85s of 2048 traded 45 times.

Week's actively quoted issues

California, Connecticut and Puerto Rico names were among the most actively quoted bonds in the week ended May 11, according to Markit.

On the bid side, the California revenue 5.25s of 2040 were quoted by 43 unique dealers. On the ask side, the Connecticut GO 5s of 2026 were quoted by 196 dealers. And among two-sided quotes, the Puerto Rico Commonwealth GO 8s of 2035 were quoted by 26 dealers.

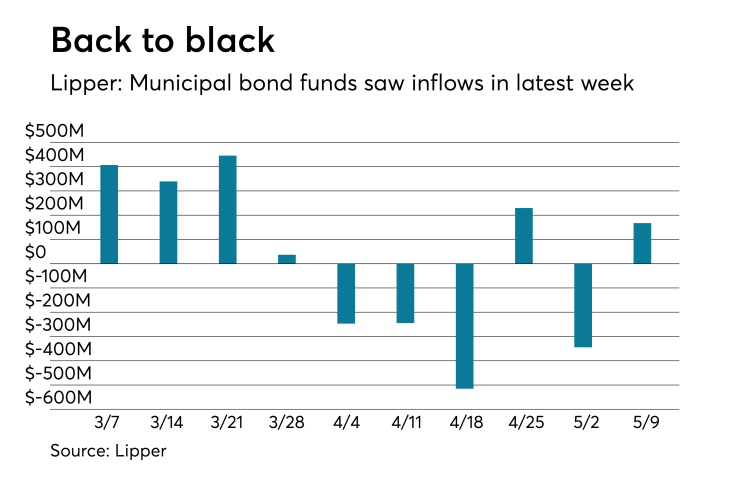

Lipper: Muni bond funds saw inflows

Investors in municipal bond funds reversed course and put cash into the funds in the latest reporting week, according to Lipper data released on Thursday.

The weekly reporters saw $167.323 million of inflows in the week ended May 9, after outflows of $344.710 million in the previous week.

Exchange traded funds reported inflows of $24.407 million, after inflows of $10.102 million in the previous week. Ex-ETFs, muni funds saw $142.915 million of inflows, after outflows of $354.813 million in the previous week.

The four-week moving average remained negative at -$115.765 million, after being in the red at -$218.779 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds had inflows of $252.252 million in the latest week after outflows of $183.551 million in the previous week. Intermediate-term funds had inflows of $68.529 million after outflows of $43.953 million in the prior week.

National funds had inflows of $200.965 million after outflows of $206.274 million in the previous week. High-yield muni funds reported inflows of $220.975 million in the latest week, after inflows of $28.680 million the previous week.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.