On a rainy day in New York City, municipal buyers saw a steady stream of deals flow into the market on Tuesday, led by water offerings from New York City and Ohio.

Primary market

Raymond James & Associates priced the New York City Municipal Water Finance Authority’s (Aa1/AA+/AA+) $461.31 million of Fiscal 2020 Series AA water and sewer system second general resolution revenue bonds.

The deal boasted top yields in 2040 of 2.71% with a 4% coupon and 2.41% with a 5% coupon.

A New York trader said the market was pleased to see long bonds on the deal priced with both 5% and 4% coupons.

“Both maturities priced slightly wider to the AAA scale than the pre-marketing price talk,” the trader said. The calendar is manageable with little volume expected next week heading into the Fourth of July holiday. “The intermediate support is better than support for long bonds,” the trader said.

The deal was priced for retail investors on Monday, with top yields in 2040 of 2.67% with a 4% coupon and 2.40% with a 5% coupon.

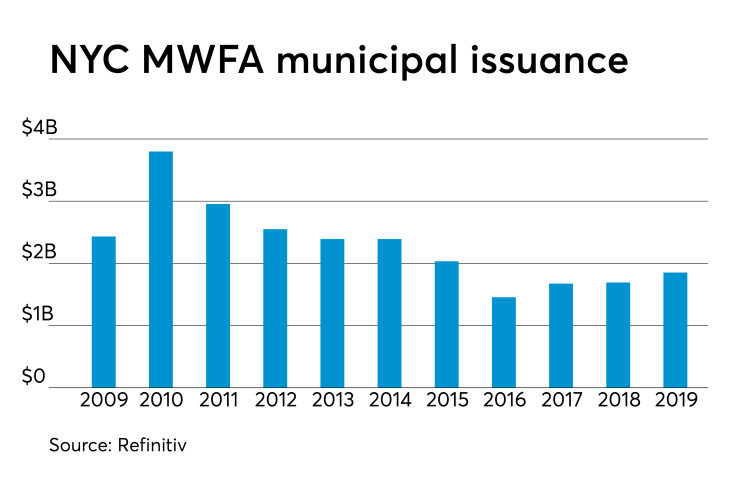

Since 2009, the MWFA has sold about $25 billion of debt, with the most issuance occurring in 2010 when it offered $3.8 billion. It sold the least in 2016 when it offered $1.5 billion.

Also Tuesday, RBC Capital Markets priced the Ohio Water Development Authority’s (Aaa/AAA/NR) $250 million of Series 2019 drinking water assistance fund revenue bonds.

JPMorgan Securities priced for retail investors the Ohio Housing Finance Agency’s (Aaa/NR/NR) $150 million of Series 2019B residential mortgage revenue bonds not subject to the alternative minimum tax for its mortgage-backed securities program.

Wells Fargo Securities priced and repriced the Illinois State Toll Highway Authority’s (A1/AA-/AA-) $300 million of Series 2019A toll highway senior revenue bonds.

BofA Securities priced Whiting, Ind.’s (A1/A-/NR) $252.74 million of Series 2019A environmental facilities refunding revenue bonds for BP Products North America.

Hilltop Securities priced Bexar County, Texas’ $137.055 million deal consisting of $88.43 million of Series 2019 combined venue tax (A2/A+/A-) tax-exempt venue project revenue refunding bonds and $48.625 million of Series 2019 Motor Vehicle Rental Tax (A1/AA-/AA) tax-exempt venue project revenue refunding bonds.

In the short-term sector, JPMorgan Securities priced the Kentucky Asset/Liability Commission’s (MIG1/NR/F1+) $400 million of Series 2019A general fund tax and revenue anticipation notes.

In the competitive arena, the Toms River Regional School District’s Board of Education, N.J., (NR/AA-/NR) sold $147.148 million of unlimited tax general obligation school bonds. Morgan Stanley won the bonds with a true interest cost of 2.8607%. Phoenix Advisor is the financial advisor; McManimon Scotland is the bond counsel. Proceeds will be used to finance improvements to various school buildings.

The Virginia Independent School District Number 707, Minnesota, (NR/AAA/NR) sold $136.355 million of Series 2019A GO school building bonds backed by the state’s school district credit enhancement program. BofA won the bonds with a TIC of 2.73%. Ehlers is the financial advisor; Dorsey & Whitney is the bond counsel. Proceeds will be used to pay for a new high school and elementary school.

Tuesday’s bond sales

Secondary market

Tuesday’s market looked promising, even though the municipal cash secondary market is taking a back seat to the primary market, Jason Lisec, a municipal trader at Hilltop Securities said on Tuesday morning.

He said secondary volumes have been low with dealer inventories difficult to turn over, yet overall the new issue market is strong.

“Fundamentally the market has support, however, buyers are patient,” Lisec said as the market was introduced to preliminary scales for new issues.

“We will need to see how the loans will be received, but expectations are reasonably confident,” given the recent evidence of strong investor demand, Lisec said.

A New York trader, meanwhile, described municipals as quiet and slightly stronger than on Monday as the 10-year Treasury bond fell below 2%.

Munis were mixed in late trade on the

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on both the 10-year muni and 30-year muni GO remained unchanged at 1.63% and 2.31%, respectively.

The 10-year muni-to-Treasury ratio was calculated at 81.7% while the 30-year muni-to-Treasury ratio stood at 91.7%, according to MMD.

One New York trader described munis as stuck between a rock and a hard place.

“Absolute low yields prohibitive or non-desirable for some, but strong technicals and cheaper (than mid-May) ratios make the product cheap, especially on the front end," the trader said. “Then you add on top the limited new issues this week, so there is no real price guidance (as there would typically be)."

Treasuries were stronger as stocks traded lower. The Treasury three-month was yielding 2.116%, the two-year was yielding 1.728%, the five-year was yielding 1.724%, the 10-year was yielding 1.987% and the 30-year was yielding 2.522%.

“Market participants are focusing on the primary market as today is new issue Tuesday,” ICE Data Services said in a market comment. “The overall market has a firmer tone with the ICE Muni Yield Curve down 1/2 basis point. High-yield is one basis point to two basis points lower in yield as it leads the market today. Tobaccos are flat to one basis point lower. Taxable yields are down with the five-year dropping almost four basis points.”

Previous session's activity

The MSRB reported 34,237 trades Monday on volume of $8.46 billion. The 30-day average trade summary showed on a par amount basis of $12.64 million that customers bought $6.34 million, customers sold $4.21 million and interdealer trades totaled $2.09 million.

Texas, California and New York were most traded, with the Golden State taking 14.484% of the market, the Empire State taking 12.167% and the Lone Star State taking 8.948%.

The most actively traded security was the Puerto Rico Sales Tax Financing Corp. restructured A-2 revenue 4.55s of 2040, which traded 68 times on volume of $27.80 million.

Treasury auctions $40B 2-year notes

The Treasury Department Tuesday auctioned $40 billion of two-year notes with a 1 5/8% coupon at a 1.695% yield, a price of 99.863062. The bid-to-cover ratio was 2.78.

Tenders at the high yield were allotted 25.35%. The median yield was 1.664%. The low yield was 1.570%.

Treasury to sell $40B 4-week bills

The Treasury Department said it will sell $40 billion of four-week discount bills Thursday. There are currently $35.000 billion of four-week bills outstanding.

Treasury also said it will sell $35 billion of eight-week bills Thursday.

Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.