Deals from two New York issuers were offered to retail buyers on Monday as a supply-heavy week kicked off.

Volume is estimated to come in at $10.8 billion, consisting of $7.3 billion of negotiated deals and $3.5 billion of competitive sales.

The nearly $11 billion supply bulge this week should be well received — as long as mutual fund outflows stay in check — but Monday gave little indication of the upcoming demand as the market got off to dreary start, according to a Florida trader.

“There were a few larger mutual funds with some bid-wanteds this morning, so the bid-wanted volume is higher, but the transactional volume is very light this morning,” he said. “It’s mostly cash buyers and tax loss swappers.”

Heading into this week’s heavy new issue calendar, the flurry of new paper should be well-received on the heels of last week’s skimpy slate — albeit if investors have available cash to spend, the trader noted. “The question mark becomes whether or not there is enough redemptions and bonds redeemed this month to match a continued week to week calendar of this supply.”

A continued heavy pace of volume later this month could create supply-side pressure that forces spreads to widen, he said.

“The redemption and reinvestment cash available to soak up any supply combined with mutual fund outflows could leave the market searching for discounted buyers that can only put money to work if things get cheap enough,” he said.

Others agreed the mutual fund outflows are impacting new issues.

“While the surge in the impending new-issue calendar should be dispatched with ease, any acceleration in fund outflows could put pressure on prices, aggravating any latent weakness in an already delicate market,” Stephen Winterstein, managing director of research & head of municipal strategy at Wilmington Trust, wrote in a weekly municipal market update released on Monday.

Overall, he said, the tax-exempt municipal market routinely ignores or is slow to respond to directional shifts in taxable benchmark interest rates, but there was some reaction by week’s end.

“The UST’s firmness last week did not transmit into the municipal bond market, at least not until perhaps Thursday,” he wrote. “By Friday’s close, the reversal and calming was entirely insufficient to generate positive returns on the week.”

“While the near-term strength in the UST market was a welcome break for taxable bond investors, the tax-exempt municipal market seemed to flout the good news,” he wrote. “Despite the applauded exceptions of a moderately firm tone on Thursday and an outright flat Friday, high-grade municipal bond investors still felt the sting of the erstwhile six-day rout,” he added.

Primary market

Ramirez & Co. priced the New York City Transitional Finance Authority’s $1.2 billion of Fiscal 2019 Series S3 Subseries S3A building aid revenue bonds for retail investors on Monday ahead of the institutional pricing on Wednesday.

The BARBs are rated Aa2 by Moody’s Investors Service and AA by S&P Global Ratings and Fitch Ratings.

The TFA is also competitively selling $199.57 million of taxable Fiscal 2019 Series S3, Subseries S3B BARBs on Wednesday.

Wells Fargo Securities priced the Long Island Power Authority, N.Y.’s $430 million of Series 2018 electric system general revenue bonds for retail investors ahead of the institutional pricing on Tuesday.

The deal is rated A3 by Moody’s and A-minus by S&P and Fitch.

Raymond James & Associates is set to price Connecticut’s $850 million of Series 2018B&C special tax obligation bonds for infrastructure purposes on Tuesday. The deal is rated AA by S&P and A-plus by Fitch.

And Bank of America Merrill Lynch is set to price the Essentia Health Obligated Group’s $707 million of healthcare facilities revenue bonds on Tuesday. The deal consists of $667 million from the Duluth Economic Development Authority, Minn., and $40 million from Cass County, N.D. The deal is rated A-minus by S&P and Fitch.

In the competitive sector on Tuesday, the Metropolitan Government of Nashville and Davidson County, Tenn., is selling $724.39 million of general obligation bonds. The deal is rated Aa2 by Moody’s and AA by S&P.

Illinois will sell $250 million of Build Illinois sales tax revenue bond in three sales consisting of $125 million of Junior Obligation Tax-Exempt Series B of October 2018, $115 million of Junior Obligation Tax-Exempt Series A of October 2018, and $10 million of Junior Obligation Taxable Series C of October 2018. The deals are rated AA-minus by S&P and A-minus by Fitch.

The Virginia Public School Authority is selling $110.02 million of Series 2018B school financing revenue bonds, 1997 resolution. The deal is rated Aa1 by Moody’s and AA-plus by S&P and Fitch.

And Minneapolis is selling $112.6 million in two deals consisting of $96.88 million of Series 2018 general obligation capital improvement green bonds and $15.72 million of Series 2018 GO library referendum refunding bonds. The deals are rated AA-plus by Fitch.

Monday’s bond sales

Prior week's top underwriters

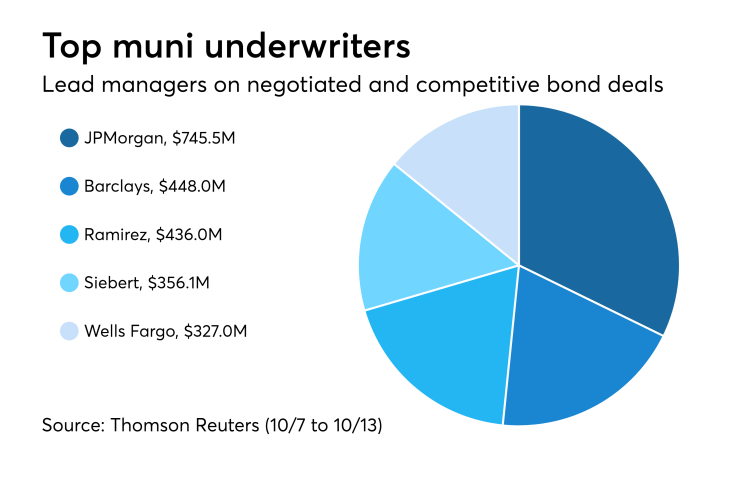

The top municipal bond underwriters of last week included JPMorgan Securities, Barclays Capital, Ramirez & Co., Siebert Cisneros & Shank, and Wells Fargo Securities, according to Thomson Reuters data.

In the week of Oct. 7 to Oct. 13, JPMorgan underwrote $745.5 million, Barclays $448.0 million, Ramirez $436.0 million, Siebert $356.1 million and Wells Fargo $327.0 million.

Bond Buyer 30-day visible supply at $12.92B

The Bond Buyer's 30-day visible supply calendar increased $955.5 million to $12.92 billion for Monday. The total is comprised of $4.46 billion of competitive sales and $8.45 billion of negotiated deals.

Secondary market

Municipal bonds were mostly stronger on Monday, according to a midday read of the MBIS benchmark scale. Benchmark muni yields fell as much as one basis point in the one- to 28-year maturities and were unchanged in the 29- and 30-year maturities.

High-grade munis were stronger, with yields calculated on MBIS' AAA scale declining as much as three basis points in the one- to 30-year maturities.

Municipals were steady on Municipal Market Data’s AAA benchmark scale, which showed the yield on both the 10-year muni general obligation and the yield on 30-year muni maturity remaining unchanged.

Treasury bonds were slightly stronger and stocks traded mixed.

On Friday, the 10-year muni-to-Treasury ratio was calculated at 87.2% while the 30-year muni-to-Treasury ratio stood at 102.7%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Prior week's top FAs

The top municipal financial advisors of last week included PFM Financial Advisors, Stifel, Public Resources Advisory Group, CSG Advisors and Montague DeRose & Associates, according to Thomson Reuters data.

In the week of Oct. 7 to Oct. 13, PFM advised on $593.5 million, Stifel $427.1 million, PRAG $300.0 million, CSG $269.4 million and Montague $215.3 million.

Previous session's activity

The Municipal Securities Rulemaking Board reported 39,151 trades on Friday on volume of $12.40 billion.

New York, California and Texas were the municipalities with the most trades, with the Empire State taking 18.815% of the market, the Golden State taking 16.932% and the Lone Star State taking 12.685%.

Prior week's actively traded issues

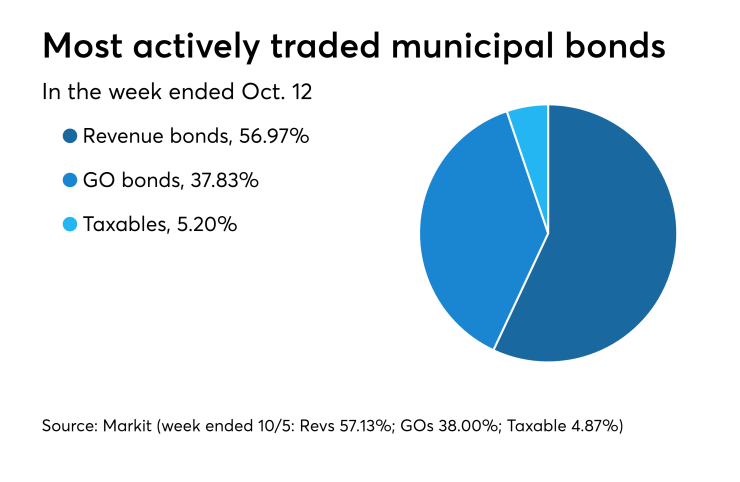

Revenue bonds comprised 56.97% of total new issuance in the week ended Oct. 12, down from 57.13% in the prior week, according to

Some of the most actively traded munis by type in the week were from New York, New Jersey and California issuers. In the GO bond sector, the New York City zeros of 2042 traded 15 times. In the revenue bond sector, the New Jersey Transportation Trust Fund Authority 4s of 2037 traded 44 times. And in the taxable bond sector, the California 7.3s of 2039 traded 11 times.

Treasury auctions discount rate bills

Tender rates for the Treasury Department's latest 91-day and 182-day discount bills were higher, as the $45 billion of three-months incurred a 2.270% high rate, up from 2. 220% the prior week, and the $39 billion of six-months incurred a 2.415% high rate, up from 2. 380% the week before.

Coupon equivalents were 2.315% and 2.479%, respectively. The price for the 91s was 99.426194 and that for the 182s was 98.779083.

The median bid on the 91s was 2.235%. The low bid was 2.190%. Tenders at the high rate were allotted 41.44%. The bid-to-cover ratio was 2.96.

The median bid for the 182s was 2.380%. The low bid was 2.275%. Tenders at the high rate were allotted 22.33%. The bid-to-cover ratio was 2.87.

Treasury to sell $40B 4-week bills

The Treasury Department said it will sell $40 billion of four-week discount bills Tuesday. There are currently $93.000 billion of four-week bills outstanding.

Treasury also said it will sell $25 billion of eight-week bills Tuesday.

Gary Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.