New-issuance volume last month came in at a pace lower than in any May since 2000.

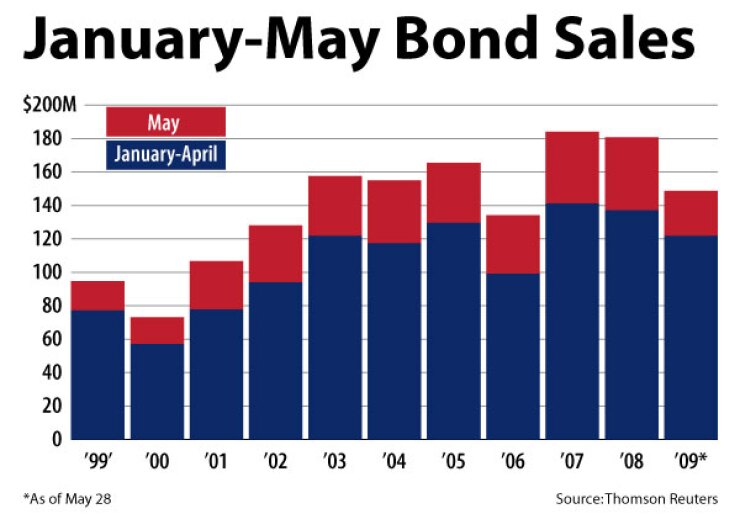

A total of 838 new issues came to market in May, with a par value of $27.02 billion. Volume was down 38.2% from the $43.75 billion issued in May 2008, when issues came to the market at a near-record pace as refundings took place to get out of auction-rate securities, according to preliminary data from Thomson Reuters.New issuance year-to-date totals 4,195 issues, with par value of $148.7 billion, down 17.7% from last year. Issuance was ahead of last year's pace for the first two months of 2009 but has fallen behind since March, when issuers last year rushed to refinance auction-rate debt.

"We've kind of reached a middle phase in market recovery," Banc of America Securities-Merrill Lynch fixed-income strategist Philip Fischer said. "The patient is up and jogging, but it's got some bruises."

The short supply of credit facilities, for instance, continues to keep issuers from gaining access to a market seeing record-low short-term rates. The SIFMA swap index fell to 0.42% on May 20, an all-time low.

Issuance of variable-rate paper with a short put is down 77% for the year to $12.7 billion. The use of letters of credit has fallen 67% to $9.6 billion, and standby bond purchase agreements are down 94.8% to $940.9 million.

Though last year's numbers were inflated by the switch from auction-rate to variable-rate debt, variable-rate issuance is still trailing the pace of previous years.

"We're still credit-impaired," Fischer said. "We have limited supply and relatively high prices [for credit facilities]. And you see that plays into VRDO issuance, which is down about $15 billion [compared to last May], so the short end of the curve has seen a significant decrease in the supply of paper."

Spreads have tightened on lower-rated credits but are still wider than historical norms. The spread between triple-A rated, 30-year general obligation bonds and single-A rated, 30-year GOs stood at 81 basis points Thursday, better than the 107 basis points to begin the year but wider than the 48 basis point spread a year earlier, according to Municipal Market Data.

Sectors such as housing, down 64.9% this year, and health care, down 40.4%, continue to lag.

"You've had health care and housing drop dramatically 2008 to 2009," said Scott Balice Strategies president Lois Scott. "I think that's because we've seen at the same time a significant widening of the credit spreads. ... Health care and housing credits are two which investors consider more complicated to review - not always lower credit quality but more difficult to review and get through credit committee. And the big drop-off in the market were those with more complicated credit structures."

The stimulus package is having an impact on issuance. Bank-qualified issuance was up 38% in May and 78.5% for the year, consistent with an increase in the smaller-issuer limit, to $30 million, and changes in the de minimis rule.

Taxable issuance was up 55.8% in May, to $3.2 billion, thanks to Build America Bonds. A total of 31 taxable BABs issues came to market in May, with a par value of $2.4 billion.

The market is still adapting to the inclusion of BABs. Though many of the earliest BAB issues came with corporate-like structures, such as bullet maturities and make-whole calls, issuers have since had more flexibility within deals.

Using its existing taxable investor base, for instance, BMO Capital Markets has had success selling BABs with tax-exempt features such as serial maturities and the standard 10-year call. It believes it could comfortably complete these deals for offerings up to at least $500 million.

Though some deals have focused on the savings BABs provide on the long end, BMO says its issues have found savings throughout the curve. A $54 million Southern Illinois University issue that BMO senior-managed in May had savings versus tax-exempt debt ranging from 31 basis points in 2011 to 125 basis points in 2030 for an all-in, present-value savings of 1.00%.

BMO said the BAB deals can work for both big and small issuers. Larger, middle-grade credits will see the biggest savings, bankers said.

"I would say there isn't an issuer that we've shown this to who hasn't seriously considered this as an option," said BMO managing director Jamie Rachlin.

The differences between the structuring of the market's largest BAB deals in April and some that came in May have essentially created two BAB markets, said Steve Heaney, a managing director and the head of public finance at Stone & Youngberg LLC.

"I think there are a couple different parts of the market that are forming," he said, "one being the corporate-style and the other being the more accepting of the tax-exempt style for the smaller issuers."