The municipal bond market saw the largest Garvee bond deal of the year comeon Thursday as North Carolina issued a $600 million offering. The street will not have much to offer on Friday in a half-day trading session ahead of the long holiday weekend.

Primary market

BofA Securities priced North Carolina’s (A2/AA/A+) $600 million of grant anticipation revenue vehicle bonds. The deal was priced as 5s to yield from 1.47% in 2020 to 2.34% in 2034.

In August 2017, BofA priced the state’s $224.64 million Garvee refunding deal, which was priced as 4s to yield 0.79% in 2018 and as 5s to yield from 0.95% to 1.49% in 2023. On Aug. 2, 2017, the yield on the 10-year muni GO stood at 1.94% while the yield on the 30-year muni was 2.74%, according to Refinitiv Municipal Market Data’s AAA benchmark scale.

In secondary trading, the Series 2017 5s of 2021, originally priced at 113.062 to yield 1.22% were trading Thursday at high price of 106.123, a low yield of 1.48% in four trades totaling $5.15 million, according to the MSRB’s EMMA website. The Series 2017 5s of 2023, originally priced at 118.602 to yield 1.49%, were trading Thursday at high price of 112.464, a low yield of 1.58% in three trades totaling $160,000, according to EMMA.

In early April,

Also on Thursday, JPMorgan Securities received the official award on Austin, Texas’ (Aa3/AA/AA) $464.54 million of taxable Series 2019A electric utility system revenue bonds.

Goldman Sachs got the written award on PEFA Inc.’s (A3/NR/A) $614.41 million of Series 2019 gas project revenue bonds.

Wednesday’s bond sales

Skittish on the sidelines

Rising municipal prices impacted the market on Thursday as many participants sought temporary shelter on the sidelines ahead of the upcoming holiday, which made for an “ugly scenario,” according to a New York trader.

"Rate shock is getting pretty gruesome,” he said, noting that municipals are underperforming Treasuries for the first week all year.

“Retail has left the building, and clearly not everyone is participating,” he said Thursday afternoon before the market closed. Meanwhile, another New York trader said the strong Treasury market was contributing to a solid municipal market with little trading on Thursday afternoon.

“We are expecting a bump to MMD of 2 basis points in the 10-year part of the curve and as much as three basis points in the long end,” he said, pointing to next week’s light holiday week calendar “further supporting munis."

Though new deals were oversubscribed, the first trader said there was an absent feeling from investors on Thursday that was building earlier in the week.

“They are not in with two feet today, and I have sensed a little resistance all week,” he said of retail investors. He said higher muni prices and percentages of municipals to Treasuries gave investors pause — as there was less incentive to jump into the market toward week’s end.

Muni percentages, he said, would likely end the day at between 88% and 90% of 30-year Treasuries, up from 84% last week. With 30-year munis hovering around 2.42%, he said the level of “raw” yields was making it tough for many investors to get involved.

“You’re getting to a point where the market is less enticing than it was just on raw yields,” the trader said. “Percentages are backing up, and the secondary feels a little anemic.”

The scenario preceded the upcoming holiday-shortened week when supply will remain on the lighter side, and investors will remain skittish.

“I think people are hoping that Treasuries pull back a little bit; the strong move today caught people off guard, so now they are rethinking jumping in at conservative prices,” the trader said.

“Real money from retail can be a lot more patient than the arbs, so they are going to wait,” he said.

In addition to many investors sitting on the sidelines, several cross currents were adding to what the first trader called “buyers’ strike.”

“With Friday being a half day and the long holiday weekend, as well as the geopolitical issues heating up, people are just taking the position that they’re going to sit on the sidelines” as yields remain lower, he said.

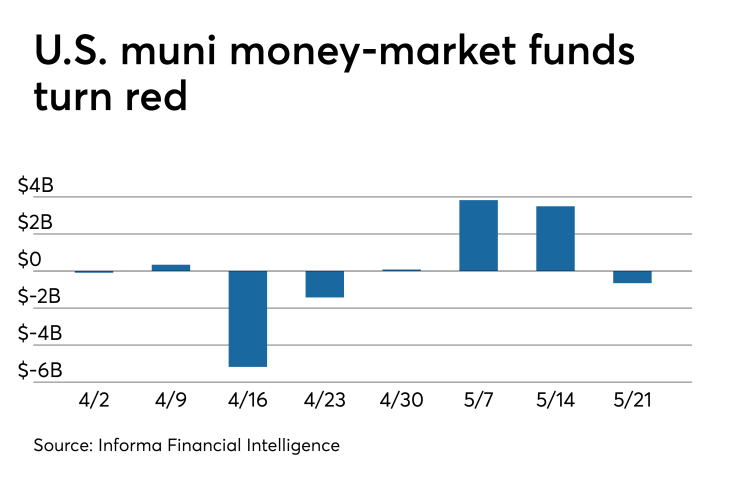

Muni money market funds fall

Tax-exempt municipal money market fund assets declined by $657.2 million, with total net assets falling to $139.27 billion in the week ended May 20, according to the Money Fund Report, a publication of Informa Financial Intelligence.

This marked the first time in four weeks — and five out of the previous eight weeks — that flows were negative.

The average seven-day simple yield for the 190 tax-free and municipal money-market funds lowered to 0.99% from 1.23% the prior week.

Taxable money-fund assets surged by $41.32 billion in the week ended May 21, bringing total net assets to $2.953 trillion. The average, seven-day simple yield for the 808 taxable reporting funds was unchanged from 2.04% last week.

Overall, the combined total net assets of the 998 reporting money funds rose $40.67 billion to $3.092 trillion in the week ended May 21.

Secondary market

Munis were stronger on the

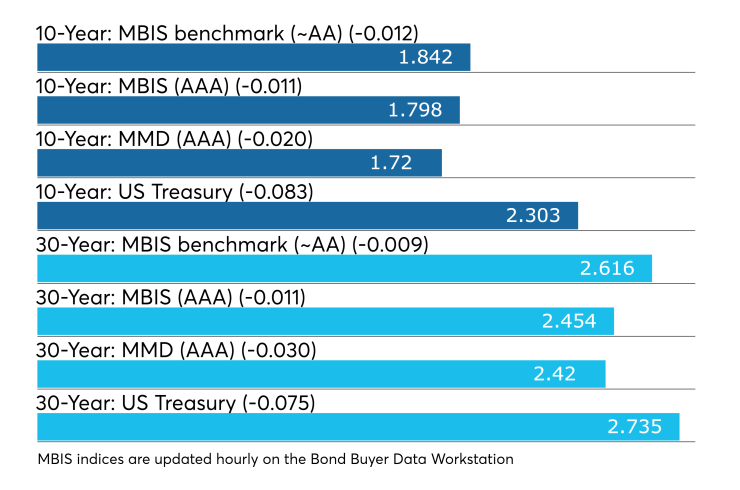

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on the 10-year muni GO fell two basis point to 1.72% while the yield on the 30-year muni dropped three basis point to 2.42%.

The 10-year muni-to-Treasury ratio was calculated at 74.8% while the 30-year muni-to-Treasury ratio stood at 88.6%, according to MMD.

Treasuries were sharply stronger as stock prices traded lower.

"The muni market is underperforming Treasuries today with the ICE Muni Yield Curve down one to two basis points," ICE Data Services said in a market comment. "Volumes were light in the morning and have started to pick up as the day progressed. High-yield is moving in tandem down two basis points ... taxables are down seven basis points in the five-year as the market is tracking treasuries more closely than non-taxable."

Previous session's activity

The MSRB reported 40,704 trades on Wednesday on volume of $14.05 billion. The 30-day average trade summary showed on a par amount basis of $12.70 million that customers bought $6.14 million, customers sold $4.36 million and interdealer trades totaled $2.20 million.

California, Texas and New York were most traded, with the Golden State taking 16.291% of the market, the Empire State taking 10.727% and the Lone Star State taking 10.175%.

The most actively traded security was the Arkansas Development Finance Authority Series 2019 revenue 4.5s of 2049, which traded 13 times on volume of $49.50 million.

Treasury announces sales

The Treasury Department announced these auctions:

- $32 billion seven-year notes selling on May 29;

- $41 billion five-year notes selling on May 28;

- $40 billion two-year notes selling on May 28;

- $18 billion 1-year 11-month 0.139% floating rate notes selling on May 29;

- $36 billion 183-day bills selling on May 28; and

- $36 billion 91-day bills selling on May 28.

Treasury auctions bills

The Treasury Department Thursday auctioned $45 billion of four-week bills at a 2.335% high yield, a price of 99.818389. The coupon equivalent was 2.378%. The bid-to-cover ratio was 2.53. Tenders at the high rate were allotted 98.88%. The median rate was 2.305%. The low rate was 2.250%.

Treasury also auctioned $35 billion of eight-week bills at a 2.330% high yield, a price of 99.637556. The coupon equivalent was 2.377%. The bid-to-cover ratio was 2.53. Tenders at the high rate were allotted 95.30%. The median rate was 2.300%. The low rate was 2.270%.

Treasury also sold $11 billion of inflation-indexed 9-year 8-month TIPs at a 0.567% high yield, an adjusted price of 103.554563, with a 7/8% coupon. The bid-to-cover ratio was 3.07. Tenders at the market-clearing yield were allotted 55.24%. Among competitive tenders, the median yield was 0.522% and the low yield 0.188%, Treasury said.

Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.