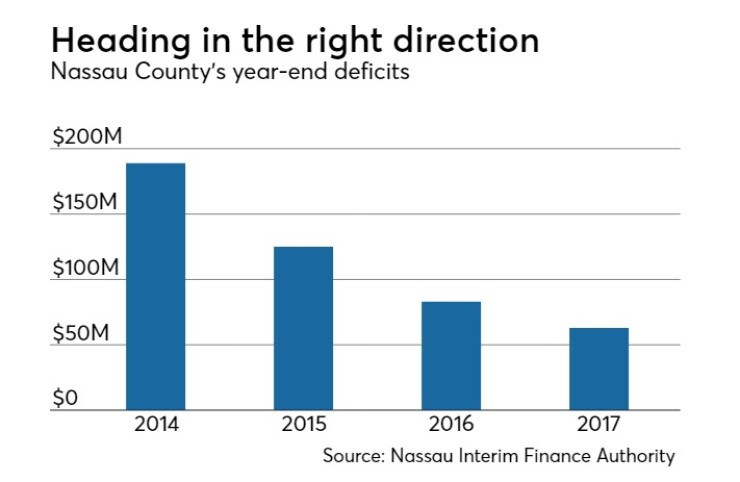

Long Island’s Nassau County is staring at its lowest budget deficit in four years, according to the large suburban government's New York State fiscal control board.

The Nassau Interim Finance Authority said in

“Since FY 2014, there has been demonstrable progress in lowering the County’s operating deficit,” NIFA stated in the 23-page report.

NIFA, which has controlled Nassau’s finances since 2011, still cautioned that the county will face an “unhealthy” outlook until it budgets more realistically to ensure the growth rate of recurring expenditures equals recurring revenues. The report notes that other large municipalities with fewer resources like Buffalo, Washington D.C. and Detroit have managed to move beyond state oversight control periods, while Nassau as one of the wealthiest counties in the nation has been unable to do the same.

Nassau County Executive Laura Curran

Among the $59.1 million of risks NIFA cited is $11.6 million of revenue the county is anticipating from fines and forfeitures, which includes $7.1 million from a boot-and-tow initiative. NIFA also said that $10 million of the county’s projected $20 million in revenue from Nassau Regional Off Track Betting Corp. for video lottery terminals at Aqueduct Racetrack in Queens is at risk because of the agency’s previously delaying owed payments. Nassau is also counting on closing $8 million of property sales on county-owned land.

"Although the County has had past success in selling property, there have been years when anticipated transactions closed later than expected (or not at all) and budgeted revenues fell short,” NIFA stated in the report. “Consequently, we consider the revenue anticipated from property sales to be at risk until specific parcels are identified, potential purchasers are located, contractual agreements are reached, and the Legislative approvals are secured.”

Nassau has bond ratings of A2 from Moody’s Investors Service, A from Fitch and A-plus from S&P Global Ratings. The large county directly east of New York City has a population of 1.36 million based on the 2016 U.S, Census Bureau Estimate.