New York next month will attempt to sell the biggest offering to date under a new tax-credit bond program to finance school construction that has gotten off to slow start.

The deal, which is expected to be considered by the Dormitory Authority of the State of New York board on Wednesday, would use $192 million of qualified school construction bonds to finance grants to school districts.

Although Congress as part of the federal economic stimulus plan authorized the allocation of $22 billion of QSCBs in 2009 and 2010, few deals have actually come to market. And in New York it's unclear if two large school districts that received separate allocations will even use the program.

For 2009, the state of New York received $192 million. New York City, Buffalo, and Rochester also received separate allocations. Those districts received allocations because they were among the top 100 largest school districts in the nation. Similar allocations are expected next year.

QSCB issuers do not pay interest - rather, the investor receives a tax credit from the federal government. In Rochester, which received its own $29.5 million allocation for 2009, the allocation is set to go unused, at least for the moment.

"We're not planning on doing any right now," said Jim Fenton, senior director of operations for the Rochester City School District. "We've been looking at it with the city and evaluating the pros and cons, and while it seems at first blush a great deal, when you start to look at the administrative costs associated with federal money it's significant, or it can be."

New York reimburses a percentage of school districts' interest costs on capital borrowing based on a formula. Rochester receives 98% of its interest costs from the state, so the savings for the district would be minimal to begin with, Fenton said. At the same time, the cost of complying with federal regulations like the Davis-Bacon act - which requires prevailing wages for federally funded public works projects - takes away the rest of the benefit of using QSCBs for Rochester, he said.

"We've gotten the regulations ... and they're more than an inch thick. It goes way beyond prevailing wage," he said. "Those administrative costs are more than the financial benefit of the local share - in other words, the 2% that's not covered by the state, in our case."

Fenton said they would look at using the program if the federal requirements were waived.

Buffalo, which was allocated $34.4 million for 2009, faces a different set of hurdles in using QSCBs, including the possibility of bumping up against the city's debt limit.

"We wouldn't be able to issue those bonds through the city due to their debt limits, so we would have to find another way to sell them," said Barb Smith, chief financial officer of the Buffalo School District. One possibility would be to sell them through the Erie County Industrial Development Agency, but Smith said that would probably require special legislation at the state level.

The school district is currently working on an approximately $300 million bond issue through the ECIDA to finance capital construction. That deal, the fourth in a planned series of five backed by an intercept of state aid, is expected to price in November.

The attention being paid to that deal has put possible QSCBs issues on the back burner.

"We're kind of just in the initial phases of looking at what we would want to use the [QSCB] money for as far as project-wise and whether it does make sense," she said. "Knowing that there's not a huge market out there for these bonds to begin with, we're not in a huge rush, either."

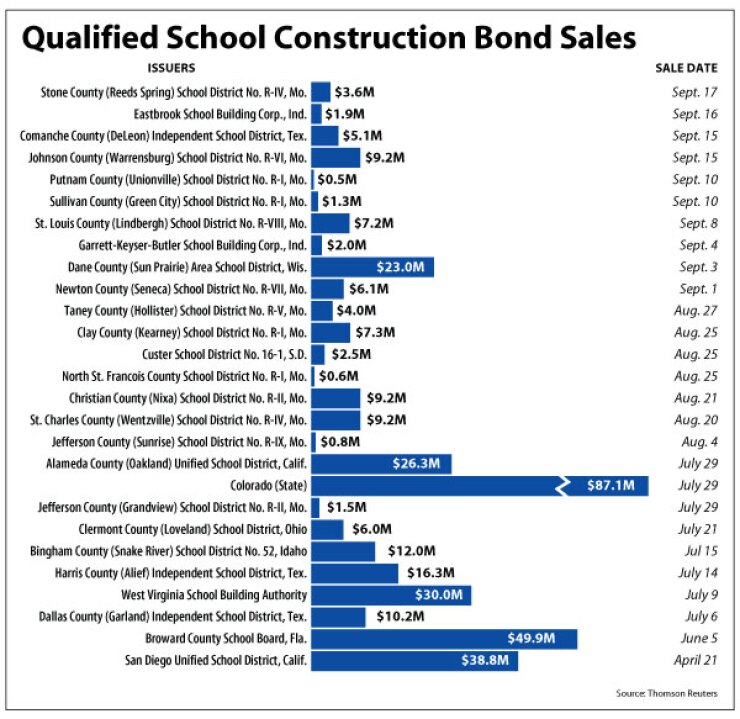

Unlike the Build America Bond program, which was also created by the American Recovery and Reinvestment Act, QSCBs have had trouble finding a market. Only 27 issues totaling $371.5 million have priced, according to Thomson Reuters. The deals have been scattered across the country and many of them have been bond deals of less than $10 million, with a large proportion sold in Missouri.

Larry Hart, president of L.J. Hart & Co., which has underwritten five of the 13 deals in Missouri, said that finding investors has been a challenge.

"It's good for the schools that are able to get their bonds sold," he said. "It's a source of some frustration for those that haven't been able to yet."

The amount of the tax credit is treated as interest for federal tax purposes to be included in an investor's gross income, and that diminishes its value.

"The real hangup is that tax credit having to be added to your personal income tax or corporate income tax before you can subtract it," Hart said. "If that step by itself wasn't in there, these bonds would fly off the shelves."

The upshot is that a bondholder's benefit is only about two-thirds of the tax credit, which is comparable to what an investor can get with traditional tax-exempt bonds, according to Hart.

"There's not a lot of difference in your net benefit," he said. "All the individuals who buy bonds are smart enough do those calculations, and banks, too."

Though he has seen a few individual buyers, Hart said local banks have stepped in to buy QSCBs in order to support the school districts as well as some national investors, primarily the Chicago-based investment management firm Guggenheim Partners LLC.

Guggenheim says it has purchased $272 million of QSCBs nationally, making it the biggest investor in the securities. The company generally buys out an entire offering.

Scott Minerd, chief investment officer at Guggenheim, said the QSCBs offer attractive yields for clients with a tax liability who might otherwise buy taxable corporate bonds.

"Some of deals are coming as cheap as single-B corporates are, and we obviously know the credit-worthiness of these school districts and these states are much higher quality than single-B corporates," Minerd said.

New York City was allocated $699.9 million in 2009 and has announced plans to get in the market. Guggenheim is interested in the city deal and has spoken to issuer officials, Minerd said. However, the city is waiting for the Treasury Department to provide guidance on how the tax credits can be stripped from the bonds' principal payments and issuer officials declined to comment further.

"Stripping for us is a big priority," Minerd said. "The deals that are coming at this stage of the game are cheap enough, yield enough, so that if we never get favorable stripping regs that these are still good investments for our clients."

Issuers also are waiting for guidance from the Treasury on carry-over. The legislation that created QSCBs allows the allocations to be carried over to future years, but it is unclear how that works. The Treasury's press office did not respond to repeated requests for comment.

Guggenheim has been in talks with New York about DASNY's QSCB offering, Minerd said.

"We anticipate that we will participate," he said. "We are going to be very supportive."

New York State plans to use the proceeds of its QSCB allocation to fund an existing school construction grant program, called Expanding Our Children's Education and Learning, or EXCEL. The bonds will be sold on the state's personal income tax credit. Standard & Poor's assigns its AAA rating to the PIT credit.

DASNY had originally expected to consider the deal at its July board meeting but it was postponed to this month at the request of the state Division of Budget so the state could perform "additional due diligence," according to budget spokesman Matthew Anderson, who did not elaborate.

Goldman, Sachs & Co. will lead manage the sale and Harris Beach PLLC is bond counsel.