Municipals remained weaker on Wednesday as the market saw several new issues sell in the primary, led by deals from North and South Carolina.

Primary market

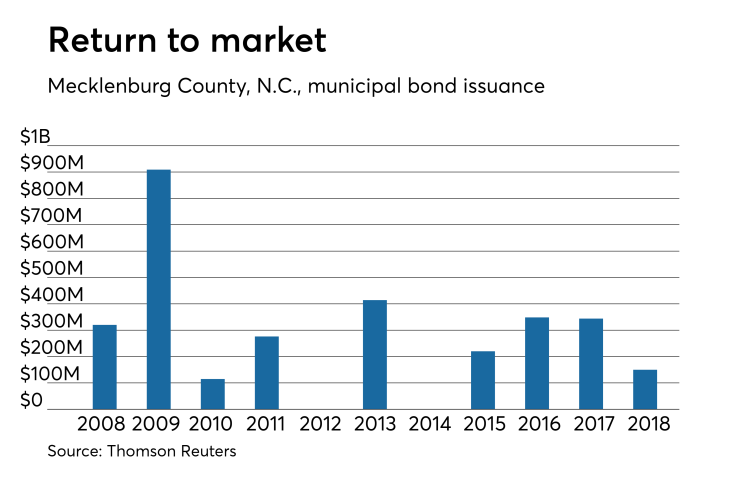

In the competitive arena, Mecklenburg County, N.C., sold $150 million of Series 2018 general obligation public improvement bonds.

Morgan Stanley won the bonds with a true interest cost of 3.0978%.

The financial advisor is Hilltop Securities; the bond counsel is Robinson Bradshaw. The deal is rated triple-A by Moody’s Investors Service, S&P Global Ratings and Fitch Ratings.

Since 2008, the county has sold about $3 billion of debt, with the most issuance occurring in 2009 when it offered $909.1 million. It did not come to market in 2012 or 2014.

The Greenville County School District, S.C., sold $105.675 million of Series 2018C general obligation bonds due June 1, 2019.

Bank of America Merrill Lynch won the bonds with a TIC of 1.868%.

The financial advisor is Compass Municipal Advisors; the bond counsel is Pope Flynn.

The deal is rated Aa1 by Moody’s and A1-plus by S&P.

The Santa Clara County Financing Authority, Calif., sold $163.3 million of Series 2018A county facilities lease revenue bonds.

Morgan Stanley won the bonds with a TIC of 3.0978%. Proceeds will be used to reimburse the county for costs related to the acquisition of the Champion Point project. The financial advisor is KNN Public Finance; the bond counsel is Orrick Herrington.

The deal is rated AA-plus by S&P and AA by Fitch.

In the negotiated sector, Bank of America Merrill Lynch priced Ohio’s $117.925 million of Series 2018C and Series 2018D serial bond interest rate hospital revenue bonds.

The deal is rated A2 by Moody’s and A by S&P.

JPMorgan Securities received the written award in the Ohio Housing Finance Agency’s $140 million of Series 2018A residential mortgage revenue bonds not subject to the alternative minimum tax under the mortgage-backed securities program and the $3.332 million of Series 2018B taxables.

The deal is rated Aaa by Moody’s.

RBC Capital Markets is expected to price the Poudre School District R-1 of Larimer County, Colo.’s $375 million of Series 2018 GOs on Wednesday. The deal is rated Aa2 by Moody’s Investors Service.

JPMorgan is set to price Indianapolis’ $358 million of Series 2018A water system first lien refunding revenue bonds on Wednesday. The deal is rated Aa3 by Moody’s, AA by S&P and A-plus by Fitch.

JPMorgan is also expected to price the Sarasota County Public Hospital District, Fla.’s $350 million of Series 2018 fixed-rate hospital revenue bonds for the Sarasota Memorial Hospital on Wednesday. The deal is rated A1 by Moody’s and AA-minus by Fitch.

On Thursday, RBC is set to price the Las Vegas Convention and Visitors Authority’s $500 million Series 2018B convention center expansion revenue bonds.

Bond proceeds from will partly fund the authority's $860 million Phase Two expansion project. JNA Consulting Group and Montague DeRose are co-financial advisors while Stradling is bond counsel. The deal is rated Aa3 by Moody’s and A-plus by S&P.

Wednesday’s bond sales

North Carolina

South Carolina

Ohio

Bond Buyer 30-day visible supply at $9.69B

The Bond Buyer's 30-day visible supply calendar decreased $1.55 billion to $9.69 billion for Wednesday. The total is comprised of $2.87 billion of competitive sales and $6.82 billion of negotiated deals.

Secondary market

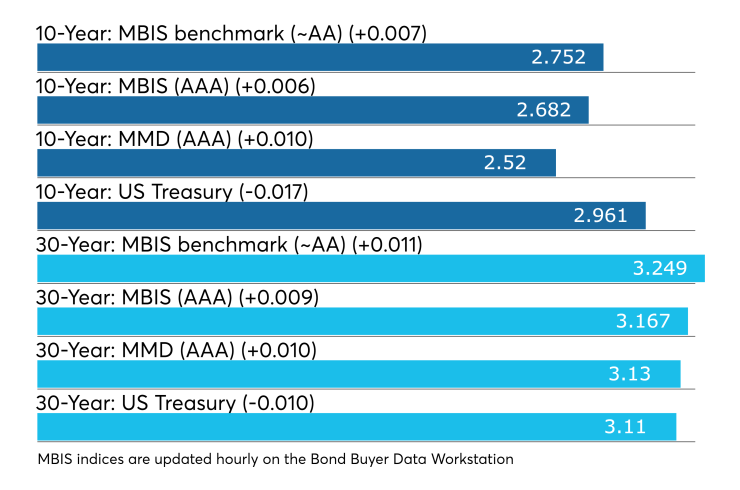

Municipal bonds were mostly weaker on Wednesday, according to a midday read of the MBIS benchmark scale. Benchmark muni yields rose as much as one basis point in the one- to 30-year maturities, with the exception of the five- and six-year maturities where yields fell less than a basis point.

High-grade munis were mostly weaker, with yields calculated on MBIS' AAA scale rising as much as one basis point in the one- to 30-year maturities except in the six- and seven-year maturities where yields fell less than a basis point.

Municipals were weaker on Municipal Market Data’s AAA benchmark scale, which showed the yield on both the 10-year muni general obligation and the yield on 30-year muni maturity rising as much as one basis point.

Treasury bonds were stronger as stock prices traded mixed.

On Tuesday, the 10-year muni-to-Treasury ratio was calculated at 84.6% while the 30-year muni-to-Treasury ratio stood at 100.2%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Previous session's activity

The Municipal Securities Rulemaking Board reported 40,516 trades on Tuesday on volume of $9.82 billion.

California, Texas and New York were the municipalities with the most trades, with Golden State taking 14.352% of the market, the Lone Star State taking 13.435% and the Empire State taking 11.478%.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.