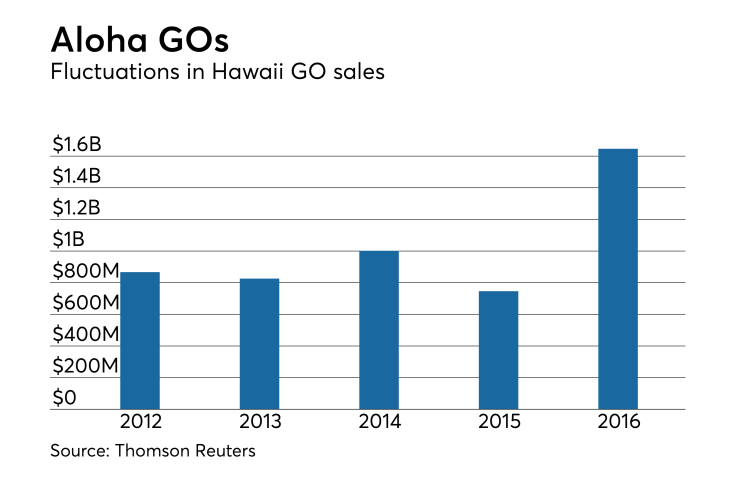

LOS ANGELES — Hawaii's bond issuance volume this year is likely to mirror levels seen the past several years.

The state plans to price $856.2 million in general obligation bonds next week just after lawmakers put the final touches on the budget.

Between the upcoming sale and another planned in the fall, Hawaii Finance Director Wes Machida said, they are anticipating issuing around $1 billion in bonds this calendar year, which is in line with what the state has issued over the past five years.

It's less than what Gov. David Ige

The sale will include $575 million in tax-exempt new money, $236.2 million in refundings, and $45 million in taxable GOs in six series, according to the preliminary offering documents.

Bank of America Merrill Lynch and Citi will be senior managers of the syndicate with Morgan Stanley and Goldman Sachs & Co. as co-managers. Public Financial Management, Inc. is pricing advisor. Orrick, Herrington & Sutcliffe, LLP is bond counsel.

The retail order period is Tuesday with institutional pricing scheduled Wednesday.

Gov. David Ige had said in December that the state would look to fund a significant portion of the more than $3 billion in capital projects it has planned in fiscal years 2018 and 2019 by issuing GOs to capitalize on its strong ratings. Ige said the state could achieve reduced debt service costs after upgrades the state received in September.

Whether or not the state issues more in fiscal 2019, the second year of the biennium, “depends on the revenue stream and the economy,” Machida said.

The governor’s budget in December asked for $1.5 billion in bond authorization for fiscal 2018, but that was reduced to $1 billion last week, Machida said.

The state received one-notch ratings upgrades in September from both Moody’s Investors Service and S&P Global Ratings ahead of that $782 million GO bond sale. Moody’s boosted its rating to Aa1 and S&P raised it to AA-plus.

Ahead of next week’s sale, Fitch Ratings revised the state’s outlook to positive and affirmed Hawaii at AA. Moody’s and S&P both affirmed the ratings and assigned stable outlooks in ratings reports issued ahead of the sale.

“Our revision of the outlook is based on actions the state has taken over the last several years to strengthen its liability position,” said Stephen Walsh, a Fitch director.

The state is on the path to full actuarial funding of both its pension and other post-employment benefits, Walsh said.

When Hawaii reduced its assumed rate of return recently to 7% from 7.5%, it did so immediately rather than gradually over a several-year period as other states have done, he said.

The state began pension reform efforts in May 2011 by passing legislation that reduced employee benefits by limiting spiking, partly through the exclusion of overtime in estimating employee annual pension payouts based on current salary. Hawaii began prefunding OPEB liabilities in 2013 with the aim of reaching 100% of its actuarially required prefunding level by 2019.

“The legislature also has approved sharply higher contribution rates this year that would take effect over the next several years,” Walsh said. “I don’t know if the governor signed it yet, there may be procedural steps remaining, but since the governor was a sponsor, it seems likely to go.”

A drop in projections by the state’s Council on Revenues raised a caution flag around increasing debt spending on top of an adverse

“When the budget was submitted in December, revenue projections were 5.5% for this fiscal year, a month later it dropped to 3% growth projections, and then March projections were lowered to 2.5%,” Machida said.

Revenues have slowed, Machida said, but part of the decline is the result of a transfer between state funds. Revenues also could pick up toward the end of the fiscal year as they did last year when projections were for 5% to 6.5%, but actual collection was 8%, he said.

The transfers are a result of an error made several years ago when money that should have gone into a separate litigated fund were kept in the state bank account where revenues are held. So the tax revenues three or four years ago were inflated, but the transfer was made this year, he said.

Ige warned in his State of the State speech on Jan. 23 that the state economy had slowed, and adjustments would be required in his proposed two-year $28.5 billion budget.

The governor has proposed an increase in state contributions to the public employees’ pension fund that provides benefits to more than 120,000 employees and retirees. In January the state’s Employees Retirement System reported its unfunded pension liability was $3.67 billion more than had been previously calculated. The actuarial funded ratio was adjusted lower to 54.7% from 61.2% for 2016 in the report issued by Gabriel Roeder Smith & Co.

The state’s work on its pension and OPEB liability and progress on its reserve funds earned it the positive outlook from Fitch, Walsh said.

Balances in the state’s Emergency and Budget Reserve Fund rose from $9.7 million in fiscal 2011 to $100.9 million in fiscal 2016, with an increase to $310.7 million, 4.4% of prior year revenues, in fiscal 2017, according to Fitch’s April 28 ratings report.

In addition to its work on reducing pension liabilities, Fitch also cited as a plus budget management guided by frequent revenue forecasts and multi-year financial plans that enable the state to make adjustments if revenue collections slow.

Fitch considers the state’s combined liabilities for pensions and long-term debt that include $6.3 billion in outstanding general obligation bonds to be moderate. Hawaii’s long-term liabilities are 18.4% of personal income as of fiscal 2016, which is more than three times the median for states.

Hawaii is unique in that it issues all of the debt for its K-12 schools, Walsh said.

Debt issued for its schools represents 40% of the state’s total debt, according to the Fitch report.

Gurtin Municipal Bond Management, which buys Hawaii bonds, expects the state’s upcoming sale to go well, said Tom Schuette, partner and co-head of Investment Research & Strategy.

“I remember we were substantially oversubscribed in some maturities in the September sale that came after the ratings upgrades,” he said.

The state realized $23.1 million in net present value savings on the September sale, he said.