DALLAS - The Oklahoma Turnpike Authority has replaced insurance from XL Capital Assurance Inc. on $530.8 million of variable-rate refunding bonds issued in 2006 with a one-year standby bond purchase agreement provided by a group of three banks.

The substitute liquidity facility will be provided by Lloyds TSB Bank PLC, which is serving as agent bank operating through its New York branch; Fortis Bank SA/NV, acting through its Connecticut branch; and Banco Bilbao Vizcaya Argentaria SA, acting through its New York branch.

The agreement will go into effect on Thursday and is currently scheduled to extend through March 26, 2009.

It provides for the payment of the purchase price of tendered bonds during the daily and weekly interest rate periods. The agreement covers the principal portion of the purchase price and up to 34 days of interest at a maximum of 12%.

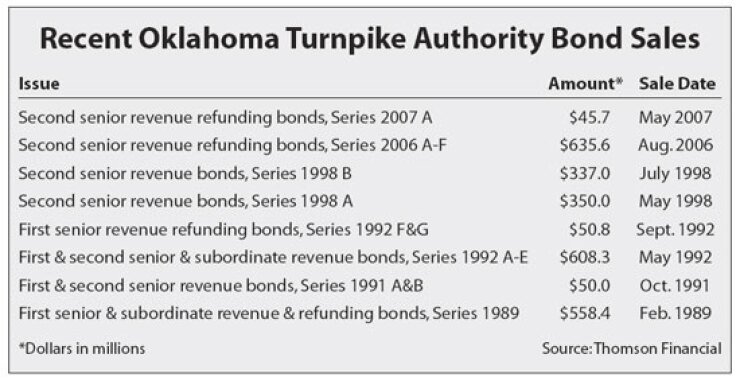

The bonds include five tranches, Series 2006B through Series 2006F, each for $106.16 million. The bonds were sold in August 2006 in a negotiated deal with Goldman, Sachs & Co. as underwriter.

Earlier this year, XL Capital Assurance's ratings were lowered from triple-A to A3 by Moody's Investors Service, and to A-minus by Standard & Poor's and Fitch Ratings.

The turnpike authority's refunding bonds have long-term underlying ratings of Aa3 from Moody's, and AA-minus from Standard & Poor's and Fitch. Moody's provided a short-term rating of P-1 for the debt, with Fitch giving a short-term rating of F1-plus.

"We've been able to get rid of the insurance and get these bonds re-rated," said Oklahoma Treasurer Scott Meacham. "We think they'll sell well with the new ratings."

Meacham said the bonds reset at a higher interest rate due to a lack of buyers at the weekly sales after XL Capital Assurance's ratings were lowered.

"The Oklahoma Turnpike Authority was being punished for something that was not a fault of its own," he said. "The authority is a stout credit with strong revenues."

With the agreement, Meacham said, the three banks will purchase the turnpike authority's refunding bonds if the owners put them back in the market.

"You have to have backup liquidity, and that's what this agreement provides," he said. "The last rate I saw on the bonds was 8%, and I expect we'll be back around 4% with this agreement.

"I think this will solve our problems with this issue," Meacham said. "The insurance that went bad is the only thing that was really holding us back."

The state expects no refunds on the money it spent on bond insurance on the turnpike authority issue, Meacham said.

"I doubt very much if XL Capital Assurance has the capability to refund those payments," he said. "Even if they did, we'd have to stand in a long line."

The agreement should mean the end of the state's exposure to variable-rate debt problems, Meacham said.

Last week, the treasurer was rebuffed in his attempts to purchase from Goldman Sachs $123.7 million of variable-rate bonds issued by the Oklahoma Capitol Improvement Authority that reset to 8% when bond insurer CIFG Assurance North America Inc. was downgraded below AA status. The state was offering 4.31% on the bonds.

"Goldman has come around and is selling us our bonds," he said. "We purchased several orders at 4.03%, or about half what we had been paying.

"I think we're OK now."

The Oklahoma Turnpike Authority was created by the Legislature in 1947 to build and operate a toll road between Oklahoma City and Tulsa. The authority currently operates 10 toll roads, ranging in length from 17 miles to 105 miles.

Authority revenues pledged to the bonds include vehicle tolls and state taxes on motor fuels consumed on the roads.