New Jersey Gov. Chris Christie Tuesday signed into law a $29.38 billion spending plan that includes debt restructuring to move costs into future years and skips a $3 billion contribution to the state pension plan.

The budget mirrors the spending plan the Republican Christie proposed earlier in the year. Approval comes as the Democratic-controlled Legislature Thursday begins a special session with little hope that it will pass Christie’s measure to constitutionally limit property-tax increases to 2.5%.

The Legislature passed the fiscal 2011 budget in a midnight session late Monday night, with Republicans voting in favor of the spending plan and a handful of Democrats also approving the measure, which enabled it to pass. Legislative leaders last week told the governor they would supply the needed votes from Democratic members in return for certain spending restorations in the budget. Fiscal 2011 begins Thursday.

The governor asked the Legislature to begin a special session on Thursday morning to take up Cap 2.5, his proposal to hold property tax increases at 2.5% annually. New Jersey has some of the highest property taxes in the nation, due in part to its numerous local governments. The current cap is 4%.

Christie’s plan involves amending the state’s constitution, a move that requires voter approval. To make it to November’s ballot, the Legislature would need to approve Cap 2.5 by July 7.

The chances of the governor meeting that deadline are slim. Derek Roseman, spokesman for Senate President Stephen Sweeney, D-Salem, said there are no plans for the Legislature to address Christie’s Cap 2.5 bill during the special session. In addition, the Democrats have their own property-tax legislation.

Both chambers Monday evening passed a bill that would limit property tax increases to 2.9% per year. That measure includes more exemptions than Christie’s initiative and as it would not amend the constitution does not require voter approval.

After signing his first budget, the governor spoke with the press and stressed that New Jersey homeowners need the Legislature to act now to tackle the state’s high property taxes.

“If they decide to come down to Trenton to just sit around, that’s fine, but I’m not going to let up until we get some action,” Christie said during the press conference. “And I think I’m going to be the least of their problems. If the people of state of New Jersey see them down there sitting around and just holding their breath and just refusing to act, I don’t think that’s going to play very well.”

He also described the higher 2.9% initiative as “a Swiss cheese piece of legislation” because the plan has several exemptions for local governments in order to get around the property tax ceiling.

Conversely, Sweeney has said that the governor’s 2.5% limit does not take into account the cost of emergency situations such as blizzards and flooding and that a 2.9% cap better matches inflation rates.

“A rush to chisel a hard cap into the constitution would inevitably lead to a situation where a town has to close its police department because the price of gas spiked,” Sweeney said in a statement.

Both proposals would allow local governments to increase property taxes beyond a set ceiling in order to meet debt service costs.

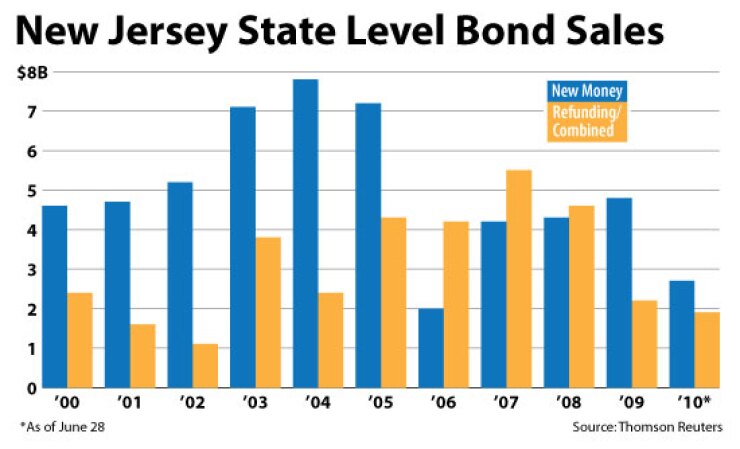

The fiscal 2011 budget includes restructuring to help lower the state’s debt service costs by $410 million by moving those obligations to future years. Officials are working on a general obligation refinancing set to price in the third quarter of 2010 with Morgan Stanley as book-runner.

Christie said the fiscal 2011 budget includes anticipated enhanced Federal Medical Assistance Percentages funding. The state expects to receive $490.5 million of FMAP funds. Congress has yet to approve extending the FMAP support to states.

The $29.38 billion fiscal 2011 budget cuts state aid to local governments and school districts by $445.9 million and $819.5 million, respectively. It skips a $3 billion pension payment for future retirement costs and eliminates $848.2 million of property taxes rebates in 2010. The administration has said that such measures were necessary in order to fill a nearly $11 billion budget deficit.

Democrats criticized the governor for vetoing last month a tax on individuals earning $1 million or more. The additional revenue would have restored property tax rebates to senior citizens.

Flanked by GOP legislative minority leaders, Christie yesterday said the budget includes a lot of difficult choices and a lot of pain, but represents the reality of the economic climate. He believes New Jerseyans are looking for the state and local governments to work with fewer taxpayer dollars.

“I feel this kind of success gives us the momentum to go even further, faster, and harder, and tougher to work for the people of the state to improve their lives in this very simple way — to get government the hell out of your way and the hell out of your pocket,” Christie said.