Top-rated municipal bonds were weaker at mid-session, according to traders, as two large deals from New York issuers came to market.

Primary market

Morgan Stanley priced the Dormitory Authority of the State of New York’s $1.74 billion of Series 2017A general purpose state personal income tax revenue bonds for institutional investors after holding a one-day retail order period.

The deal was priced for institutions to yield from 0.99% with a 2% coupon in 2019 to approximately 3.345% with a 3.25% coupon in 2040. The 2018 maturity was offered as a sealed bid.

On Tuesday, the issue was priced for retail to yield from 0.97% with a 2% coupon in 2019 to approximately 3.345% with a 3.25% coupon in 2040. The deal is rated Aa1 by Moody’s Investors Service and AAA by S&P Global Ratings.

Citigroup priced the New York Metropolitan Transportation Authority’s $744.95 million of climate bond certified Series 2017B transportation revenue green bonds for retail investors ahead of the institutional pricing on Thursday.

The $444.95 million of Subseries 2017B-1 bonds were priced for retail to yield from 0.97% with a 3% coupon in 2018 to 3.03% with a 5% coupon in 2038. A 2042 maturity was priced as 4s to yield 3.44% and a 2047 maturity was priced as 5s to yield 3.15%. The 2052 and 2057 maturities were not offered to retail.

The $300 million of Subseries 2017B-2 bonds were priced to yield from 1.58% with 3% and 5% coupons in a split 2022 maturity to 2.44% with a 5% coupon in 2028. The deal is rated A1 by Moody’s, AA-minus by S&P and Fitch Ratings and AA-plus by Kroll Bond Rating Agency.

The deal was upsized from an expected $500 million. Last week, the MTA competitively sold $500 million of transportation revenue bond anticipation notes in a sale that was downsized from the $700 million originally planned.

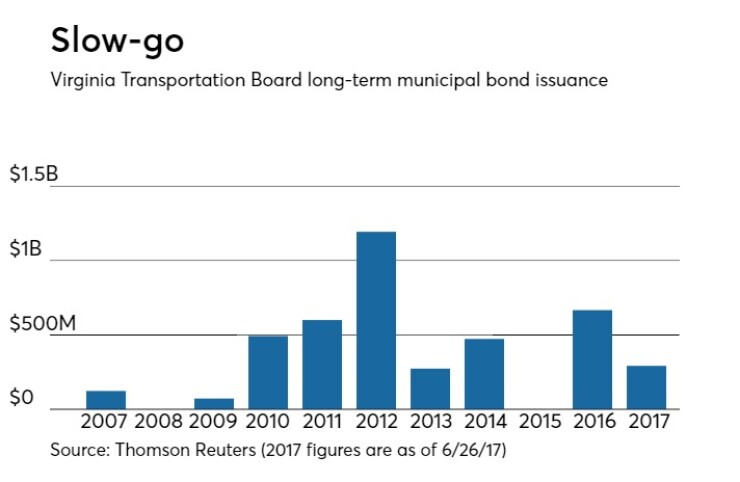

In the competitive arena on Wednesday, the Virginia Transportation Board sold $255.41 million of Series 2017 transportation capital projects revenue bonds.

Bank of America Merrill Lynch won the deal with a true interest cost of 3.16%. The issue was priced to yield from 0.91% with a 5% coupon in 2018 to 3.18% with a 4% coupon in 2038; a 2042 maturity was priced as 4s to yield 3.26%. The deal is rated Aa1 by Moody’s and AA-plus by S&P and Fitch.

Since 2007 the board has sold about $4.19 billion of securities, with the highest issuance in 2012 when it sold roughly $1.19 billion. It did not come to market in 2008 or 2015.

Goldman Sachs is set to price the Los Angeles Department of Water & Power’s Series 2017C power system revenue bonds for retail investors ahead of the institutional pricing on Thursday. The deal is rated Aa2 by Moody’s and AA-minus by S&P and Fitch.

Raymond James is expected to price the Comal Independent School District, Texas’ $263.5 million of unlimited tax school building bonds. The deal, backed by the Permanent School Fund guarantee program, is rated triple-A by Moody’s and Fitch.

Secondary market

The yield on the 10-year benchmark muni general obligation rose two to four basis points from 1.88% on Tuesday, while the 30-year GO yield increased two to four basis points from 2.70%, according to a read of Municipal Market Data's triple-A scale.

Treasuries were mostly weaker on Wednesday around midday. The yield on the two-year Treasury fell to 1.35% from 1.37% on Tuesday, the 10-year Treasury yield rose to 2.22% from 2.20% and the yield on the 30-year Treasury bond increased to 2.77% from 2.74%.

The 10-year muni to Treasury ratio was calculated at 85.6% on Tuesday, compared with 86.7% on Monday, while the 30-year muni to Treasury ratio stood at 98.5% versus 99.1%, according to MMD.

Bond Buyer reports 30-day visible supply

The Bond Buyer's 30-day visible supply calendar decreased $1.3 billion to $7.24 billion on Wednesday. The total is comprised of $1.44 billion of competitive sales and $5.80 billion of negotiated deals.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 44,053 trades on Tuesday on volume of $9.10 billion.