Even as stocks turned around and moved higher on Wednesday, municipal bonds remained stronger before the Thanksgiving holiday.

Ipreo forecasts weekly bond volume will jump to $6 billion from a revised total of $863.8 million in the prior week, according to updated data from Thomson Reuters. The calendar is composed of $4.9 billion of negotiated deals and $1.1 billion of competitive sales.

With the market eager to head home early for the upcoming Thanksgiving holiday, traders expected a quiet end to lackluster trading activity.

“It’s extremely quiet today,” a New York trader said Wednesday morning. “Munis have performed well all week following the lead of a strong Treasury market.”

He said sizable bid lists continue to flood the secondary market and there are expectations for a heavy new issue calendar over the next three weeks.

Primary market

Topping the calendar are $1.2 billion of general obligation bonds coming out of New York City.

Bank of America Merrill Lynch is set to price the city’s $856 million of tax-exempt fixed-rate bonds, consisting of Fiscal 2019 Series D Subseries D-1 and Fiscal 2008 Series J Subseries J-1 and J-11 as a reoffering.

The deal is expected to have a two day retail order period starting on Tuesday and be priced for institutions on Thursday, Nov. 29.

Joint lead manager is Blaylock Van; Citigroup, Goldman Sachs, JPMorgan Securities, Jefferies, Loop Capital Markets, Ramirez & Co., RBC Capital Markets and Siebert Cisneros Shank & Co. serving as co-senior managers.

Also on Thursday, the city is competitively selling $350 million of taxable fixed-rate GOs in two sales consisting of $223.79 million of Fiscal 2019 Series D Subseries D-2 GOs and $126.21 million of Fiscal 2019 Series D Subseries D-3 GOs.

Proceeds will be used for capital projects, with the exception of some of the tax-exempt fixed-rate bond proceeds, which will be used to convert $175 million of outstanding floating-rate bonds into fixed-rates, the city said.

The deals are rated Aa2 by Moody’s Investors Service and AA by S&P Global Ratings and Fitch Ratings.

Also on tap, the Chicago Board of Education will be coming to market with a $763 million deal.

JPMorgan Securities is expected to price the dedicated revenues Series 2018C unlimited tax GO refunding bonds and Series 2018D unlimited tax GOs on Wednesday.

The deal is rated B-plus by S&P, BB-minus by Fitch and BBB by Kroll Bond Rating Agency.

Bond Buyer 30-day visible supply at $8.07B

The Bond Buyer's 30-day visible supply calendar increased $3.8 billion to $8.07 billion for Wednesday. The total is comprised of $1.90 billion of competitive sales and $6.17 billion of negotiated deals.

Looking at Treasury yields

Treasury yields have declined sharply on concerns over slowing economic momentum, falling oil prices and Brexit uncertainty, according to Bill Merz, a director of fixed-income at U.S. Bank Wealth Management in Minneapolis.

“Market expectations for [Federal Reserve] rate hikes dropped, with investors challenging the idea that the economy can sustain numerous additional rate hikes,” Merz wrote in a weekly market comment released on Wednesday. “Even if the Fed trims its outlook for 2019 rate increases, markets still likely underappreciate the extent of tightening. We believe U.S. Treasury yields will migrate higher on Fed hikes, increasing Treasury issuance, declining central bank purchases and unattractive U.S. yields for foreign investors once currency risks are hedged.”

He said expected Fed rate hikes suggest an upside to Treasury yields going forward.

“The futures market prices in more than a 90% likelihood of a December hike. We expect a 0.25% increase to the Fed’s target funds range, but only a 0.20% increase to interest on excess reserves. The futures market prices in an additional 1.45 hikes (+0.37%) in 2019 compared to the Fed’s median estimate of three hikes (+0.75%),” he said.

Merz said that market expectations on rate hikes in 2019 dropped after Fed Chairman Jerome Powell emphasized the Fed’s data dependence and acknowledged slowing global growth. He also cited Fed Vice Chairman Richard Clarida’s cautious comments on the economy.

“Economic conditions suggest rate hikes are likely to continue for the time being,” he said. “However, it appears increasingly likely the Fed’s median estimates for 2019 and later rate hikes will come down slightly.”

Secondary market

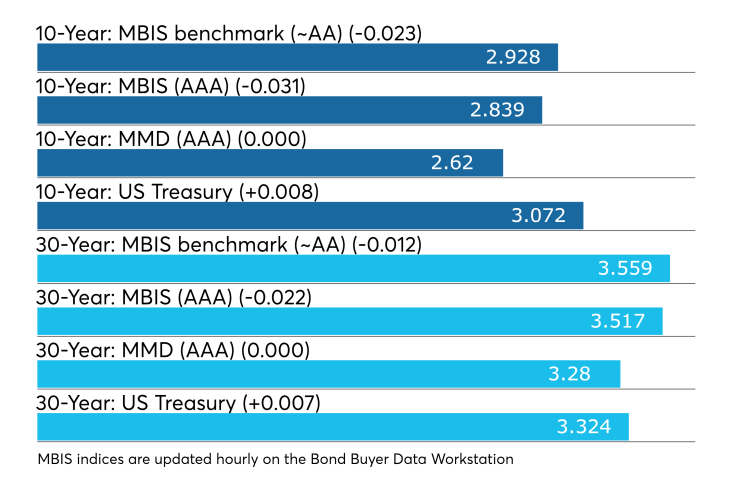

Municipal bonds were mostly stronger on Wednesday, according to a mid-session read of the MBIS benchmark scale. Benchmark muni yields dipped as much as two basis points in the three- to 30-year maturities, rose less than a basis point in the one-year maturity and were unchanged in the two-year maturity.

High-grade munis were stronger, with yields calculated on MBIS' AAA scale decreasing as much as three basis points across most of the curve.

Municipals were steady on Municipal Market Data’s AAA benchmark scale, which showed the yield on both the 10-year muni general obligation and the yield on 30-year muni maturity remaining unchanged.

Treasury bonds were weaker as stocks traded up. The Treasury 10-year stood at 3.072% while the Treasury three-month bill was at 2.404%.

The Dow Jones Industrial Average was up 0.5% while the Nasdaq Composite Index rose 1.1% and the S&P 500 Index gained 0.6%.

On Tuesday, the 10-year muni-to-Treasury ratio was calculated at 85.9% while the 30-year muni-to-Treasury ratio stood at 99.2%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Previous session's activity

The Municipal Securities Rulemaking Board reported 46,605 trades on Tuesday on volume of $13.32 billion.

California, New York and Texas were the municipalities with the most trades, with the Golden State taking 14.379% of the market, the Empire State taking 13.719% and the Lone Star State taking 9.222%.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.