An Ohio issuer came to market with a top-quality water deal as a Nevada sale offered buyers a competitive sale of flood control bonds.

Municipals were stronger in quiet trade at mid-session.

Primary market

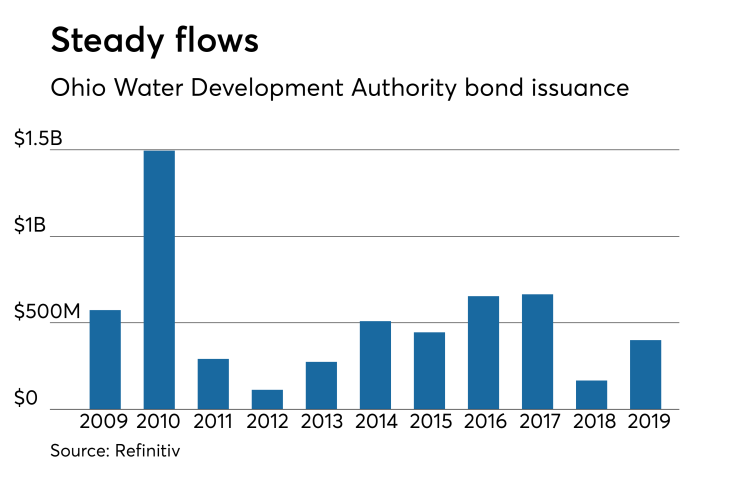

Bank of America Merrill Lynch priced the Ohio Water Development Authority’s $400 million of Series 2019A water pollution control loan fund revenue bonds.

The deal is rated triple-A by Moody’s Investors Service and S&P Global Ratings.

Since 2009, the authority has issued about $5.5 billion of debt, with the most occurring in 2010 when it sold $1.5 billion of bonds. It sold the least amount of debt in 2012, when it issued $112 million.

Clark County, Nev., competitively sold $100 million of Series 2019 limited tax general obligation flood control bonds additionally secured with pledged revenues.

Morgan Stanley won the issue with a true interest cost of 2.8279%.

The financial advisors are Hobbs, Ong & Associates and PFM Financial Advisors. The bond counsel is Sherman & Howard.

The deal is rated Aa1 by Moody’s and AA-plus by S&P.

Prior to Tuesday’s sale, the county last competitively sold comparable bonds on Feb. 12 when JPMorgan Securities won the $32.225 million of Series 2019B limited tax GO transportation refunding bonds with a TIC of 2.0442%.

On Wednesday, BAML is expected to price the Chandler Industrial Development Authority, Ariz.’s $500 million of Series 2019 industrial development revenue bonds and the Oregon Business Development Commission’s $100 million of Series 250 economic development revenue bonds for Intel Corp.

Also Wednesday, Ramirez & Co. is expected to price the Los Angeles Department of Airports’ $438 million of revenue bonds. The issue consists of Series 2019A subordinate revenue bonds subject to the alternative minimum tax, Series 2019B subordinate revenue bonds not subject to the AMT and Series 2019C subordinate refunding revenue bonds not subject to the AMT. The deal is rated Aa3 by Moody’s and AA-minus by S&P and Fitch Ratings.

In the competitive arena on Wednesday, the New York City Municipal Water Finance Authority plans to sell $390.415 million of Fiscal 2019 Series EE water and sewer system second general resolution revenue bonds in two offerings. The deals consist of $275 million of Subseries EE-2 bonds and $115.415 million of Subseries EE-1 bonds. The financial advisors are Lamont Financial Services and Drexel Hamilton. The bond counsel are Nixon Peabody and the Hardwick Law Firm. The deals are rated Aa1 by Moody’s and AA-plus by S&P and Fitch.

Bond sale

Ohio

Bond Buyer 30-day visible supply at $7.04B

The Bond Buyer's 30-day visible supply calendar increased $788.9 million to $7.04 billion for Tuesday. The total is comprised of $3.22 billion of competitive sales and $3.82 billion of negotiated deals.

Secondary market

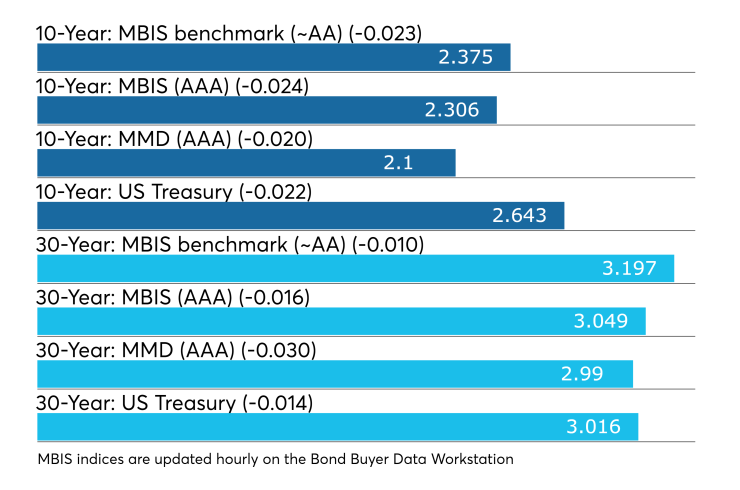

Municipal bonds were stronger Tuesday, according to a read of the MBIS benchmark scale. Benchmark muni yields fell as much as two basis points in the four- to 30-year maturities, rose less than a basis point in the one- and two-year maturities and were unchanged in the three-year maturity.

High-grade munis were also stronger, according to MBIS, with muni yields falling as much as two basis points in the four- to 30-year maturities and rising less than a basis point in the one- to three-year maturities.

Investment-grade municipals were stronger on Refinitiv Municipal Market Data’s AAA benchmark scale, which showed the yield on the 10-year muni general obligation falling as much as two basis points while the yield on the 30-year muni maturity dropped one to three basis points.

Treasury bonds were stronger as stock prices traded mixed.

On Monday, the 10-year muni-to-Treasury ratio was calculated at 78.6% while the 30-year muni-to-Treasury ratio stood at 98.5%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Previous session's activity

The Municipal Securities Rulemaking Board reported 36,174 trades on Monday on volume of $7.17 billion.

California, New York and Texas were the municipalities with the most trades, with the Golden State taking 15.427% of the market, the Empire State taking 11.536% and the Lone Star State taking 10.856%.

Treasury auctions year bills

The Treasury Department Tuesday auctioned $26 billion of 364-day bills at a 2.470% high yield, a price of 97.502556.

The coupon equivalent was 2.559%. The bid-to-cover ratio was 3.60.

Tenders at the high rate were allotted 14.47%. The median yield was 2.450%. The low yield was 2.430%.

Treasury to sell $60B 4-week bills

The Treasury Department said it will sell $60 billion of four-week discount bills Thursday. There are currently $35.000 billion of four-week bills outstanding.

Treasury also said it will sell $35 billion of eight-week bills Thursday.

Treasury said it may announce and auction a 41-day cash management bill on Feb. 28, to be issued on March 1.

Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.