While a somber mood fell over Wall Street as the finance industry reflected on the devastating terrorist attack 17 years ago, the municipal market attracted pickup in supply and some cheaper prices on new deals, according to John Mousseau, chief executive officer of Cumberland Advisors.

"You can get 4% if it’s a new deal, goes out mega long or maybe has an A rating," Mousseau said Tuesday afternoon, after attending a 9/11 remembrance ceremony in Sarasota, Fla., where Cumberland president David Kotok recalled his memories at the World Trade Center that day.

"The real point is that the long end of the muni market is still dirt cheap, while the front end is ridiculously rich," he said, calling it "the tale of two ratios."

Primary market

Action got underway in the primary market with competitive arena taking center stage Tuesday, led by sales from Washington, Florida, and Nevada issuers.

The Shoreline School District No. 412, Wash., sold $206.81 million of unlimited tax general obligation bonds under the Washington state school district credit enhancement program. Proceeds will be used to pay costs of certain capital improvements.

Morgan Stanley won the bonds with a true interest cost of 3.4555%. The financial advisor is PFM Financial Advisors; the bond counsel is Foster Pepper. The deal is rated AA-plus by S&P Global Ratings.

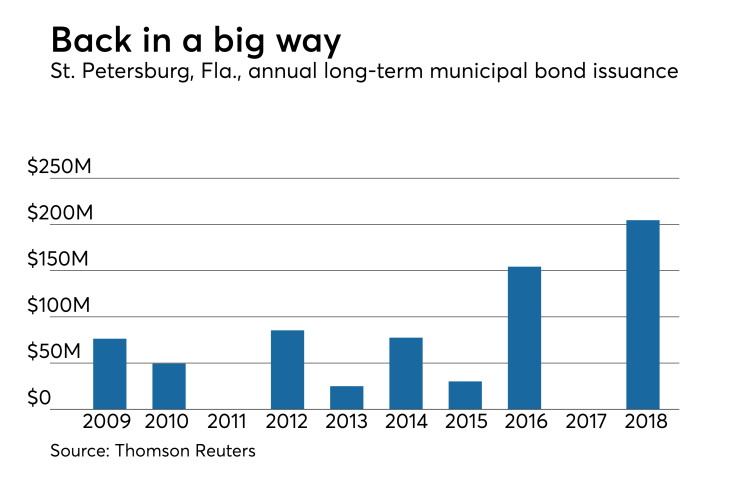

Saint Petersburg, Florida, sold $204.605 million of Series 2018 public utility refunding revenue bonds. The proceeds will be used to refund all of the city's outstanding Series 2017 public utility subordinate lien bond anticipation notes.

Bank of America Merrill Lynch won the bonds with a TIC of 3.711%. The financial advisor is PFM Financial Advisors; the bond counsel is Bryant Miller. The deal is rated Aa2 by Moody’s Investors Service and AA by Fitch Ratings.

Since 2009, the city has sold roughly $703 million of securities – with the biggest year of issuance excluding Tuesday’s sale, taking place in 2016 when it sold $154.3 million. It did not come to market in 2011 or 2017.

Pompano Beach sold $99.375 million of Series 2018 GOs. Proceeds along with other city money will be used to finance certain capital projects.

Citigroup won the bonds with a TIC of 3.6475%. The financial advisor is PFM Financial Advisors; the bond counsel is Greenspoon Marder. The deal is rated Aa2 by Moody’s and AA by S&P.

North Las Vegas sold $99 million of Series 2018 limited tax GO building refunding bonds additionally secured by pledged revenues. Proceeds will be used to refund some of the city’s outstanding debt.

BAML won the bonds with a TIC of 3.8092%. The financial advisor is Zions Public Finance; the bond counsel is Stradling Yocca. The deal is insured by Assured Guaranty Municipal and rated A2 by Moody’s and AA by S&P.

The Fort Mill School District No. 4 of York County, S.C., had been slated to sell $100 million of Series 2018B GOs on Tuesday, but postponed the sale until Thursday, Sept. 13. The deal is rated Aa1 by Moody’s and AA by S&P.

In the negotiated sector, JPMorgan Securities priced the Omaha Public Power District, Neb.’s $145.8 million of Series 2018A electric system revenue bonds. The deal is rated Aa2 by Moody’s and AA by S&P.

Tuesday’s bond sales

Florida

Nevada

Washington

Nebraska

BlackRock: Muni bonds still going strong

After municipal bonds delivered a fourth consecutive month of positive performance in August, Peter Hayes, head of BlackRock’s municipal bonds group, said the market is “poised to transition back" to net-positive supply.

“Looking to the fall months ahead, we maintain a cautious outlook on the asset class,” Hayes said. “Additionally, we see potential for an increase in volatility should uncertainty heighten around upcoming Fed moves, the midterm elections and geopolitical developments.”

the S&P Municipal Bond Index gained 0.19% in August, bringing its year-to-date return to 0.42%, Hayes said in BlackRock’s monthly report. Interest rates migrated lower over the month as investors focused more on macro uncertainties – geopolitical concerns, trade negotiations and Special Counsel Robert Mueller’s investigation of Russian meddling in Preisdent Trump's election – versus continued strong U.S. economic growth. (Bond prices typically move inversely to interest rates.)

“Demand for the asset class has remained firm. Notably, alongside the recent divestment from equities, investor flows into municipal bond mutual funds have been yield-driven and concentrated in long-term and high yield funds,” Hayes said. “The stronger performing areas of the market in August included high yield, led by Puerto Rico and tobacco, bonds with terms of 15 years+, the hospital and education sectors, and issues of high-tax states such as New Jersey, California, Illinois and Massachusetts.”

He added that gross issuance levels are gradually returning to normal after a dearth earlier in the year.

“Still, the muni market continued to benefit from the tailwind of net negative supply that typically occurs in the summer months. For the month of August, gross issuance of $32.4 billion paired against the seasonal swell of capital reinvestment resulted in net negative supply of negative $7.2 billion.”

Secondary market

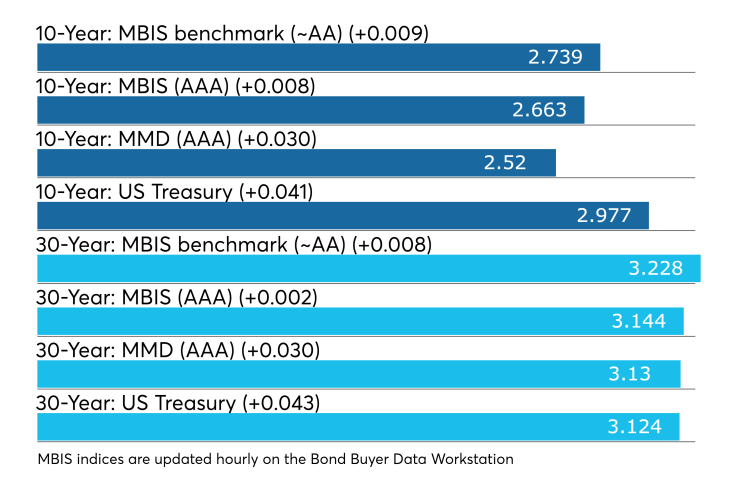

Municipal bonds were weaker on Tuesday, according to a late read of the MBIS benchmark scale. Benchmark muni yields rose as much as one basis point in the one- to 30-year maturities.

High-grade munis were mostly weaker, with yields calculated on MBIS' AAA scale rising less than one basis point in the three- to 30-year maturities and falling less than a basis point in the one- and two-year maturities.

Municipals were weaker on Municipal Market Data’s AAA benchmark scale, which showed the yield on both the 10-year muni general obligation and the yield on 30-year muni maturity rising three basis points.

Treasury bonds were weaker as stock prices traded higher.

On Tuesday, the 10-year muni-to-Treasury ratio was calculated at 84.6% while the 30-year muni-to-Treasury ratio stood at 100.2%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Previous session's activity

The Municipal Securities Rulemaking Board reported 33,239 trades on Monday on volume of $7.68 billion.

California, Texas and New York were the municipalities with the most trades, with Golden State taking 16.083% of the market, the Lone Star State taking 11.338% and the Empire State taking 9.979%.

Lipton sees cautious optimism

Cautious optimism has settled on the municipal market as the summer months and Labor Day have passed and investors are looking forward to strong municipal performance through year end, according to a new report from Jeffrey Lipton, managing director at Oppenheimer & Co.

“While outflows are likely to episodically return during the second half of the year, more prevalent inflows should be a key driver of market recovery and performance,” Lipton wrote in a report Tuesday.

“Investors are advised to pay close attention to potential relative value opportunities as long ratios could migrate higher and the argument for extending duration becomes stronger,” he advised. “For those duration-conscious investors, it remains reasonable to stay inside of 20-year maturities as over 90% of the curve can be captured.”

He looked at the budget, interest rates, and tax reform impacts.

“The market has now moved beyond the heavy summertime reinvestment needs given the sizeable redemptions, maturities and coupon payments against a backdrop of thinning product, particularly for short-dated cash-flow notes — a by-product of improving budgetary conditions,” Lipton wrote.

Part of the richer valuations on the short-end can also be explained by a tax-reform driven thinning of short-tenor supply thanks to the elimination of advance refunding capability, he noted. “Much of the available cash was placed on the short-end as investors remained tentative ahead of the Fed’s gradual tightening sequence,” Lipton said.

Tax-exempt bond prices exhibited a soft tone for much of last week as U.S. Treasury securities drifted range-bound until Friday’s solid employment data sent prices decidedly lower, he wrote.

“The weaker bias and relative underperformance — despite Friday’s outperformance — for the week were underscored by a course reversal as municipal bond mutual fund flows turned negative during the last reported period,” he continued.

Growing bid wanted lists threatened to test market liquidity, he added.

After some bond prices fell last week, Lipton said there is some expectation for a rebound ahead of the Federal Open Market Committee meeting scheduled for Sept. 25 and Sept. 26, especially given that rate increases are expected in September and December.

Lipton said he believes investors have cash to spend and may end up on the short end of the market. “Any extended softness in demand could pressure relative value ratios higher, thus presenting more compelling entry points,” he wrote.

While supply has been limited so far in 2018, Lipton does not expect volume to show a material improvement through year end, though there is likely to be some activity ahead of further Fed tightening actions and issuance trends do tend to accelerate after the summer months.

“Many municipal issuers are still carefully balancing their debt requirements against a number of other budgetary needs competing for limited resources, not the least of which are pension and OPEB liabilities,” he wrote. “We also believe that geopolitical and domestic uncertainty may give pause to a number of issuers already debating the appropriateness of accessing the market,” Lipton said. “The domestic recovery is not necessarily yielding a uniform benefit to many local jurisdictions and revenue-generating enterprises.”

He noted that new-money issuance in August increased almost 16.5% year-over-year, while August’s refunding volume dropped by 28%

“This suggests that issuers remain committed to essential bedrock projects, particularly given favorable voter authorizations of bond-financed activity,” Lipton said. “We suspect that September and October volume may keep with the trend, but November and particularly December will likely deviate given the out-sized accelerated volume experienced during those two months last year in anticipation of new bonding constraints.”

Treasury sells $45B 4-week bills

The Treasury Department Tuesday auctioned $45 billion of four-week bills at a 1.975% high yield, a price of 99.846389.

Tenders at the high rate were allotted 15.90%. The median rate was 1.950%. The low rate was 1.910%

The coupon equivalent was 2.006%. The bid-to-cover ratio was 2.97. The bills have an issue date of Sept. 13 and are due Oct. 11.

Tenders totaled $133,542,659,100 and the Treasury accepted $45,000,074,600, including $980,517,100 non-competitive. The Fed banks bought nothing for their own account.

Treasury auctions $26B 1-year bills

The Treasury Department Tuesday auctioned $26 billion of one-year bills at a 2.465% high yield, a price of 97.507611.

Tenders at the high rate were allotted 27.07%. The median rate was 2.450%. The low rate was 2.420%. The coupon equivalent was 2.547%. The bid-to-cover ratio was 3.76.

The bills have an issue date of Sept. 13 and are due Sept. 12, 2019.

Tenders totaled $97,749,733,300 and the Treasury accepted $26,000,254,400, including $596,208,300 non-competitive. The Fed banks bought nothing for their own account.

Treasury 3-year notes go at 2.821% high yield

The Treasury Department Tuesday auctioned $35 billion of three-year notes at a 2.821% high yield, a price of 99.797279.

The notes has an issue date of Sept. 17 and are due Sept. 15, 2021.

The median yield was 2.795%. The low yield was 2.600%. The bid-to-cover ratio was 2.68.

Tenders at the high yield were allotted 55.37%. Tenders totaled $93,917,713,200 and the Treasury accepted $35,000,019,100, including $110,513,200 non-competitive. The Fed banks bought nothing for their own account.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.