Municipal bond investors saw little supply price into a strong market on Tuesday ahead of Wednesday’s early session close before the Fourth of July holiday.

Janney: 1H was strong for munis

The first half of 2019 was good for municipal bond investors, Alan Schankel, managing director and municipal strategist at Janney, writes in a monthly market wrap-up released Tuesday afternoon.

“The Bloomberg Barclays Municipal bond index registered a 5.09% total year-to-date return through June 30th; credit conditions have generally improved, with upgrades from all three rating agencies exceeding downgrades; and favorable supply and demand dynamics have been supportive of municipal outperformance relative to Treasuries,” Schankel said.

He noted that the 10-year municipal-to-Treasury ratio, which started off the year at 87.6%, dropped to a record low point of 71.6% just before Memorial Day (based on Bloomberg data beginning in 2001), and then moved higher in recent weeks.

“Through six months, new-issue supply has been flat compared to 2018, which in turn was the lowest in four years. Demand is strong, illustrated by the $50 billion of net new cash flowing to municipal mutual funds and ETFs so far in 2019, the strongest annual start to a year in at least a decade,” Schankel said. “Our

Primary market

The muni market will see an early close on Wednesday ahead of the full close for the July 4 holiday.

The Metropolitan Water District of Southern California (NR:NR/NR:A1+/AA+:F1+) came to market with two remarketing deals totaling $271.255 million. JPMorgan Securities remarketed $175.63 million of Series 2017C subordinate water revenue bonds and Series 2017D subordinate water revenue refunding bonds in SIFMA Index mode. BofA Securities remarketed $95.625 million of Series 2017E subordinate water revenue bonds in SIFMA Index mode.

In the competitive arena, Salt Lake County, Utah, sold $70 million of Series 2019 tax and revenue anticipation notes on Tuesday.

Morgan Stanley won the TRANs with a bid of 3% and a premium of $547,400, an effective rate of 1.242125%.

Zions Public Finance is the financial advisor; Chapman and Cutler is the bond counsel.

Tuesday’s muni sale

Secondary market

Munis were mixed in late trade on the

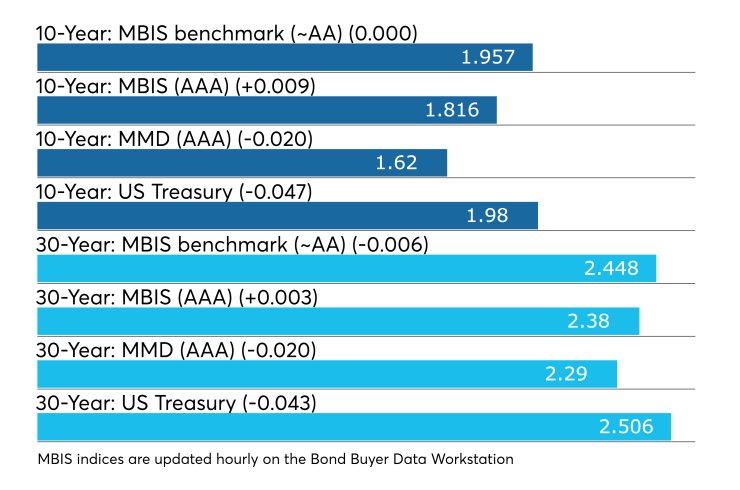

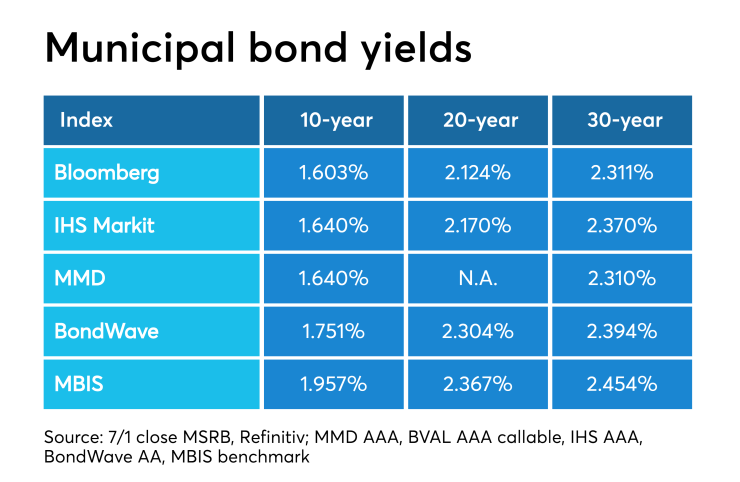

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on the 10-year fell two basis points to 1.62% while the 30-year declined two basis points to 2.29%.

The 10-year muni-to-Treasury ratio was calculated at 81.0% while the 30-year muni-to-Treasury ratio stood at 90.7%, according to MMD.

“The ICE muni yield curve is about one basis point lower from the five-year maturities and longer,” ICE Data Services said in a Tuesday market comment. “This week’s shortened trading week combined with a lack of new issue supply continues to compress yields. The two-year/10-year spread is 33.8 basis points, in from yesterday’s 34.3 basis points. Tobaccos and high yield are also one basis point lower.”

Yields on Illinois general obligation bonds rose on news of

IHS said yields were higher by 12 basis points on some GOs while MMD said the state GO spreads widened by 20 to 25 basis points in trading activity.

Treasuries were stronger as stocks traded mixed. The Treasury three-month was yielding 2.193%, the two-year was yielding 1.761%, the five-year was yielding 1.750%, the 10-year was yielding 1.980% and the 30-year was yielding 2.506%.

Previous session's activity

The MSRB reported 36,619 trades Monday on volume of $11.24 billion. The 30-day average trade summary showed on a par amount basis of $12.54 million that customers bought $6.54 million, customers sold $3.93 million and interdealer trades totaled $2.06 million.

California, New York and Texas were most traded, with the Golden State taking 18.046% of the market, the Empire State taking 11.864% and the Lone Star State taking 9.016%.

The most actively traded security was the Los Angeles 2019 TRANs 5s of 2020, which traded 133 times on volume of $119.96 million.

Treasury to sell $40B 4-week bills

The Treasury Department said it will sell $40 billion of four-week discount bills Wednesday. There are currently $35.003 billion of four-week bills outstanding. Treasury also said it will sell $35 billion of eight-week bills Wednesday.

“In consideration of the Independence Day holiday, the noncompetitive and competitive closing times for the 4 and 8-week bill auctions on Wednesday, July 3, 2019, are 9:30 a.m. and 10:00 a.m. ET, respectively,” Treasury said.

Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.